Join Our Telegram channel to stay up to date on breaking news coverage

The recent market happening is currently stirring up the line of thought of placing a ban on cryptocurrency derivatives by the FCA. The FCA( Financial Conduct Authority) is U.K’s financial regulatory body. The regulatory body stated this in a recent report.

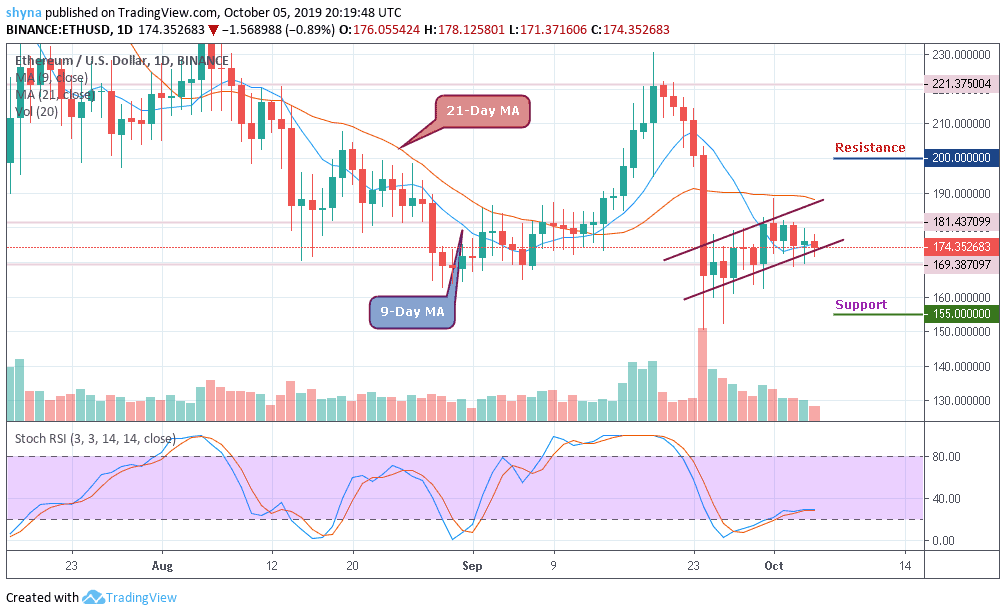

Recall there was a nosediving drop in Bitcoin price past weeks which the cryptocurrency fell within the space of 30mins down by more than $1000. The Financial regulatory body is greatly concerned about the volatility of crypto derivatives and as such is considering a ban to curb losses that might result from such future market occurrences. An estimated value of $288 million is believed by the FCA to be saved if a ban is placed.

FCA Considers Banning Bitcoin(BTC) and Other Crypto Derivatives Products

Ongoing market volatility might spur a reaction from FCA causing a ban on Bitcoin(BTC) and other crypto financial instruments. This includes options and futures as well. Recall how Bitcoin price crashed in the past weeks and subsequently forcing down BitMEX’s earnings by a whopping $643 million. BitMex is a crypto trading platform that handles Bitcoin contracts.

Considering the total amount of crypto derivatives products sold in recent times especially this year 2019, research stated this as more than $23billion, so ongoing market volatility occurrences like that in the past few weeks may generate concerns in the financial sector worldwide.

Recounting a loss suffered on crypto financial instruments across the UK crypto space in the past two years to be an estimated amount of $457 million, the FCA might consider a blanket ban on it.

The regulatory body also pointed out that leverage and high trading costs make crypto derivatives more susceptible to market twists resulting in a greater loss.

Cryptocurrency Against All Odds

So much is yet to be understood about cryptocurrency. This generalized misconception is triggering an anti-crypto stance in places apart from the UK. Germany and Japan are considering a regulatory change in crypto trading.

In South Korea, the financial regulatory body is receiving backlash from cryptoanalysts for the stringent measures it’s taking as regards cryptocurrency believed to be unfriendly.

Join Our Telegram channel to stay up to date on breaking news coverage