Are you residing in Vietnam and looking to try forex trading? If yes, then the primary and one of the most important things you need to do is find a legitimate forex broker that accept Vietnamese local traders.

Check out our detailed guide below to learn more about the best forex brokers in Vietnam, the kind of services they offer, their fee structures, spreads or commissions they charge, the leverage limits they give and a lot more that can assist you in identifying the most appropriate forex broker for your needs.

On this Page:

Our recommended Vietnam forex broker

We’ve carefully examined all the specific features of the top forex brokers available in Vietnam. We concluded that the forex broker below offers the most user-friendly and robust trading platform.

Best Vietnam Forex Broker Sites of 2020

The following are the five most recommended forex brokers in Vietnam. They all offer reliable and safe forex trading platforms which means that your money will always be in safe hands.

How to Join a Vietnam Forex Broker in 2020

Below is an in-depth tutorial that will guide you on how you can successfully open your account, verify your identity, deposit cash and trade major forex pairs within less than 20 minutes.

Step 1: Choose a forex broker that accepts Vietnamese traders

There are numerous forex brokers that you can quickly access online. However, only some of them accept Vietnamese traders.

Ensure that you check first the “Supported countries” section of your chosen forex broker’s site to check whether Vietnam is included in its list. In case you don’t see it there, then you will have to search for another forex broker.

Another significant thing that you have to consider is whether or not your chosen forex broker is regulated. If your forex broker is based abroad, it must be regulated by big financial authorities such as CySEC, FCA, ASIC and MAS.

Other things that you have to consider are the broker’s commission rate, spreads, ease of use of its trading system, supported payment payments and many more.

Step 2: Open an Account and Verify Your Identity

While opening an account, you’ll need to provide the following important information in order to create your account.

- First and last name

- Email address

- Password

- Phone number

- Home address

- Date of birth

In order to verify your identity, you’ll have to upload a picture or a scanned copy of your government-issued ID such as your driver’s license and passport. Other forex broker sites may also require you to send a proof your address. In order to verify your location, you will have to upload an image or duplicate copy of your electricity bill or telephone bill to prove your address.

Step 3: Deposit Funds

Before depositing your funds, first of all, check the minimum amount of deposit required. If you’re a beginner trader, it’s highly suggested that you only send the minimum deposit amount so you can try forex trading without risking a lot of money.

Some of the supported deposit payment methods are the following:

- Visa debit/credit card

- MasterCard debit/credit card

- Maestro debit/credit card

- PayPal

- Skrill

- Neteller

- Bank transfer

- Web Money

- Union Pay

Step 4: Trade Forex

Once your deposit shows up in your trading account, you can now buy and sell any currency pair. In case you are still new to trading, do not make leverage. Only use leverage once you’re confident enough that you can manage the art of trading well.

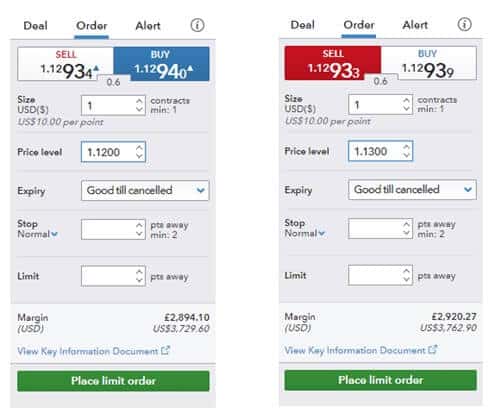

In order to place a trade, you’ll need to fill out an order.

- Select if you want to make a ‘Buy or sell order’

- Enter the amount you want to trade

- Decide if you will apply leverage or not

- Select if you want to utilize a limit order or a market order

- Input the take-profit trigger price and determine the stop-loss

How to Choose a Vietnam Forex Broker

If you are still not sure which forex broker to sign up for, you should read the following list of the main factors you need to consider when choosing a Vietnam forex broker.

- Licensing

The forex broker you select should be controlled by at least one top financial authority in the world. The top-tier forex brokers are typically regulated by the ASIC, CySEC or FCA.

By selecting a regulated and licensed forex dealer, you can be assured that your money and account information will be in safe hands.

- Forex pairs

The greater the number of available forex pairs, the better forex trading experience you will get. Both major and minor forex pairs must be fully supported by your chosen forex broker. Similarly, make sure that your chosen currency pairs are part of the list of available forex pairs.

- Payment methods

It must be easy to deposit and withdraw money. It’s extremely recommended that your selected forex broker includes credit/debit card, bank transfer and PayPal in its list of supported payment methods.

- Spreads and Commission

Nearly all forex brokers charge spreads. Most of them don’t charge commission fees but some still do. The spread means the difference between the buy and sell price of a currency pair, and it is measured in pips.

Your chosen forex broker must also offer tight spreads so that you can minimize the fees you need to pay. The commission fee some brokers charge could be a small percentage of the trade value. For example, if the commission fee is 1%, and the value of the trade is $1,000, then you will have to pay $10.

- Trading tools

A good forex broker must offer you trading analysis tools like the RSI, trading articles, Fibonacci Retracement, expert tips and video tutorials.

- Customer support

It’s recommended that you pick a forex broker that is able to assist you with a problem right away. Many well-known forex brokers offer online, round the clock chat support while others ensure that they always reply via email within a few hours after you send them an inquiry.

Leverage at Vietnam Forex Brokers

Traders in Vietnam can apply a leverage of up to 10000:1. If you wish to trade $1000 and utilize a 10000:1 leverage option, then you could effectively be trading with $1,000,000. Nonetheless, you must not use a 10000:1 leverage or even a 50:1 leverage if you’re a beginner trader because a single wrong trade can make you lose all your money.

Conclusion

After knowing the top forex brokers available for Vietnamese traders and some guidelines on how you can determine which forex broker can suit your trading needs, it is now the perfect time to create a forex trading account and start trading.

Lastly, if you are a newbie, remember to only trade what you can afford to lose. Have fun trading!

FAQs

Are Vietnamese forex brokers safe?

Yes. Vietnam forex brokers such as the ones described above provide trustworthy and secure trading platforms for Vietnamese traders. They are also regulated top-tier financial authorities all over the world, which means they are completely legitimate.

What leverage limits do Vietnamese forex brokers offer?

Vietnamese traders can apply a leverage up to 10000:1.

Should I join a commission-free Vietnamese forex broker?

Yes. If you find a forex broker with a completely reliable and safe trading platform offering commission-free trading, then you should definitely sign up on such brokerage firm.

What is the minimum deposit amount available at Vietnamese forex brokers?

Forex.com only requires a minimum deposit of $50. Other Vietnam forex brokers require either $100 or $200 minimum deposit.

What payment methods do Vietnamese forex brokers support?

The most common payment methods they accept include debit/credit cards, bank transfer and PayPal.