Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) Price Analysis – September 18

Litecoin adds 4.16% in a day, and it is now being traded around $78.2. The next major resistance is likely to come at $84.

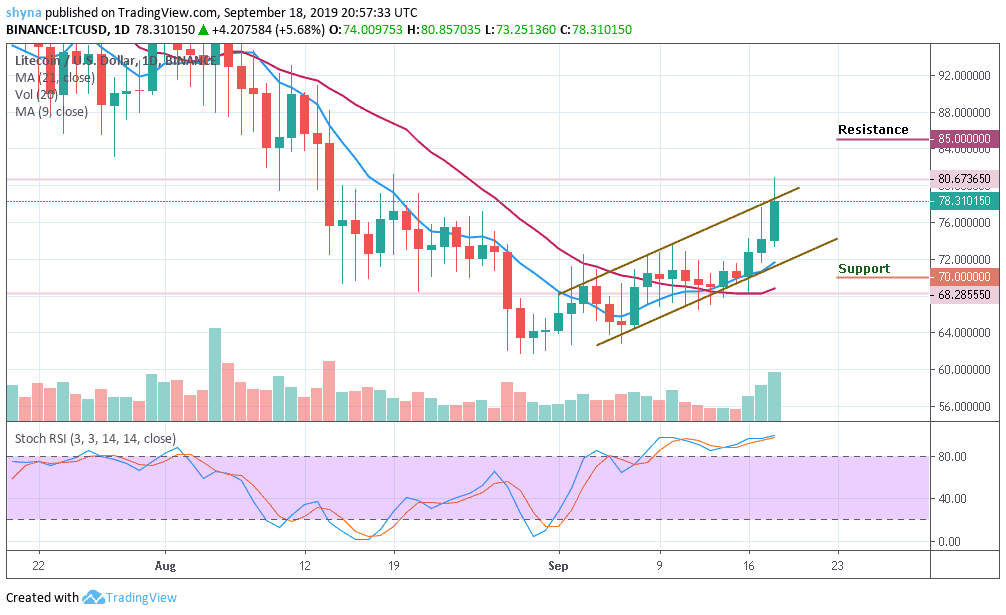

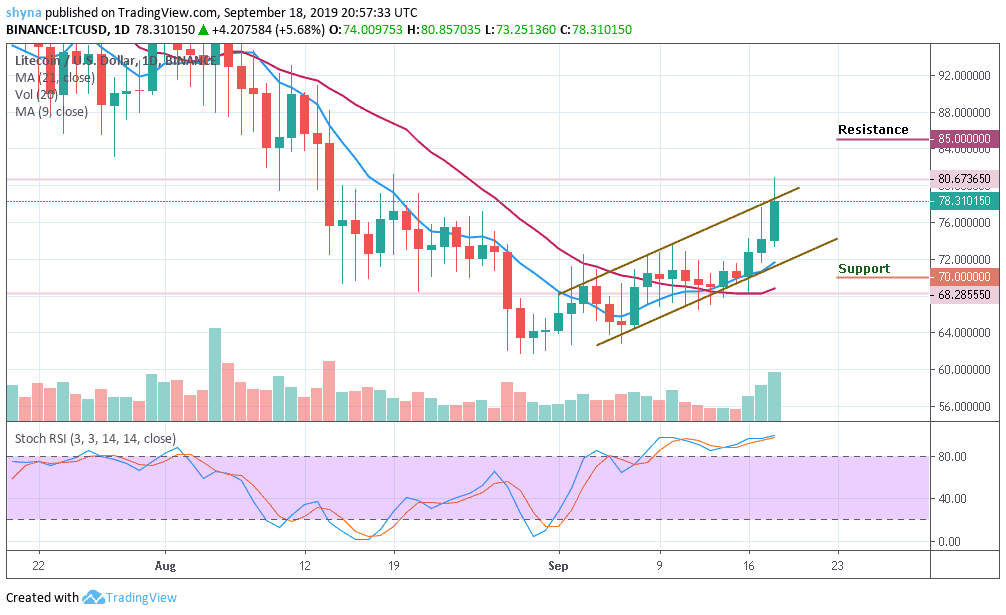

LTC/USD Market

Key Levels:

Resistance levels: $85, $90, $95

Support levels: $70, $65, $60

Litecoin has been able to fetch a decent hike in the last 24 hours that took the coin near $79 after a while. The coin is already on a path of price recovery after the previous week’s unprecedented slowdown. LTC is one of the most emerging coins of the market, and it is likely to touch $85 in the coming days as its next resistance. The long-term outlook is likely to be bullish.

However, as the trading volume is increasing, the coin is moving within the ascending channel and could exceed the resistance levels of $85, $90 and $95 before the end of the month if the bulls make more effort. Nevertheless, the stochastic RSI is at the overbought territory but the bears could step back into the market once the signal lines turn downward and the nearest support levels lie at $70, $65 and $60 respectively.

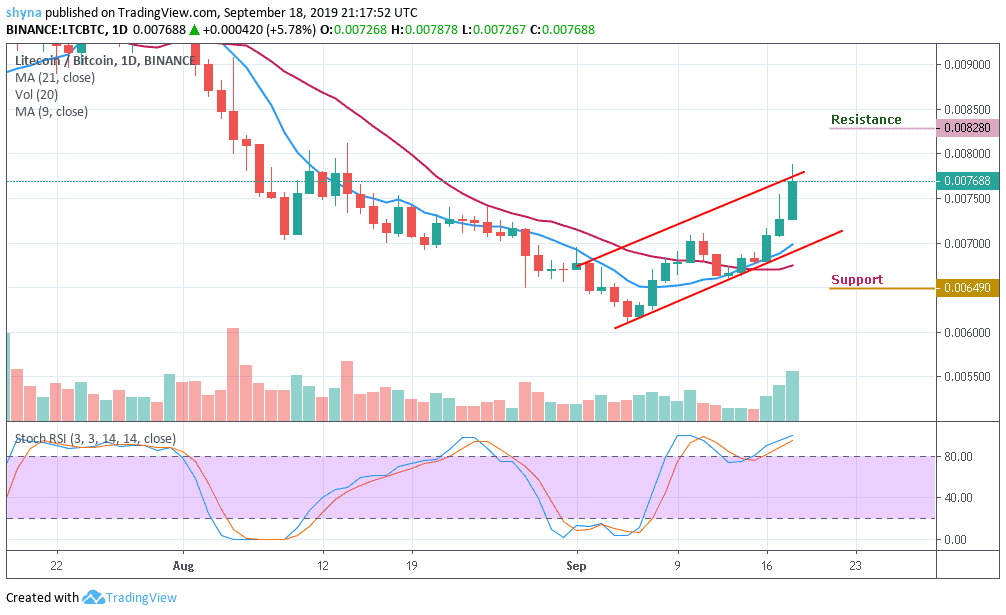

LTC/BTC Market

Against Bitcoin, the daily chart has shown that the buyers are dominating the market with a heavy upsurge as the price moves above the moving averages of 9-day and 21-day. Meanwhile, if the bulls can put more effort into the price to break out of the ascending channel, the key resistance levels lie at 0.0082BTC and 0.0085BTC. A further rise may push the price to 0.0088BTC.

Moreover, for a rebound move, the 0.0070BTC support is likely to resurface and if the 0.0070BTC could not hold the rebound, the price may further drop to 0.0065BTC, 0.0062BTC, and 0.0059BTC support levels. The stochastic RSI keeps swimming in the overbought zone, which could inject bearish signals into the market when turns down.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage