Join Our Telegram channel to stay up to date on breaking news coverage

Are P2E a sustainable way to profitability? The quick answer, in general, is no, but there are exceptions. The specifics of each game and its underlying game economy will determine this. In this article, we explain what is needed for a P2E game to be financially viable below. If these conditions aren’t met, you’re most likely dealing with a P2E pyramid scheme.

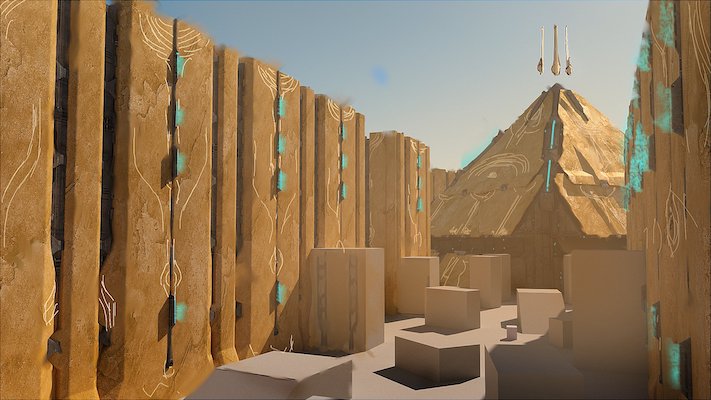

An illustration of a P2E game

It’s crucial to note, before we continue, how challenging it is to make P2E games deliver on their promise of generating actual cash for all or the majority of users. Imagine a trivially simple game that only uses dollars and is modelled after the fundamental design of the majority of current blockchain P2E games to illustrate how this works.

In order to “start playing,” players in this game purchase NFTs from a fictitious GameCo for $100. After that, they can use the NFT in-game to receive a return from GameCo that will be credited to their debit account at the rate of $1 each day for a year. The NFT purchase for the buyer returns 265% over a year and pays for itself in 100 days (if paid in full) (again, if paid in full). It seems like a fantastic deal!

GameCo quickly acquires USD from the NFT sales as more players join the game. But soon the excitement fades and the market becomes oversaturated. Fewer and fewer individuals buy new NFTs as everyone recognizes the business isn’t viable. When this occurs, a significant number of recurrent $1 payouts and almost zero inflows cause GameCo’s bank balance to start falling until it reaches zero. It’s inevitable that GameCo fails.

Individuals that purchased NFTs early and accrued incentives for 100 days or more are ultimately net winners, whereas players who joined later are net losers. It’s a “zero sum” game strictly speaking. Every dollar one person makes, another person loses. Early arrivals “earned money,” while late arrivals suffered losses of up to 100%. This hypothetical video game is a classic Ponzi scheme.

It gets worse if we add a little bit of realism since GameCo incurs expenses. The people who actually built the product—game designers, software engineers, artists, marketing teams, etc.—must be paid. The gaming model shifts from zero sum to negative sum when we take into account these (sometimes substantial) outlays. At least one dollar is lost by other players for every dollar P2E players make.

Why are we saying this? The majority of P2E gaming models have this same fundamental ponzi basis. The problem is that the underlying economics are not immediately clear due to the complexity of the different currencies and assets involved (Ethereum, in-game tokens, game-related cryptocurrencies, and NFTs), as well as the high price volatility of those assets.

In current P2E games, you receive in-game tokens or crypto-currencies on some blockchain instead of U.S. dollars for your NFTs, which you can subsequently exchange for stablecoins (like Tether) to cash out. While this makes things more difficult to understand cognitively, it has little impact on the fundamental economic structure or sustainability standards.

(How) Is P2E Sustainably Doable?

The only way a subset of P2E players can consistently profit from the game (as measured in USD) is if the game receives funding from an external income stream unrelated to P2E. In order to develop demand for the in-game crypto-assets and ultimately make them redeemable for stablecoins at a fair price, GameCo needs to be able to generate this income stream.

Where does this external money source originate from, which drives up demand for the game’s crypto assets? It might originate from various places:

- Subscribers and game buyers who pay (that are in it for the fun, not for the returns)

- Microtransactions (shortcuts and in-game services that don’t guarantee rewards)

- Vanity things (like NFTs, that promise no economic returns)

- Income from external advertising (e.g. digital billboards)

More dubious sources include the following non-conventional ones:

- The Treasury of GameCo’s investments’ returns

- Cryptocurrency donors that support GameCo

- Sustained appreciation of tokens and coins

It’s not difficult. All of GameCo’s P2E players need to make money for this to happen, but where will the money come from? From the list’s items 1 through 4, start with the most obvious. The external revenue may come from paying customers who play for fun or entertainment and pay a subscription fee (like in MMORPGs) or a one-time fee (like in console gaming). It might also result from in-game microtransactions, where users who are just playing for pleasure pay to speed up specific mechanics or advance in a line (or whatever else). It might also result from the selling of status-enhancing vanity items (such as skins, expensive mounts, titles, etc.). It might also result from in-game promotions for outside goods (like computer hardware or accessories).

My point is that GameCo needs to generate revenue in order to use it to increase demand for in-game tokens, cryptocurrencies, and assets. It must do this in order for P2E players to eventually cash out at fair pricing and make money (in USD). Additionally, GameCo’s revenue must originate from reliable sources, such as non-P2E gamers who are willing to pay the company in exchange for the enjoyment, entertainment, sense of community, and other benefits that come with playing traditional video games.

What About Alternative Sources of Funding?

Then there are other, less obvious income streams that, in principle at least, may sustainably finance player demand for the game’s crypto-assets and, consequently, P2E payouts. The warning is that all of these are either exceedingly hazardous or uncertain, or both.

Treasury revenue is one (possible) source of income. Let’s say GameCo is operating a conventional Ponzi scheme similar to the one we initially described. However, it invests the initial $100 NFT sales proceeds in a profitable but unrelated business venture rather than just depositing the large sum of cash in a bank. If the investment is successful, the proceeds might theoretically be used to pay out rewards to P2E players (through demand from buy-backs of the game’s crypto-assets).

Nevertheless, the notion of paying P2E payouts with investment profits is absurd and stupid for a variety of reasons. First, how much better is a crypto-gaming company than a venture capital fund or an exchange-traded fund (ETF) at identifying lucrative investments? Sure, they might strike it rich and become wealthy. However, generally speaking, they are undoubtedly inferior than investment specialists, so why bother? Second, because the investment vehicle is disguised as a gaming company, it would be an extremely inefficient method to invest because it would have to pay for all the game developers, engineers, and marketers. Why would you pay for that? Thirdly, you most likely lack the information, openness, and protections that come with conventional investing instruments. This P2E payout model is a terrible concept for these and other reasons.

Crypto charity is another source of income that might be used to finance P2E payouts. A whole generation of crypto millionaires and billionaires have been made rich by the amazing rise in the value of Bitcoin, Ethereum, and other digital assets. These individuals now want to “give back,” particularly in ways that promote or advance crypto and the crypto community. These individuals may be willing to invest money up front to fund ex-ante payouts for a certain game because they want P2E blockchain gaming to “work.” Crypto billionaires are more inclined to intervene ex-post in a collapsing ponzi game to attempt and limit the harm to their reputation and preserve the idea of blockchain gaming and P2E. There have been stranger occurrences.

Can P2E become viable through token/coin appreciation?

Usually no. Since the games were released, crypto assets from well-known gaming firms like Axie Infinity and Gala Games have seen extraordinary price hikes that have made a lot of individuals quite wealthy. However, unless certain requirements are satisfied, these normally high and rising prices cannot be maintained over the long term.

Ultimately, one of the following conditions must be met for game-related crypto-assets to have continuous value growth over time:

- The game’s cryptocurrency assets must demonstrably stake a claim to an increasing revenue stream, or

- In the long run, the intangible value-added offered to purchasers and holders of the game’s crypto-assets (presuming there is one) must rise rather than fall.

Let’s talk about (2) first. We have discovered in the past year or so that a variety of assets can acquire and (seemingly) maintain extraordinarily high valuations despite having little economic viability, fundamental business disclosures, or practical application. Consider the stock of Donald Trump’s SPAC, which lacks a viable business plan. Think about GameStop, which is still over $100. Consider the governance tokens for the constitution DAO, which saw a sharp increase in value when the DAO failed to purchase a copy of the U.S. constitution and was unable to refund the funds due to prohibitively high Ethereum transaction fees.

According to Bloomberg contributor Matt Levine, these exorbitant valuations are not just the result of FOMO and investors seeking profits in a speculative bubble. He speculates that buyers are also prepared to pay for the cultural, social, ideological, or aesthetic value they receive from purchasing risky assets. They are prepared to take significant financial risks in order to take part in a larger crypto/meme movement or revolution. Although it is unknown if and how long this phenomena will last, for the time being it is contextually significant.

Theoretically, gaming crypto-assets may rise in value in a similar manner. Perhaps game developers will be able to add intangible value through the process of purchasing and keeping the game’s linked crypto assets rather than through the game itself. In the event that game developers are successful in doing this, the intangible value-added from owning coins and NFTs increases over time as opposed to decreasing, and the crypto assets are not depleted by the creation of new assets, sustained appreciation is (probably) feasible.

To be fair, it’s very doubtful for this being feasible on a large scale or being a sustainable means for P2E gamers to make money. Sure, certain historic NFTs and cryptocurrencies may have unique cultural value that will only grow with crypto adoption. To develop assets with these (amazing) qualities, however, is not something that any ol’ P2E gaming company should be expected to be able to do, especially if the games are subpar, which they frequently are.

So what about (1)? Game-related crypto assets may also go up in value and generate “income” to P2E players if they represent a claim on an income stream that is growing. The claim can be direct (through dividends or airdrops) or indirect (through buybacks). But there can only be a growing external income stream if there are more game subscriptions, game sales, micro-transactions, vanity item sales and advertisement. In this sense, (1) is nothing new, just a restatement of the initial conditions for sustainability we articulated above.

What about Axie Infinity?

Axie is probably also a pyramid scheme. Why? Because by and large, no one is playing for the fun of it. Instead, people in developing countries just log on day after day and grind for hours because their outside option is even worse, for now.

Real players aren’t putting money in to buy vanity items to show off with their friends. People aren’t paying monthly subscriptions to have a good time. Nobody is buying micro-transaction products from Axie to make the game more enjoyable. Axie isn’t selling ad space to third parties.

As a result, there are no structural sources of demand for the so-called Smooth Love Potion (SLP), the cryptocurrency that Axie players grind endlessly for. And without that built-in demand, there is not much to support SLP’s sagging price. If nobody wants SLP for anything other than speculating on its price or for breeding new Axis to generate yet more SLP, the price will eventually fall, as it recently has.

More likely than not, Axie will end badly, as all pyramid schemes eventually do. Maybe a crypto billionaire can step in and buy SLP to keep the show running for a while longer. Maybe Axie’s parent company can fund SLP buybacks with income from its web3 excursions or the business that its Ethereum side-chain Ronin might generate. But that’s doubtful.

Instead, the most likely outcome is that the people that get wiped out if and when Axie Infinity collapses are the very same people in the Philippines, Venezuela and elsewhere it was supposed to help.

Related

- Stacked Wants to be The Twitch of the P2E Gaming Space; Series A Pulls in $13 Million

- A P2E Crypto Is Gaining Support Despite the Crypto Market Facing a Major Downturn

- 10 Best P2E Gaming NFTs to Invest in

Join Our Telegram channel to stay up to date on breaking news coverage