Best 8 Spread Betting Brokers & Platforms 2022

Are you interested in making money through spread betting but don’t know yet which of the many spread betting brokers you should go for?

Spread betting is a type of investment that involves betting on the rise or fall in the value of assets, while not physically owning the asset. Spread betting platforms will grant you access to a number of global markets. Through your spread betting broker, you’ll be able to bet on ETFs, bonds, futures, commodities, forex, indices, cryptocurrencies, options and more.

Read our comprehensive guide below and discover some of the popular spread betting brokers in the UK, and which providers offer mobile apps. As with all investments spread betting incurs risk, and aspiring traders should never risk more than 5 percent of their bankroll on a single spread bet.

Popular Spread Betting Platform UK 2022 List

Before we take an in-depth look at spread betting brokers, here’s a quick list of the popular spread betting platform UK and some other good options.

- Pepperstone – Popular UK spread betting broker

- Trade Nation – Spread betting with risk management tools

- FXCM – Advanced spread betting platform

- IG – Over 10,000 assets to spread bet on

- City Index – Excellent research tools

- Spreadex – Low fees for spread betting

- ETX Capital – Strong educational content

-

-

What is spread betting?

Spread betting is a trading strategy that allows you to speculate on the price movement of different financial instruments. By spreadbetting, a trader is taking a position (a wager/bet) on whether the price of a given financial instrument will rise or fall. It doesn’t involve buying or selling the underlying asset and spread betters will, therefore, not enjoy the rights and privileges associated with these instruments like the dividends related to shares and bonds.

A spread bet is the amount of money you wish to place on a trade, per point in movement. Your profits increase when the market moves in your favour. How much you make from the bet is calculated by multiplying the pip change (the difference between the trade opening and closing price) and the value of your spread bet. Spreadbetters have access to leverage, and the earnings from spreadbetting are not subjected to capital gains tax.

Spreadbetting Vs CFD

Spread betting is a trading strategy that allows you to bet on whether the price of a commodity will rise or fall. It doesn’t involve buying or selling the underlying asset, and the profits realized aren’t subject to tax.

CFDs, on the other hand, are financial derivatives of different financial instruments. By CFD trading, you are essentially buying and selling contracts that represent the value and price of particular financial instruments without necessarily taking ownership of the asset.

CFDs and spread betting share a wide range of similarities, including access to leverage. They are both derivatives of financial products and neither involves taking ownership of the underlying product.

However, they differ significantly in tax treatment given that earnings from spreadbetting aren’t subjected to capital gains tax.

Popular Betting Brokers in the UK

1. Pepperstone

Launched in the U.K in 2016, Pepperstone has morphed into one of the most popular online spread betting sites in the country. Key among the factors endearing online investors and traders to Pepperstone is the ease of opening a Spread betting account with the broker and the number of spreadbetting opportunities available.

Traders registered with the broker can, for instance, take positions on such financial instruments as indices, shares and stocks, currency pairs, treasuries, cryptocurrencies, futures, and commodities like spot metals and energies. Other advantages of spreadbetting on Pepperstone include the fact that profits the generated here tax-exempt. The online broker’s platform is also highly advanced with low latency and fast order execution speeds.

The broker’s trading accounts are hosted on the highly versatile MT4 and MT5 platforms. These industry-leading platforms don’t just host some of the most advanced trading and market analysis tools but also make it possible for you to create and deploy an automated trading tool (expert advisor).

Our Rating

Your capital is at risk. Sponsored ad3. Trade Nation

Trade Nation is a multi-asset CFD broker founded in 2014. The platform is popular in large part thanks to its wide selection of assets and tight spreads. With Trade Nation, you can spread bet on over 1,000 shares, forex pairs, commodities, and stock indices. Plus, the broker supports margin trading up to 30:1 for major forex pairs.

Trade Nation's spreads are fixed, not variable, which makes it easier to know how much a spread bet will cost you ahead of time. Spreads start from 0.6 pips for the popular EUR/USD trading pair and 0.8 pips for stock indices like the NASDAQ Tech 100.

Another reason to use Trade Nation for spread betting is that it offers excellent tools for managing the risk inherent in your trades. In addition to basic order types like market and limit orders, you can easily set up trailing stop losses that move automatically as your trade progresses. The platform also has a hedging feature to help you create opposing trades when you're uncertain about which way the market will move.

Trade Nation is regulated by the UK FCA and the broker offers customer support by phone and email. There's no minimum deposit required to open an account and deposits and withdrawals are free. You can make a deposit by credit card or debit card when you're ready to start trading.

Our Rating

Your capital is at risk. Sponsored ad4. FXCM

FXCM has been actively involved in the online spread betting niche for close to two decades. Over the years, the brokerage has gained a lot of popularity with the UK and Ireland spread betters because of their commission-free and competitively small bet sizes – starting from 0.7 pips per point. Other factors endearing spread betting professionals to the platform include the brokers impressive list of supported spread betting options.

Unlike most other trading instruments supported on the platform like CFDs, Indices, and commodities, earnings from spread bets are income tax and stamp duty-free. Importantly, FXCM members are also exposed to margin trades with leverages of between 1:2 and 1:30.

Registering a spread betting account at FXCM is straightforward. And if you are an inexperienced spread better, the broker gives you access to a free practice account and up to £50,000 in virtual funds. You are also exposed to numerous training and educational resources as well as a readily available customer support team.

Our Rating

Your capital is at risk. Sponsored ad5. IG

IG live towards the top of the list as one of the popular spread betting brokers in the UK. IG has proven to be an all-rounder in terms of its range of trading options, in addition to being one of the oldest and by far the biggest players in the spread betting market.

Founded in 1974, IG is now recognized as the number one CFD provider in the world, having nurtured its reputation over several decades. Their reputation is predicated on an impressive product catalog coupled with competitive fees.

IG provides one of the popular spread betting platforms for both new and experienced traders where they can easily access essential information about a wide variety of markets. The interface is easy-to-navigate, well-organized and contains transparent fees against their trading products. When it comes to transparency with fees, we feel they are unmatched.

Traders like the fact that it is not only regulated by the FCA but also by the Australian Securities Investment Commission (ASIC) in Australia. Through IG’s Financial Services Compensation Scheme or FSCS, all of its traders have a 500,000 GBP default broker protection.

Your capital is at risk. Sponsored ad6. City Index

City Index is another of the popular spread betting brokers in the UK and has been around since 1983. City Index is the trading name given by Gain Capital Group for its UK operations.

It provides a wide range of products, trading tools, webinars as well as indicators. It is one of the most flexible brokers in the UK and continues to develop as time goes by. It is considered as one of the popular when it comes to research and tools that traders need for spread betting.

Like IG, it is also regulated by financial authorities like the FCA, ASIC and even the Monetary Authority of Singapore (MAS). It offers it customers easy access to around 12,000 markets across indices, shares, cryptocurrencies, commoditie, forex, etc.

Our Rating

Your capital is at risk. Sponsored ad7. Spreadex

Spreadex was named “Best for efficiency of taking trades” at the Investments Trends UK Awards. It is popular because of its non-equity CFDs and commission-free spread bet trading.

Spreadex traders get access to an advanced trading platform wherein they can see the 10-year price history of a stock. Advanced order features like the guaranteed stop feature are also being offered by Spreadex. Similar to other spread betting brokers, it is also regulated by the FCA and offers a wide array of tradeable assets.

Our Rating

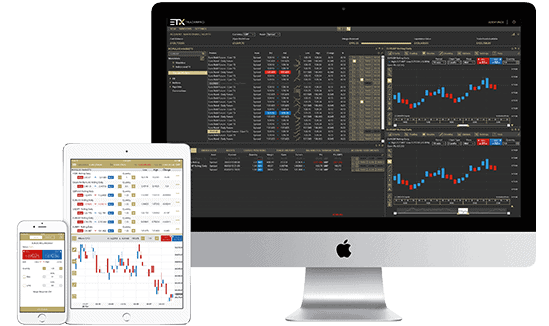

Your capital is at risk. Sponsored ad8. ETX Capital

Founded in 1965, ETX Capital is a global FX and CFD broker. Monecor LTD, which is also established in London, is its parent company. ETX Capital has been growing rapidly over the past years. It provides tight spreads on FX, equities, and indices as well as AIM stocks.

It is an ideal platform for newbies because it can provide them the fundamental guidelines they need to start spread betting. New traders can open an account and start spread betting easily because it only needs a minimum $100 deposit.

Our Rating

Your capital is at risk. Sponsored adWhat are the some Popular Spread Betting Mobile Apps?

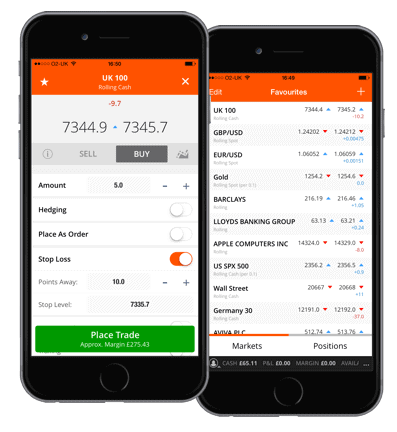

If you want to be connected to the market on the go, spread betting mobile apps are a necessity, after all, it’s not always possible to be plugged into a laptop or desktops all the time. Most trading apps will help you safeguard your trading positions anywhere you can get a signal.

IG and CMC Markets provide some of the popular mobile apps. They have great features that support spread betting, MT4 and CFDs.

All our reviewed spreadbetting broker platforms offer mobile apps to help you grow your portfolio. Spreadex and ETX Capital are noted as providing some of the popular mobile app services with good screen execution of commands.

PayPal Spread Betting Brokers

Even though the use of cards and wire transfer makes it convenient for traders to deposit and withdraw their funds, many still consider PayPal as their number one payment option.

Paypal spread betting brokers allow traders to use PayPal as their payment method. By using PayPal, they are not required to provide all their personal information and card details. The process of depositing and withdrawing funds is also quicker, more efficient and sometimes less costly when using PayPal.

Forex Spread Betting Brokers

Forex spread betting is a subcategory of spread betting. It involves taking a bet on the price appreciation or depreciation of currency pairs.

A forex spread betting broker will quote two prices. These are the bid price and ask price. These two prices are what spread betting traders call as the spread. Traders bet whether the currency pair price will be higher than the ask price or lower than the bid price. The transaction cost of the trade will be low if the spread is narrow.

The popular spread betting brokers for Forex include FxPro, Oanda, ActivTrades, ThinkMarkets, LCG and ATFX.

What To Look For In A Spread Betting Broker Firm

- Trade offer

The ability of a broker to permit you access to different spread betting markets is one of the vital criteria to look out for.

The spread betting broker should have market specialties and can provide you with a wide array of tools that can help you in your trading endeavors.

It is also important to look out for how fast the broker updates their trade offer options. The ability to offer you other instruments like forex, EFTs and CFDs is also another important quality to look out for in a broker.

- Fees

As far as the broker’s standards and costs may differ, it is important to note that the size of the spread matters a lot to the trader. This has a lot of weight since it is also the point at which the broker makes a profit.

Pips count a lot (the percentage point change of the item being traded) and if the spreads aren’t tight the small differences become significant for a trader. In case of a 0.3% spread, the trader should make a profit of that same amount before he can be at a breaking point position. This makes the spread a very vital factor for you to consider when making a decision on the choice of broker you want to work with.

Other important factors to consider include the withdrawal fees, minimum deposit, minimum limit, and account maintenance fees. You should look out for brokers with favorable fees.

- Platform Design

Look for a simple and friendly platform to use as you trade online. The account creation, verification process, deposit, trading, and withdrawal process should all happen on the spread betting broker’s website or app.

- Customer Support System

You are bound to get into problems and finding the quickest help possible is one of the factors to consider when selecting a broker.

Choose a broker that has a 24/7 customer support system and offers efficient modes of communication. The communication modes can be through the phone or email or even a live chat system.

Can You Make Money Spread Betting?

Yes, you can make money spread betting.

Spread betting is a trading mechanism that offers you a wide variety of markets to choose from. Correctly predicting the price movement of the tradeable assets and selling at the right time results in your profit margin.

Being able to bet on every price move of an asset is what makes spread betting totally different from the normal betting. For example, if you bet £1 for every point on an asset that is valued at 100 and then it drops to 0, you can lose up to £100. On the other hand, if you place the same bet and it goes up to 500 then you can win up to £400.

Finding a broker that you can use easily is a vital factor when choosing the right spread betting platform for you. You also need to look out for the liquidity, research tools, educational content and the range of markets it provides. Remember to take your time and do some due diligence before you can open an account with any broker.

How Important Are Tight Spreads When Spread Betting?

The spread is just the difference between the buying price of an asset and the selling price of that asset. For example, in case the buying price of an asset was 124.6 while the selling price was 125.4, then the 0.8 difference between the prices is the spread.

Making a profit while spread betting dictates that the underlying amount exceeds the spread amount. The asset prices have to move by at least the same spread points for you to make a profit. For instance, to make a profit using a two-point spread, the asset point needs to move by at least two points at the time you are closing your position. If this doesn’t happen, then you’ll make money.

Tight spreads are very important during these small movements in the value and prices. They aid in making quick profits from the small movements in the values and prices of the asset.

Regulation And Its Importance For Spread Betting Brokers

The Financial Conduct Authority (FCA) is a body that regulates and governs financial institutions in the UK as well as markets and trades.

This body ensures that no one manipulates the trading market to their benefit at the expense of others. It is, therefore, a legal requirement for all UK brokers to be regulated by FCA. The ones that aren’t regulated operates on illegal grounds.

The FCA acts as a referee to set the rules by which trades can take place. Its presence is very important for spread betting brokers since it sees to it that there are no fraudsters and illegal activities during trading. The ground has to be fair for all the parties so the need for a powerful independent body to regulate the activities is a necessity. Regulation of spread betting brokers also guarantees the reputation of the brokers as well. This, however, doesn’t mean that you have chosen the perfect broker just because they are regulated. Find out other qualities before you select a broker you want to trade with.

Golden Rules Of Day Trading Via Spread Betting

Every game has got its rules and this is no different for spread betting if you want to make money. The following are some of the golden rules you need to stick with in order to make profits day trading via spread betting.

i) Follow the trend

This simply requires you to go with the market trend and learn when to get out.

The key to making a profit here is to follow the flow of the market and step out at the right time. For instance, a downward chart continues to go down. You know that this will last for some time before it shifts again. At this moment, you need to sell your assets.

Irregular charts like the zig zaggy ones are quite difficult to predict so you should wait for the chart to become more regular before making a move. The trick in making money is staying closer to the most liquid assets like the FX pairs and the major indices.

ii) Use stops And limits

Spread betting requires an understanding of what are reasonable price movements in order to create realistic benchmarks for when to get in or get out. Set a standard amount that you are willing to lose on every trade. Managing your risks comes out when you stick to your set limits and using stops to cut some losing positions.

iii) Diversification

A successful trader takes time to sample and analyze a wide variety of trends and a lot of charts. This aids in knowing some of the basics and the trends that exist during trading. It also gives you some set of open diverse positions to work with. You’ll be able to have positions on indices, commodities, FX and stocks.

Once you have found some good open positions to work with, it will be easier for you to know what is happening as afar as profits and losses are concerned. In doing so, you can learn the art of closing positions since this is all that matters. You can earn a lot of profits by knowing when to close the right position at the right moment.

How to Use Spread Betting If the Market Going Down?

Being able to bet on a market that is going down is an important skill that every trader should have. In fact, even hedge funds are doing this process.

This is how the process takes place.

- Trader X anticipates a drop in the value of Amazon, prompting him to bet on the drop that will take place in a few months time.

- Trader X knows that Trader Y has long term shares in Amazon.

- Trader X asks Trader Y if he can borrow the Amazon shares and sell them to a different party.

- Trader Y accepts the offer and charges a fee of 5% on the price of the shares.

- Trader X sells the shares on the London Stock Market.

- After a short period of time, the value of the Amazon shares drops and Trader X buys them back.

- Trader X completes its deal by giving back the shares to reserve Y.

Private spread betting traders don’t need to face the hassle of requesting for stocks from anyone since they can just bet on certain values for each point that the shares will depreciate in order to make money.

Technical Analysis Versus Fundamental Analysis In Spread Betting

Both the technical analysis and fundamental analysis are very crucial when spread trading. This is because they are useful at different durations of the trade.

The fundamental analysis comes in handy to give good guidance for long-term investments while the technical analysis helps in short-term trading. So then which one is better?

There is no straight answer as to which one is better solely because they compliment each other. Another reason is that they are used for different purposes and that they are client-inclined. Some clients prefer either but they consider both before going into trade. Timing is vital and you don’t want to go into an investment without checking the technical analysis.

The technical analysis, as well as the fundamental analysis of different assets, are easily accessible via most brokerage accounts. The spread betting broker accounts provides you with different tools that are based on fundamental and technical analyses.

How to Avoid Currency Risk When Liquidating

There should be no currency risk during the liquidation of your positions when you are spread betting with foreign currency dominated securities. This is because when the USD depreciates or goes up, the profit or loss from that spread bet needs to capture the percentage profit or loss on the basic currency pair and should be paid in that percentage in USD.

For instance, in case a trader from the US speculates a £1 move on a UK asset valued at £10 for each share and he places $0.05 per £1 and the stock market moves up to £15 during the closing time, then the profit should be 50% regardless of the exchange rate between dollars and pounds.

How Safe Is Your Money When Using Spread Betting Brokers?

It is very important to look out for your spread betting broker’s financial stability and capital strength. The broker firm should step up and solve issues quickly and efficiently so that you can maintain smooth trading.

The safety of your money, depends on the financial soundness of your broker firm and its capital base. Going for public companies can be a good idea since it is a legal requirement for them to make their financial accounts public on a regular basis. Firms like IG and Plus500 regularly post their financial accounts.

Best UK Trading Platform 2021

- Trade Crypto, Forex, CFDs and More

- FCA Regulated

- Only £200 Minimum Deposit

- Accepts Paypal

75% of retail investors lose money when trading CFDs with this provider.Glossary of trading platform terms

Platform FeeThe trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. It can be a one –time fee paid for the acquisition of the trading platform, a subscription fee paid monthly or annually. Others will charge on a per-trade basis with a specific fee per trade.

Cost per tradeCost per trade is also referred to as the base trade fee and refers to the fee that a broker or trading platform charges you every time you place a trade. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades.

MarginMargin is the money needed in your account to maintain a trade with leverage.

Social tradingSocial trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders.

Copy TradingCopy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one another. In most cases, it is the newbies and part-time traders that copy the positions of pro traders. The copiers -in most cases - are then required to surrender a share of the profits made from copied trades – averaging 20% - with the pro traders.

Financial instrumentsA Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties.

IndexAn index is an indicator that tracks and measures the performance of a security such as a stock or bond.

CommoditiesCommodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver.

Exchange-Traded Funds (ETFs)An ETF is a fund that can be traded on an exchange. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. ETFs allow you to trade the basket without having to buy each security individually.

Contract for difference (CFD)CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. CFD’s will basically allow you to speculate on the future value of securities such as stocks, currencies and commodities without owning the underlying securities.

Minimum investmentThe minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Daily trading limitA daily trading limit is the lowest and highest amount that a security is allowed to fluctuate, in one trading session, at the exchange where it’s traded. Once a limit is reached, trading for that particular security is suspended until the next trading session. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.

Day tradersA day trader is a term used to describe a trader who is constantly opening trades and closing them within a day. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes.

FAQs

Do spread betting brokers offer a demo account?

Yes. Most spread betting brokers in the UK offer demo accounts to new traders. You can use the demo account to practice and hone your trading skills before you use real money to spread bet.

Are all UK spread betting brokers regulated by the FCA?

All of the UK spread betting brokers mentioned above are regulated by the FCA. It’s important that you choose a spread betting broker that is regulated by the FCA so your money and trading account will always be protected.

Is spread betting for long-term traders?

Spread betting is more suitable for short-term traders.

How much can you bet?

The minimum bet size when spread betting depends on your broker. Most spread betting brokers require £1 per point.

What types of markets can I bet on when spread betting?

When you have a spread betting account, you can bet on a wide range of global markets. For example, City Index will give you access to around 12,000 markets across indices, shares, cryptocurrencies, commoditie, forex, etc.

Alan Draper Lewis

View all posts by Alan Draper LewisAlan is a content writer and editor who has experience covering a wide range of topics, from finance to gambling.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.OkScroll Up