Join Our Telegram channel to stay up to date on breaking news coverage

XRP Price Prediction – March 22

The Ripple (XRP) is following a sideways movement as the bulls fail to move the cryptocurrency to a new height.

XRP/USD Market

Key Levels:

Resistance levels: $0.19, $0.20, $0.21

Support levels: $0.11, $0.10, $0.009

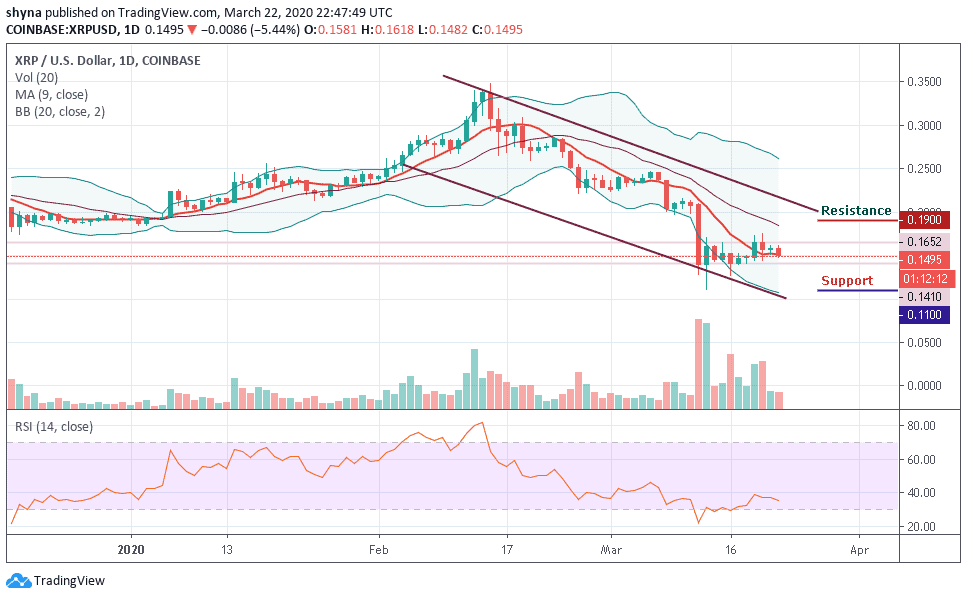

Earlier today, the price of XRP/USD has gone up from $0.15 to $0.16 before giving a bearish signal as at the time of writing, the coin is also floating within the middle of the channel as the RSI (14) indicator moves in the same direction. The daily breakdown shows that the intraday support and resistance lie between $0.141 and $0.165 respectively.

Moreover, the Ripple price has continued to demonstrate a sign of weakness across its markets. Now, the XRP/USD market is down by 5.44%, reflecting a price drop in the market trading around the 9-day moving average and the fall might become heavy if the bearish action continues. Meanwhile, around six days ago, the third largest-cryptocurrency has witnessed a bullish drive against USD.

Therefore, since the XRP/USD is moving in sideways, the trend may likely advance higher if the current price holds and remain inside the channel. A channel breakout could strengthen the bulls and push the price to the resistance levels of $0.19, $0.20 and $0.21 whereas a channel breakdown might lead the market in a bearish scenario if the price continues to fades and the closest supports to reach are $0.11, $0.10, and critically $0.009.

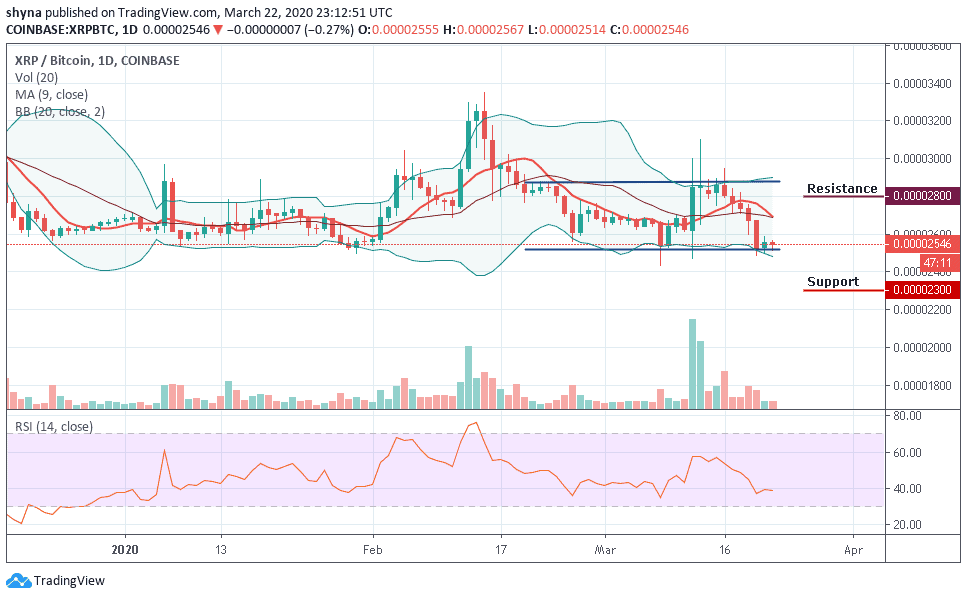

Against Bitcoin, the Ripple (XRP) is consolidating within the channel and trading below the 9-day moving average. However, if the bulls could energize and push the price towards the moving average, the bullish continuation may likely take it to the resistance levels of 2800 SAT and 2900 SAT respectively.

Looking at the daily chart, should the bulls failed to hold the price, then it may likely fall below the channel and the nearest support levels for the coin are 2300 SAT and 2200 SAT. The RSI (14) moves below 40-level, which indicates a sideways movement.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage