Join Our Telegram channel to stay up to date on breaking news coverage

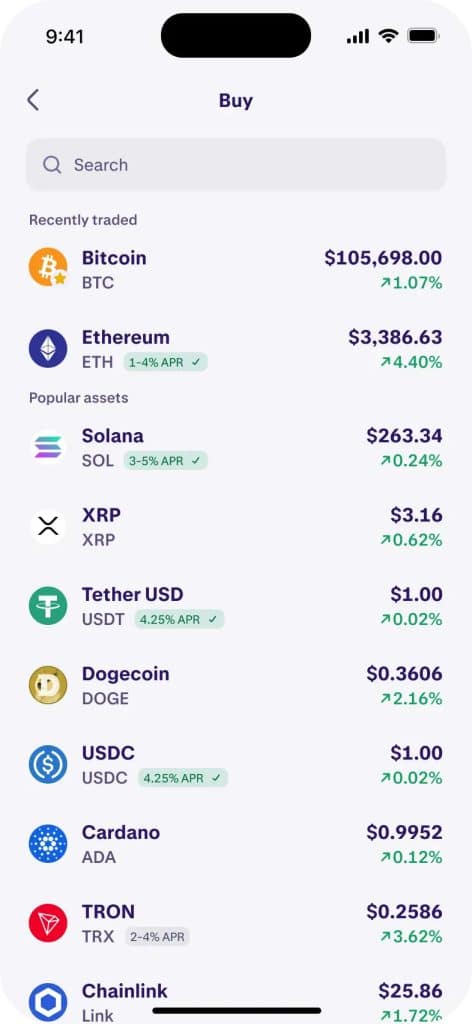

Kraken, hailed as one of the best crypto exchanges by Forbes in its January 2025 review, has unveiled its US Strategic Reserve Watchlist, which coincided with the momentous White House Crypto Summit, held on March 7th, 2025. The list offers a curated selection of cryptocurrencies that could potentially become part of the reserves, including digital assets like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA).

The timing of the watchlist alongside the summit is significant, as they complement each other. While the summit focused on bringing regulatory clarity to the reserve, the watchlist helps investors better understand its key digital assets and navigate the evolving regulatory landscape.

Notably, the Kraken team met Senator Cynthia Lummis in January 2025 to discuss the reserve and comprehensive digital asset frameworks.

Explaining Kraken US Strategic Reserve Watchlist

The selection of assets Kraken included in its crypto strategic reserve watchlist is based on two clear reasons. First, these five assets occupy a substantial share of the crypto market. Bitcoin and Ethereum alone account for nearly 70% of the market, while XRP, SOL, and ADA rank among the top ‘Made in USA’ cryptocurrencies by market capitalization.

Another Made in USA coin that performed significantly well in recent times registering significant gains in a short time, was $TRUMP. In a couple of days, the coin’s price had crossed the US$70 mark from an opening price of less than US$9.

With these market trends shaping discussions at the White House Crypto Summit, Kraken’s watchlist provides investors with a clearer perspective on key assets that may play a role in future US crypto regulations-related developments.

Key Takeaways: White House Crypto Summit & US Strategic Reserve

The summit followed the news that President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve, funded through federal asset forfeiture at no cost to taxpayers. Key topics included the reserve’s structure, crypto taxation, regulatory clarity, and government adoption.

Attendees included the Secretaries of Treasury and Commerce, along with key regulators such as Mark Uyeda (Acting Chair of the SEC), Caroline Pham (Acting Chair of the CFTC), Bo Hines (Executive Director of the Presidential Working Group on Digital Assets), and Kraken CEO Arjun Sethi, among other industry leaders.

The discussions helped shape future crypto investment strategies. The Executive Order mandated a full audit of government-owned digital assets—estimated at 200,000 Bitcoin—and committed to holding them as a long-term store of value. Preventing premature Bitcoin sales could reduce losses, as past sales have already cost taxpayers $17 billion.

The summit was key in exploring budget-neutral crypto strategies. For retail investors, Kraken’s watchlist makes it easier to follow key assets that may be influenced by regulatory changes.

Step-by-Step: Investing in the US Strategic Reserve Watchlist on Kraken

Getting started with buying, selling, or converting crypto on Kraken is straightforward. Whether you’re using your crypto balance, payment card, Plaid ACH, or other options, adding digital assets to your portfolio only takes a few steps.

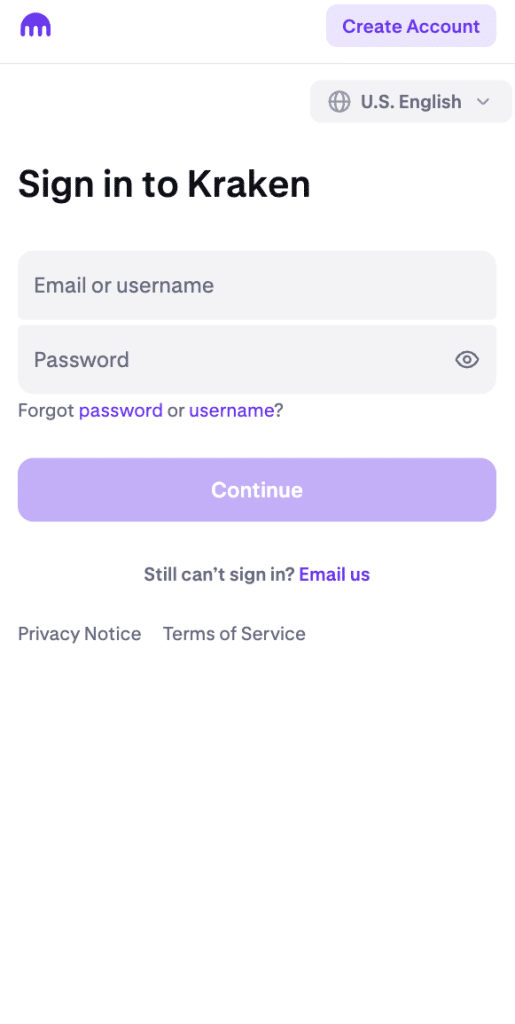

Step 1: Sign in to Kraken

Open the Kraken website or app, log in, and head over to the Buy Crypto or Markets section.

Step 2: Find the Crypto You Want

Use the search bar or scroll through the available cryptocurrencies. Let’s say you want to buy Bitcoin on Kraken.

Step 3: Buy or Convert

Now, buy or convert your crypto, which is Bitcoin in our case. Kraken makes it easy to swap between crypto-to-crypto or crypto-to-cash.

Step 4: Review & Confirm

Enter the amount, check any applicable fees, and confirm your transaction. Once done, the asset is added to your portfolio instantly.

When it comes to trading features, security, and accessibility, Kraken has built a strong reputation. Its security, ease of use, and a range of trading features help users manage their crypto effectively.

Multiple Ways to Trade – Whether you want to set up recurring buys to steadily grow your portfolio or place custom orders at a specific price, Kraken offers flexibility.

Competitive Fees – Fees get lower as you trade more, with some transactions costing as little as 0%.

Security & Support – Kraken’s security team constantly monitors for threats, and if you run into issues, live chat support is available 24/7.

The Key Benefits of Using Kraken for Crypto Investing

From day one, Kraken has played a key role in shaping the reserve. Users can rely on it to navigate the regulatory landscape and make smart decisions about investing in reserve assets. Over the years, it has earned the trust of millions by being a simple, supportive, and knowledge-sharing exchange.

Kraken’s comprehensive security approach includes regular third-party proof of reserves audit, robust custody security, advanced information security solutions, and consistent security.

It encourages participation through various unique initiatives, including its Affiliate Program, which rewards content creators and publishers by paying 20% of the trading fees collected from the clients they refer.

Altogether, SBR is shaping the future of US crypto investment, and exchanges like Kraken will help users leverage this shift for maximum gains. So, sign up for Kraken today and explore the US Strategic Reserve Watchlist.

References

- Trump signs order to establish strategic bitcoin reserve (Reuters)

- Top Made in USA Coins by Market Cap (Coingecko)

- At Crypto Summit, Trump Says U.S. Will Be ‘the Bitcoin Superpower’ (NY Times)

Join Our Telegram channel to stay up to date on breaking news coverage