Join Our Telegram channel to stay up to date on breaking news coverage

- What The US’ Federal Open Market Committee meetings suggest a mild recession to come

- Why Inflation remains well above the Fed’s 2% target while the labor market is still tight

- What next Committee to maintain a restrictive stance for monetary policy, guided by a data-dependent approach

In its minutes document released on July 5, the Federal Reserve Open Market Committee (FOMC) reaffirmed its commitment to keeping the federal funds rate between 5% and 5.25% in the near future. All members of the Fed expressed a strong commitment to bringing inflation back down to 2%. However, they anticipate a “mild recession” sometime in the year, which would be proceeded by a “moderately paced recovery.” Amidst the development, Bitcoin price remains stable, holding above $30,500.

After a streak of ten consecutive rate hikes over 15 months, the Federal Reserve decided to pause its rate-hiking program in June. This marked the first month without any rate changes.

Federal Reserve’s Monetary Policy Outlook and Projected Interest Rate Hikes

The Fed considers various factors, such as the impact of monetary policy on economic activity and inflation. These considerations come in play when deciding whether to lower interest rates. As part of its reduction efforts, they plan to sell agency debt, Treasury securities, and agency mortgage-backed securities, according to the Federal Open Market Committee (FOMC).

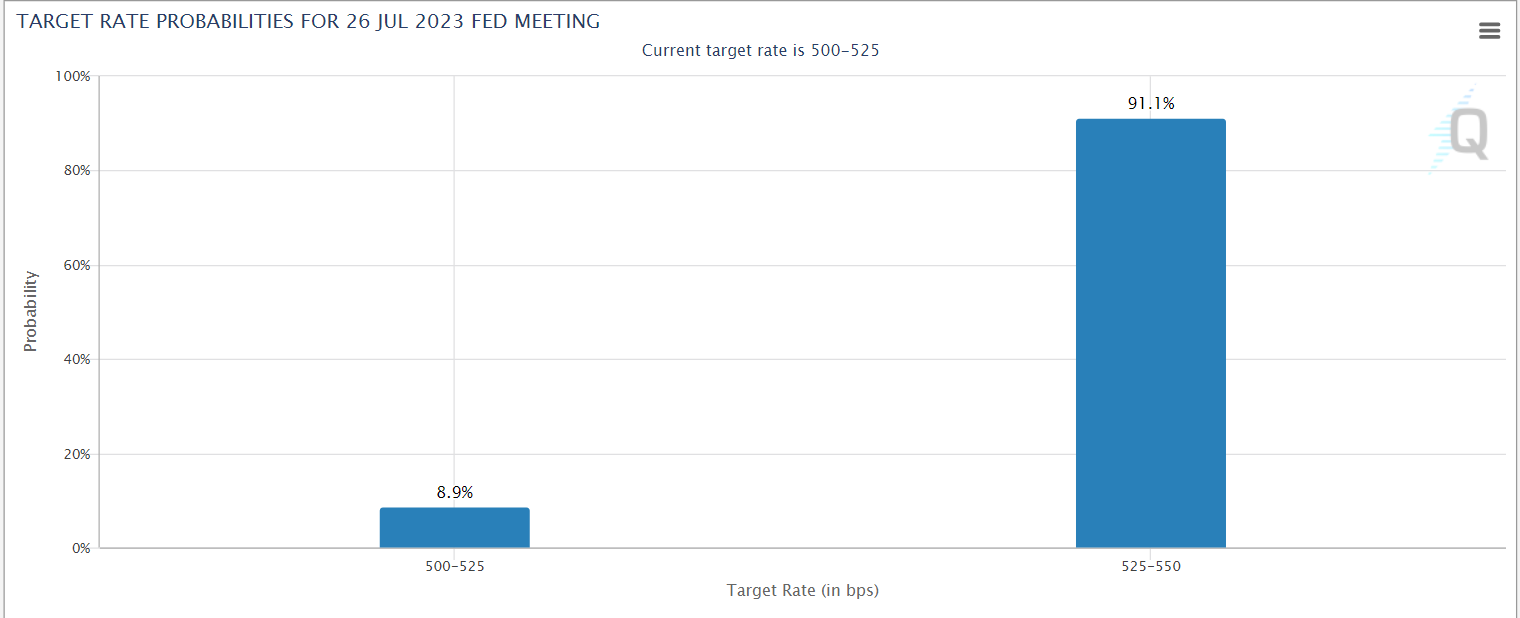

The CME FedWatch Tool currently predicts a 91.1%% chance of a quarter-point rate hike in July, about 21 days before the next meeting. This probability has steadily increased, particularly in the past week. This suggests a target rate increase to 5.25%-5.50% at the next meeting. Consequently, the price of Bitcoin, which has been performing well recently, may be influenced.

FOMC Meeting Suggests Uncertainty In Future Rate Hikes and Mild Recession

The Fed’s revised Summary of Economic Projections indicates a key insight. The median projection of FOMC members expects the federal funds rate to reach 5.6% by the end of this year. It represents a significant increase from the 5.1% projected in March. This points to the possibility of two additional quarter-point rate hikes in the remaining four sessions of 2023.

The Federal Reserve meeting participants agreed that the economic outlook and inflation levels are uncertain. While they anticipate a moderate and temporary economic downturn, Fed staff still predicts a recession in the US later this year.

However, Fed Chair Jerome Powell remains confident in achieving a “soft landing.” He envisions a situations where inflation decreases without triggering a severe economic slump.

Also Read:

- Bitcoin price prediction as the coin corrects after a sharp rise past $31k

- Crypto Market Outlook – The Trend of Crypto Events On July 5, 2023

- Best 4 Crypto to Buy Now July 2023 – Huge Potential

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage