Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market structure is still in a dilapidated state, facing shrinking volumes. Ethereum price has been pivoting around $1,800 for a few days with the tug of war between the remaining bulls and bears getting fierce.

Two key levels are likely to determine where the largest smart contracts token with $214 billion in market capitalization is heading, starting with an ascending trendline and the 50-day Exponential Moving Average (EMA).

Despite the stability exhibited by Ethereum following the rejection from $2,000 earlier in the year, its downside appears vulnerable. That said support provided by the trendline around $1,750 is bound to play a vital role in what happens next.

Ethereum Whales Back in Accumulation Mode

At the time of writing, Ethereum price is trading at $1,775 amid the risk of a weakening downside. It has been a challenging time for most cryptocurrencies with on-chain data from Glassnode indicating that ETH addresses with at least 10,000 coins had hit a six-month low of 1,156 on Wednesday.

However, this analysis looks beyond the worrying picture, using additional on-chain data to show that the situation is not that dire for the second-largest crypto.

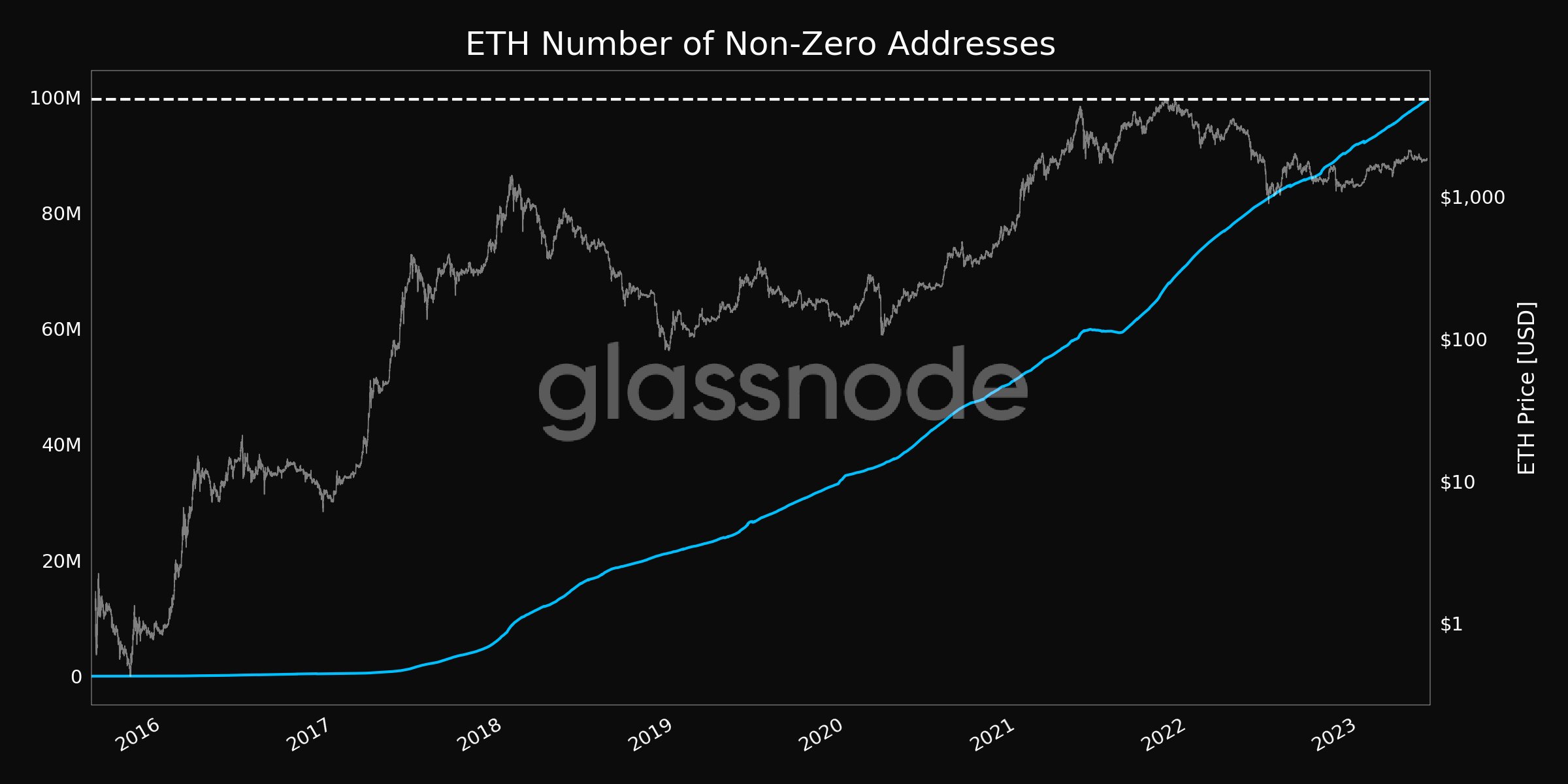

The same Glassnode also shared more stats from the network, with the number of non-zero balance addresses increasing to an all-time high of 99,597,841.

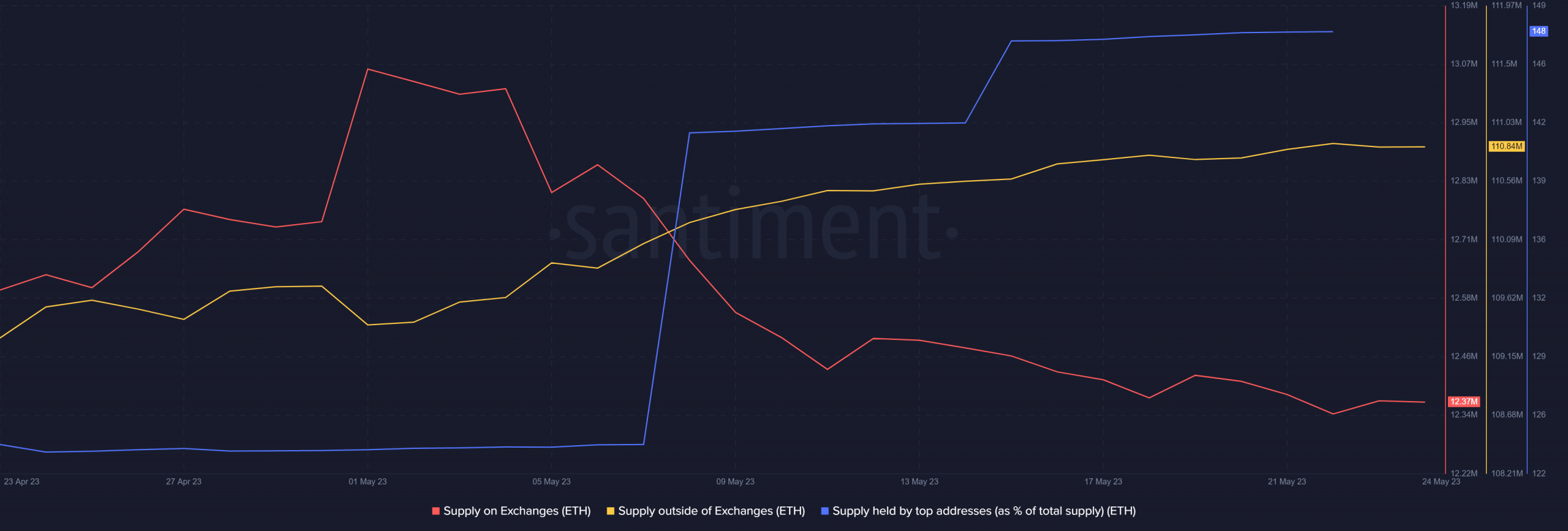

The situation could even be getting better if we consider on-chain data from Santiment, which reveals that investors are accumulating Ether as opposed to selling. For instance, the chart below shows that the supply held by top addresses had soared significantly over the last 30 days.

The crypto’s supply held in known exchange addresses had dropped considerably. On the other hand, supply held by non-exchange addresses was increasing consistently.

It is worth noting that investors send their tokens to exchanges when they intend to sell, otherwise, they prefer to keep their holdings off-exchange platforms.

On the other hand, when supply held by exchanges is reducing it means that selling pressure is also weakening – a situation likely to nurture a bullish breakout. Moreover, these metrics suggest that investors are on an accumulation spree.

What Does This Accumulation Mean for Ethereum Price?

Accumulation implies that investors are confident that although the current market structure is not favorable, a rebound is in the offing in the short term.

In addition to that, the Moving Average Convergence Divergence (MACD) reveals that buyers are slowly gaining the upper hand.

For those new to this indicator, underlying the chart below, a buy signal comes into the market when the MACD line in blue crosses above the signal line in red.

Another signal to watch out for from the momentum indicator is its movement from the negative region (current position) to the positive territory. Such a move implies that buyers are getting stronger.

In the meantime, Ethereum’s downside is sitting on support provided by 100-day EMA (in blue) at $1,775. Below this is the ascending trendline, which as illustrated in the chart, has remained relevant to Ethereum since November.

In that case, Ethereum is expected to retest the trendline, sweep through fresh liquidity and start the much-awaited rebound to $2,000.

However, if declines overwhelm the trendline support, all hell could break loose, and increase the risk of revisiting levels at $1,600 and $1,450, respectively especially if the 200-day EMA (in purple) does little to prevent the losses.

Evaluating Ethereum Price With Other Indicators

The Money Flow Index (MFI) has rebounded from levels close to 20 into the upper half of the neutral region. This bounce suggests that more money is flowing into ETH markets compared to the money flowing out. If sustained, we can anticipate a trend reversal in the upcoming sessions or a few days.

In the same chart, the negative divergence in the Relative Strength Index (RSI) exhibits rising overhead pressure in Ethereum markets.

That said, if ETH does not shoot above $1,800 soon, we could anticipate more downside action, possibly to the ascending trendline as analyzed. Here, a rebound could commence with the help of fresh liquidity and the accumulation among investors, as earlier established.

yPredict’s Viral Presale is Selling Out Fast

As investors wait for the start of a new era for the crypto industry in Hong Kong, it would be prudent to start diversifying portfolios early enough.

Up-and-coming projects like yPredict allow investors to buy highly discounted tokens in their presale stages.

The InsideBitcoins.com team analyzes these emerging ecosystems weekly, to bring you some of the best crypto presales to buy for 2023.

In brief, yPredict is an AI-powered trading and market intelligence platform that mainly focuses on helping investors block out the noise and see the bigger picture which is vital to making the desired profits.

yPredict aims to enhance its technological capabilities and deliver innovative AI solutions to its clients.

Meanwhile, the team is introducing YPRED tokens in the market via a viral presale that has raised $1.69 million in a matter of weeks.

Investors are buying YPRED for $0.09 in stage six but this price will increase to $0.1 in the next round, while the token is expected to list on exchanges at $0.12.

Related Articles:

- 10+ Best New Cryptocurrency Coins to Buy

- Cardano Price’s Deep Slumber Elapses as Hong Kong’s Crypto Trading Hype Explodes

- Trader Michael Wrubel Aims for Moonshot With New Low Cap Meme Coin – How to Get Rich Off Crypto

- Investors Rush to Beat Price Rise as DeeLance, the Web3 Freelancing Platform, Raises $1 Million in Presale

Join Our Telegram channel to stay up to date on breaking news coverage