Join Our Telegram channel to stay up to date on breaking news coverage

Tron (TRX) Price Analysis – June 6

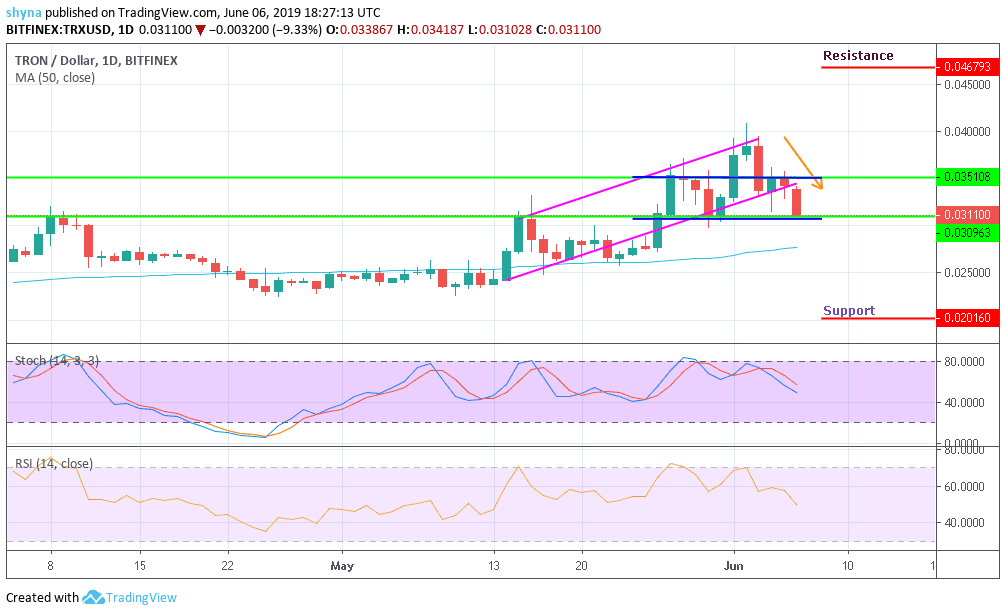

Losing 25% in the weekly trade, Tron has shown some negative signs due to the short-term bearish play which has sunk the market in the past three days. The bulls attempt to regain momentum has proven shallow and weak. Bearish exhaustion might pave way for buying momentum, which seems unlikely at the moment.

TRX/USD Market

Key Levels:

Resistance levels: $0.036, $0.038, $0.04

Support levels: $0.028, $0.025, $0.022

Tron market has been substantially low for the past four days as the token losses 5.83% in the last 24-hours of trading. The latest decline in the market is due to the recent sudden drop in Bitcoin’s price which has led to a significant decline in the entire crypto market. Currently, the bears are closing $0.3 area, where the lower wedge lies. However, testing this area could lead to a bounce or break.

If a break occurs, Tron may further sell towards the $0.28, $0.26, $0.024 and $0.022 supports. Otherwise, a bounce up could throw the buyers back to $0.036, $0.38 and $0.4 resistance. The slope spiral play is still intact. As shown on the 4-hours RSI indicator, the market has pulled back near the oversold area. However, if the bulls fail to defend their position at $0.3 level, the bears will ride straight to the potential break supports.

TRX/BTC Market

After testing the 471SAT level a few days ago, the sellers stepped in the market which eventually turned the trend to the current bearish scenario with trading around the 416SAT as of the time of writing. As a matter of fact, the 4-hours RSI has crossed to the bearish territory.

The TRX traders are now shorting positions as selling pressure slowly nears the lower wedge, below lies the 400SAT support. Further support lies at 380SAT, 360SAT, and 340SAT. If the market resumes positive move, we should expect a buying pressure towards the 440SAT, 460SAT and 480SAT resistances. Taking a look at the current market, the bears are in charge for now.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage