Join Our Telegram channel to stay up to date on breaking news coverage

In the U.S., 27 states have introduced legislation related to Bitcoin and cryptocurrency assets, reflecting a growing governmental focus on digital asset adoption. At the federal level, discussions are underway regarding establishing a national Bitcoin reserve. Globally, interest in Bitcoin as a reserve asset is also expanding, with the Czech Republic being the latest nation to consider adding Bitcoin to its national holdings.

As institutional and governmental interest in Bitcoin grows, investors also look beyond BTC to explore high-potential alternative cryptocurrencies. With a rapidly evolving market, identifying the best altcoins to buy now can provide lucrative opportunities for those seeking diversification and long-term gains.

5 Best Altcoins to Buy Now

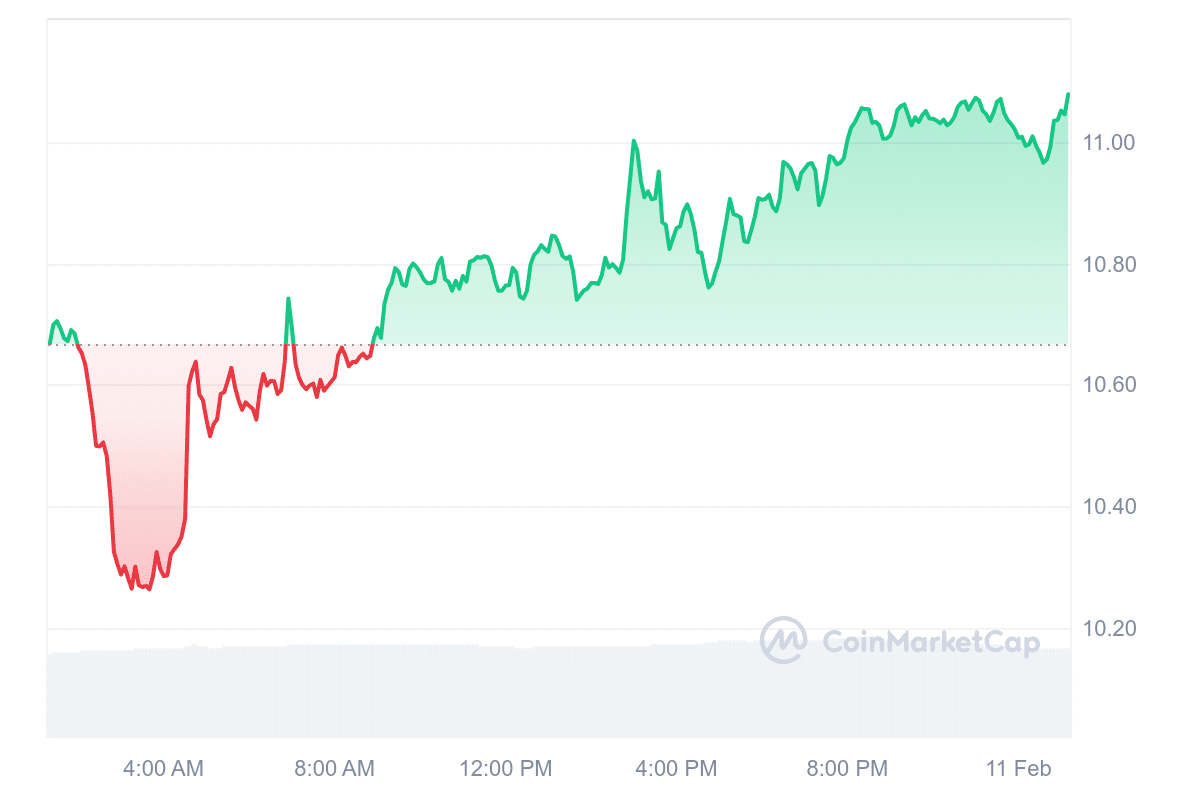

NEO is priced at $11.08, reflecting a 4.37% increase in the past 24 hours. Decentraland’s MANA token has experienced market fluctuations, with analysts predicting a steady rise in value over the coming months. Raydium (RAY) has gained notable attention due to its recent price movements and overall market trends.

The Meme Index ($MEMEX) provides a structured investment approach to meme coins while mitigating risks associated with fraudulent tokens. Meanwhile, the Cosmos ecosystem is emerging as a key player in the Real-World Assets (RWA) sector. Michael Saylor’s firm has also acquired another $742 million worth of Bitcoin amid the recent market dip.

1. Neo (NEO)

NEO, a blockchain platform focused on smart economy solutions, recently participated in ConsensusHK alongside its ecosystem partners, including GrantShares, DeXFun, Intersect_fi, and Goodr. This event provided an opportunity to showcase real-world applications and strengthened industry connections.

NEO is valued at $11.08, reflecting a 4.37% increase over the past 24 hours. The market capitalization is $781.41 million, with a daily trading volume of $33.06 million, indicating a relatively high liquidity level.

Market projections suggest potential price growth. In February 2025, NEO’s value could rise by approximately 10.29%, averaging $12.23, with a possible range between $10.28 and $13.84. If these forecasts hold, the estimated return on investment (ROI) would be around 24.77%.

We're proud to sponsor #ConsensusHK!

This time we're exhibiting alongside our ecosystem projects @GrantShares, @DeXFun_Official, @Intersect_fi, and @goodrdotfun, showcasing real-world use cases and aiming to build valuable connections.

Looking forward to seeing you there! 🔥 pic.twitter.com/7HamF4368o

— Neo Smart Economy (@Neo_Blockchain) February 10, 2025

March is expected to continue this positive trend, with an estimated 17% price increase from current levels. Analysts predict a peak of $15.31 and a low of $12.19, with an average price near $12.97. This would present a potential ROI of 38.07%, making it an appealing option for investors seeking moderate gains.

April forecasts suggest a significant price shift, with NEO possibly reaching $23.04, representing a 107.78% change. The predicted price range spans $15.28 to $23.04, averaging $18.77. If this scenario unfolds, it could offer considerable growth opportunities.

2. Decentraland (MANA)

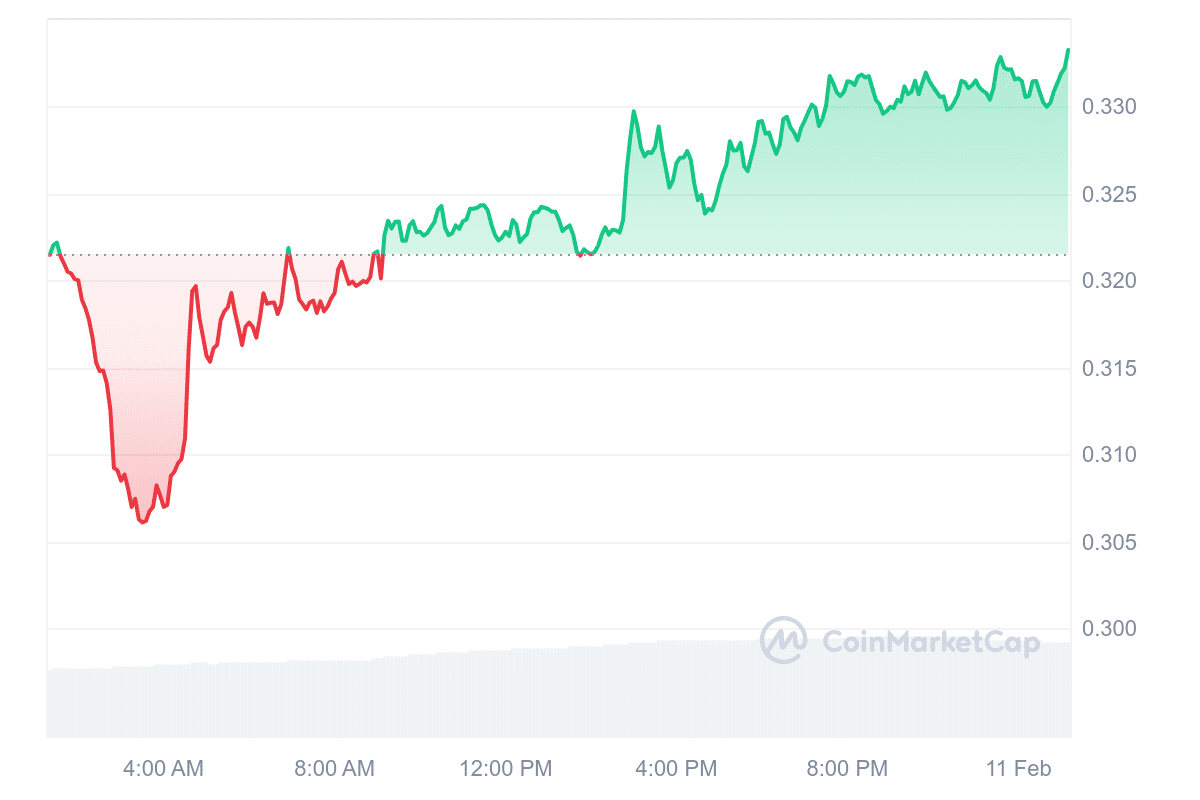

Decentraland’s MANA token has shown fluctuations in market trends, with analysts anticipating a gradual price increase over the coming months. In February 2025, MANA is expected to grow by 0.85%, with an average price of $0.335414. Market projections indicate further growth in March, with an estimated 12.95% increase, bringing the average price to $0.375651. April forecasts suggest a possible rise of 17.70%, with a high of $0.391438.

Meanwhile, the Starknet Foundation, in collaboration with Ubisoft, The Sandbox, and Decentraland, has announced a webinar series aimed at game developers. Scheduled from March 5 to April 9, 2025, this initiative seeks to bridge the gap between traditional gaming and blockchain-based development.

Decentraland thrives on the passion and creativity of its builders 🫶

On February 11th it's time to celebrate some of the unique virtual spaces pushing the boundaries of design ❤️

Congrats to @PepeGawd, @dogebusters, @Rizkgh, @RoustanNFT, @KJWalker3D, @CanessaDCL, Ken, and… pic.twitter.com/z9CetGXwD8

— Decentraland (@decentraland) February 7, 2025

The program is an online educational platform designed for Web2 and Web3 developers. By bringing together industry leaders, the initiative aims to provide insights into emerging technologies and their integration into gaming. This collaboration between Starknet and prominent gaming entities suggests a growing interest in blockchain applications within the industry.

These predictions indicate potential investment opportunities for traders. Furthermore, the webinar initiative aligns with the evolving landscape of blockchain gaming, providing developers with the knowledge needed to navigate this shifting industry.

3. Raydium (RAY)

Raydium (RAY) has gained significant attention due to its recent price movement and market trends. Currently ranked 55, it has a market capitalization of $1.53 billion, reflecting an 11.23% increase. The 24-hour trading volume is $123.11 million, making up 8.11% of its market cap.

A key development is the launch of Raydium’s Perpetual Futures Trading in collaboration with Orderly Network. This feature enables Solana users to trade without gas fees and minimal transaction costs across 70+ trading pairs. Over the past year, RAY’s price has surged by 394%, outperforming Bitcoin, Ethereum, and 92% of the top 100 cryptocurrencies.

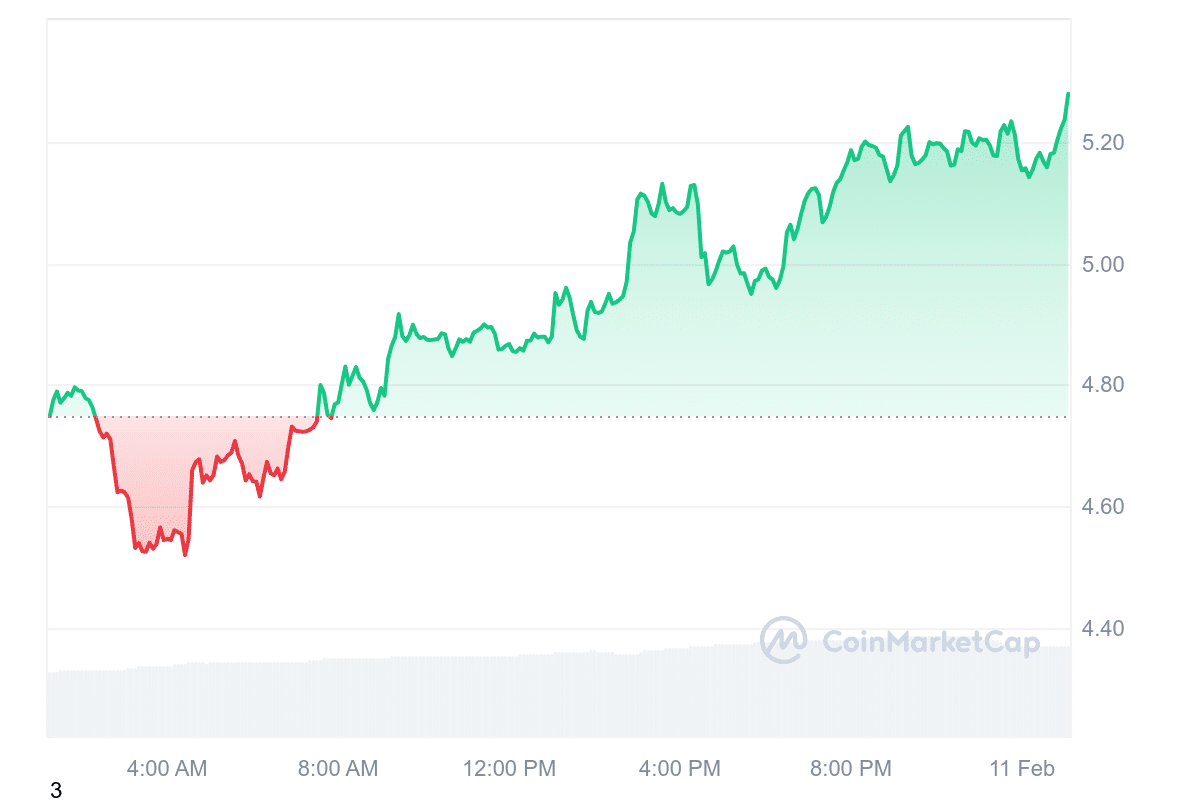

From a technical standpoint, RAY has broken out of a descending trendline and is consolidating around $5.05. If this support level holds, it may push toward the next resistance at $5.50. The token trades 40.05% above its 200-day simple moving average ($3.83), indicating strong upward momentum.

GM Radiators, BIG news!

Public Beta for Perpetual futures trading is now LIVE on Raydium, powered by @OrderlyNetwork 🚀

Raydium Perps offers Solana users gas-free trading and the lowest fees on over 70 pairs 😎

Check it out:https://t.co/w4VOE8J5zK

More info below 👇

1/4 pic.twitter.com/FByJbAB5my— Raydium (@RaydiumProtocol) January 9, 2025

February 2025 projections suggest a potential price range between $4.98 and $17.07, with an average forecast of $9.43. Based on current levels, this scenario presents a possible return on investment (ROI) of 216.75%.

4. Meme Index ($MEMEX)

Meme Index ($MEMEX) offers a structured approach to investing in meme coins while addressing concerns about fraudulent tokens. With over $3.5 million raised during its presale, the project has attracted investors seeking a safer alternative.

Meme coins have surged in popularity in 2024, but scams have become a major concern. Copycat tokens, particularly those linked to public figures like Donald and Melania Trump, have misled investors. Meme Index aims to mitigate these risks by requiring investors to hold $MEMEX tokens to access its platform and indexes.

The platform provides four investment categories to accommodate different risk levels. The Meme Titan Index includes established tokens like Dogecoin ($DOGE) and Shiba Inu ($SHIB), offering relative stability. The Moonshot Index targets mid-range tokens with moderate risk, while the Midcap Index focuses on assets between $50 million and $250 million in market cap. The Meme Frenzy Index takes the highest risks by investing under $50 million in emerging tokens.

A key feature of Meme Index is its community-driven governance. Holders of $MEMEX tokens can vote on token selection and index structures, enhancing investor control and reducing exposure to unreliable projects.

As the meme coin sector evolves, demand for safer investment options is increasing. Meme Index presents a model that balances risk and reward, providing an alternative to speculative investing.

5. Cosmos (ATOM)

The Cosmos ecosystem is increasingly positioning itself as a hub for Real-World Assets (RWAs), driven by key developments such as Ondo Finance’s launch of Ondo Chain. This new Layer 1 blockchain is designed to support institutional-grade RWAs with features like verified collateral and integrated margin trading. Cosmos’ growing appeal in this sector is further highlighted by Ondo’s partnership with digital asset issuer Noble, which introduced USDY, a native yield-generating stablecoin for Cosmos-based networks.

Mantra, another Cosmos-based project, is also leveraging the RWA trend. Its OM token shows resilience despite broader market fluctuations. The overall RWA market has surpassed $35 billion, reflecting increasing institutional interest in blockchain-based assets.

Welcome to Cosmos, @IntentoZone!

By launching with Interchain Security, Intento inherits economic security from the Cosmos Hub.

Intento uses IBC features Interchain Accounts and Interchain Queries to orchestrate actions anytime on any chain ⚛️.https://t.co/ceLUjigItf

— Cosmos Hub ⚛️ (@cosmoshub) February 10, 2025

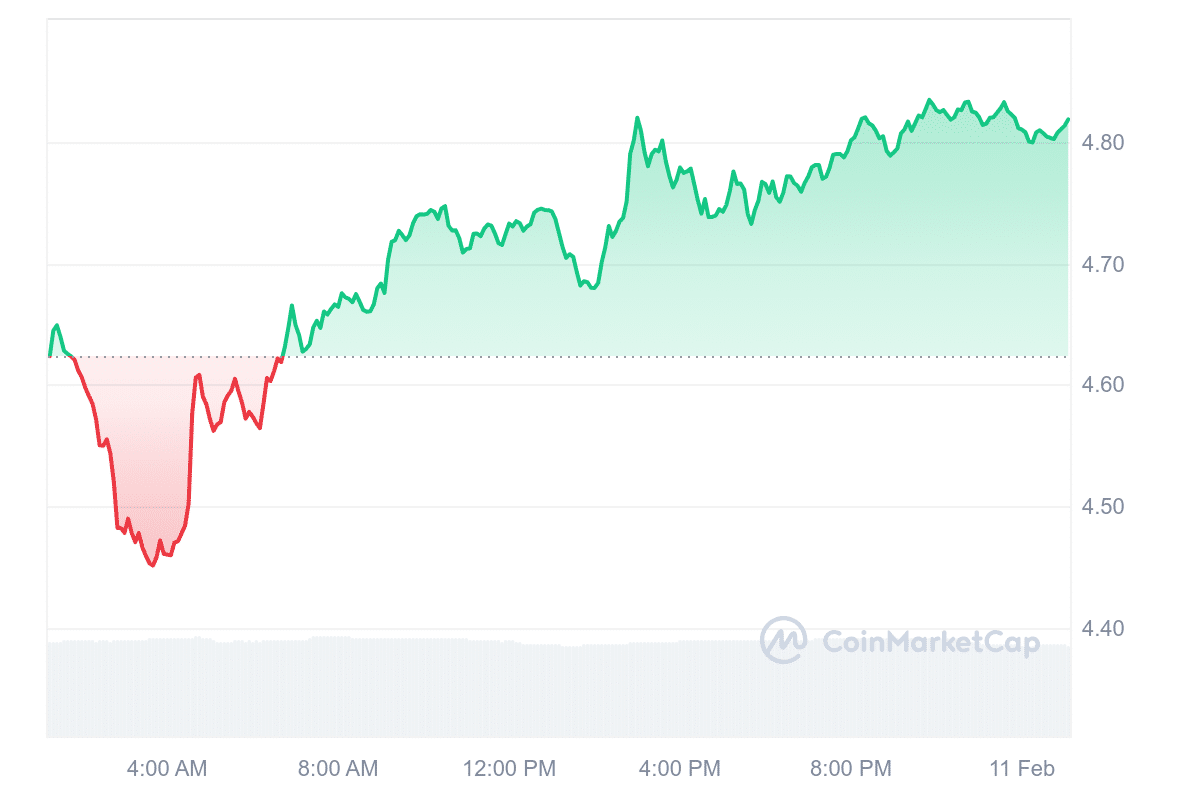

Meanwhile, Cosmos’ native token, ATOM, has demonstrated positive price momentum. Forecasts suggest a potential 20.4% increase in February, with prices expected to fluctuate between $4.35 and $7.01. If the trend holds, investors could see up to 44.95% returns. As the adoption of RWAs continues, Cosmos appears to be strengthening its position in the evolving blockchain landscape.

Learn More

Newest Meme Coin ICO - Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool - High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage