Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is up almost 2% in the last 24 hours to trade for $52,311 as of 6:30 a.m. EST time.

Trading volume has dwindled almost 15% during the same period, with investors anticipating a drop in the BTC price, citing fractals. For the layperson, “fractals are indicators on candlestick charts that identify reversal points in the market.”

$BTC Fractal: Keeping it simple. https://t.co/1zloqRbfuI pic.twitter.com/eFRjJTtIeP

— MAXPAIN (@Mangyek0) February 19, 2024

Traders capitalize on fractals to get an idea about the direction in which the price will lean towards. One trader and analyst, @Mangyeko, says, “Tuesdays are usually bearish so expecting consolidation today or dump NY PM session,” adding that this would be a nice confluence in his opinion. If there is truth to the analyst’s supposition, then the Bitcoin price could drop on February 20 after a weeklong consolidation below the $52,789 barricade.

It is worth mentioning that @Mangyeko is not the only analyst anticipating a correction in the Bitcoin price. Another trader, @TSignalyst says the king of cryptocurrency is coiling up for a breakdown.

Check out my #BTCUSDT analysis on @TradingView: https://t.co/3pgBke2u7T

— TheSignalyst.eth (@TSignalyst) February 19, 2024

Meanwhile, an analyst from on-chain aggregator tool IntoTheBlock says there are five possible catalysts that could send BTC to an all-time high in six months.

📈 With bullish momentum surging, @intotheblock forecasts an 85% chance #Bitcoin hits new ATHs in the next 6 months, driven by Halving, ETFs, Easing, Elections, & Treasuries (HEEET). pic.twitter.com/tI3ZEWDxnD

— Satoshi Club (@esatoshiclub) February 16, 2024

The analyst, Lucas Outumuro, who is the head of research at on-chain aggregator tool IntoTheBlock, puts the odds at 85% of the Bitcoin price recording a new all-time high (ATYH).

Five Catalysts That Could Send The Bitcoin Price To A New ATH

According to Outumuro, the expected surge in the Bitcoin price comes on the back of increased bullish momentum. The researcher accredits this supposition to five key themes.

Halving

The halving is due on April 24, barely eleven weeks out. The event will see miner rewards slashed in half, potentially ushering in the next bull cycle, if history is enough to go by.

Exchange-Traded Funds (ETFs)

The ETF narrative continues to drive the cryptocurrency market since the landmark approval on January 10. The US market continues to register growing demand in the sector with more than $4 billion in new inflows reported within the first thirty days of trading, or thereabouts, since January 10. Recent reports revealed that the Chinese, European, and Canadian markets are all lining up for a piece of the US ETF cake.

Next Wave of US ETF Bulls Coming From Abroad as Global Funds Lag – It isn't just China investors, but Europe and Canada locals are also rushing to buy US-focused ETFs as flow % way higher than aum % for most regions.. awesome note today from @psarofagis & @RebeccaSin_SK pic.twitter.com/fsP1tfGTBI

— Eric Balchunas (@EricBalchunas) February 8, 2024

Easing Monetary Policies

Easing monetary policies by the Federal Reserve is a macroeconomic catalyst that may also drive the Bitcoin price higher. It comes amid declining inflation rates, with hopes that the Fed could lower interest rates. If this happens, the market would witness increased liquidity, benefiting risk-on assets such as BTC and stocks.

4. Monetary Policy:

Central banks in recession-hit countries like Britain and Japan..may implement accommodative monetary policies, including interest rate cuts and quantitative easing, which can weaken their currencies relative to the USD.

— 🏴☠️Mr Red (@MrRedOG) February 18, 2024

The US Elections

As Americans prepare for the 2024 election in November, IntoTheBlock sees this as a potential bullish catalyst. This is because the odds for a Republican administration taking office continue to increase with time. Notably, Republicans have often been pro-crypto, with one easy example being the SEC commissioner Hester Pierce, alias Crypto Mom.

Institutional Treasuries

Lastly, IntoTheBlock highlights regions such as Asia and South America that are enjoying the legitimization of BTC. With this, corporate treasuries and accessibility to ETFs are enablers for the US market enjoying a similar turn, promoting the growth of the cryptocurrency industry.

Bitcoin's use cases extend beyond individual ownership to include corporate treasuries. As more companies recognize the value of holding Bitcoin as part of their reserves, this trend could contribute to a sustained increase in demand.

— BARBARA enimeleth (@CHARRISmiranda) February 18, 2024

With these five elements at play, IntoTheBlock’s Outumuro says there is an 85% chance of the Bitcoin price hitting a new all-time high in the next six months.

Bitcoin Price Outlook Amid Speculation Of A New All-time High

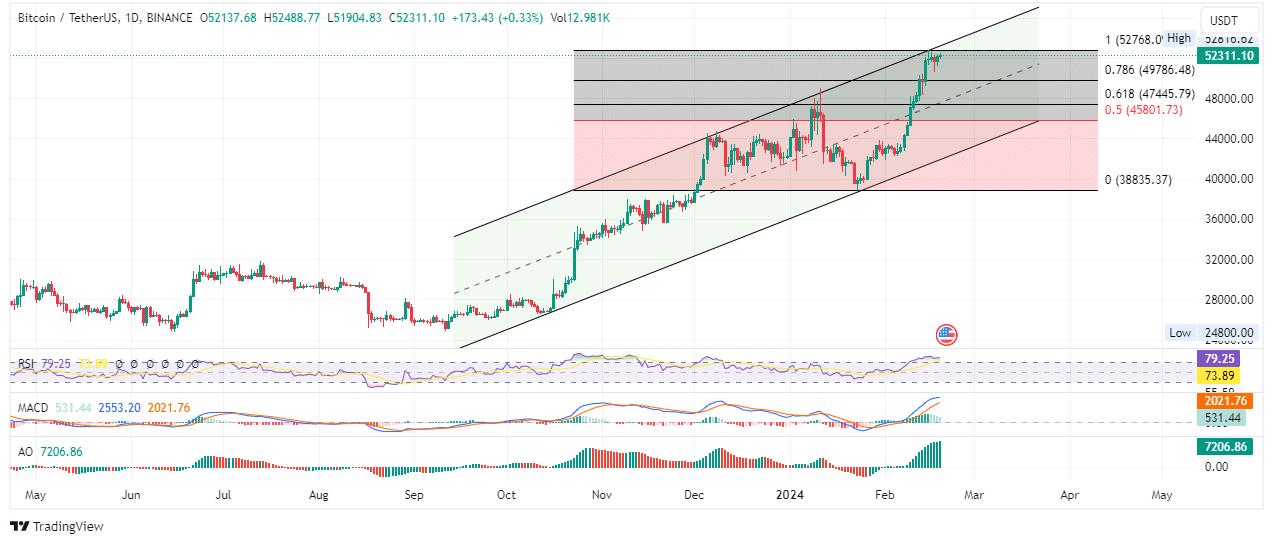

The Bitcoin price is confronting a formidable roadblock, at $52,768, with the Relative Strength Index (RSI) hinting at a possible rejection. This is because this momentum indicator appears to be subdued, moving horizontally to show buyer exhaustion. The position of the RSI at 79 also shows that the Bitcoin price is massively overbought, suggesting a possible correction.

Notice the paling histogram bars of the Moving Average Convergence Divergence (MACD), showing the bullish cycle is losing steam. The MACD is also flattening out, adding credence to the exhaustion thesis.

If the bears have their way, the Bitcoin price could retract, possibly retracing the 78.6% Fibonacci level of $49,786. An extended fall could see BTC test the most critical Fibonacci level, 61.8% at $47,445. In a dire case, the king of crypto could slip below the 50% Fibonacci level at $45,801. A slip below this buyer congestion level could see the Bitcoin price roll over to the $40,000 psychological level, nearly 25% below current levels.

TradingView: BTC/USDT 1-day chart

Converse Case

Nevertheless, with the Awesome Oscillator (AO) indicator still recording large volumes of green histogram bars, the bulls have a strong presence in the Bitcoin market. If this cohort of traders enhances their buyer momentum, the Bitcoin price could shatter the $52,768 blockade.

Such a move would not only bring the $55,000 target into focus but also make the $60,000 milestone the next logical target.

Elsewhere, with IntoTheBlock now joining the list of market watchers eyeing the halving event, forward-looking investors are looking at BTCMTX, with analysts including YouTuber Jacob Bury saying it has the potential to 10X on launch.

Promising Alternative To Bitcoin

BTCMTX powers the Bitcoin Minetrix ecosystem, an innovative project that has decentralized and tokenized BTC mining. This makes it accessible even to the ordinary folk.

Embarking on a new era of cloud mining with #BTCMTX! 🚀

Users gather staking credits, managing their mining skills.#Ethereum network's smart contracts guarantee automatic, decentralized allocations, ensuring a secure and dependable mining experience. 🔗⛏️ pic.twitter.com/1SpVeCK2DN

— Bitcoinminetrix (@bitcoinminetrix) February 18, 2024

Bitcoin Minetrix revolutionizes the cloud mining space and is focused on delivering a dependable route to BTC mining for enthusiasts, leveraging transparency, independence, and safety.

#BitcoinMinetrix revolutionizes cloud mining by blending stake holding and cloud mining.

Leading the way in tokenized cloud mining with a focus on transparency, independence, and safety, #BTCMTX is committed to offering a dependable route for $BTC mining enthusiasts. 🔄🔨 pic.twitter.com/FaWyl9ZFdW

— Bitcoinminetrix (@bitcoinminetrix) February 18, 2024

The project is in the presale stage, boasting upwards of $11.162 million in sales out of a target objective of $11.85 million. Traders can now buy BTCMTX for $0.0135, a stage 26 price tag that will last less for less than 20 hours before an increase. So, act fast if you are interested.

Just 1 more day until Stage 26 of #BitcoinMinetrix comes to an end!

What role do mining nodes play in the #Bitcoin network? ⛏️ pic.twitter.com/KikhErtKFv

— Bitcoinminetrix (@bitcoinminetrix) February 19, 2024

Enjoy easy access, simplified pricing, and a hassle-free BTC mining experience on Bitcoin Minetrix, with analysts listing its token, BTCMTX, among the best penny crypto investments with potential for explosive growth.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Price Prediction: BTC Rallies 21% In A Month As Bitcoin ETF Institutional Buying Dominates And The Bitcoin Minetrix Presale Pumps Past $11 Million

- Bitcoin Price Prediction: Unusual BTC Surge Coincides With Dollar Strength, Rising Treasury Yields As Bitcoin Minetrix Blasts Past $11 Million

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage