Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – October 10

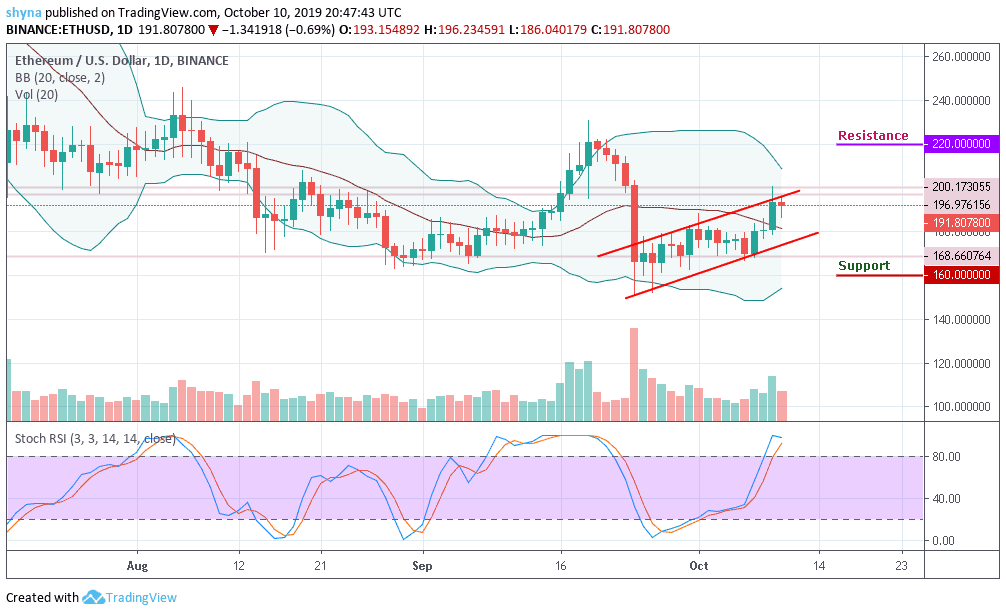

Ethereum price is seen moving higher within a rising channel that has been tested severally on both sides.

ETH/USD Market

Key Levels:

Resistance levels: $220, $225, $230

Support levels: $160, $155 $150

Ethereum, the second-largest cryptocurrency with the current market capitalization of $20.7billion, has been range-bound recently. The coin faced stiff resistance on approach to psychological $200 and settled at $191.80 as at the time of writing. ETH/USD has gained about 0.35% on a day-on-day basis since the beginning of today’s trading.

At the moment, the price of Ethereum is been bitten by the bear as the coin is experiencing a price drop in the market. Nevertheless, after touching the $196.97 level today, the coin has been waiting for a break out of the ascending channel to the upside, but with the look of things, this might not come into play as being revealed by the technical indicator.

However, Ethereum price is moving within the ascending channel and above the Bollinger bands middle level. More so, should in case the bulls maintain its upward movement, they may likely push the price to reach the resistance at $220, $225 and $230 levels, otherwise, there is a possibility of it getting to the support levels at $160, $155 and $150 respectively because the stochastic RSI is already at the overbought zone.

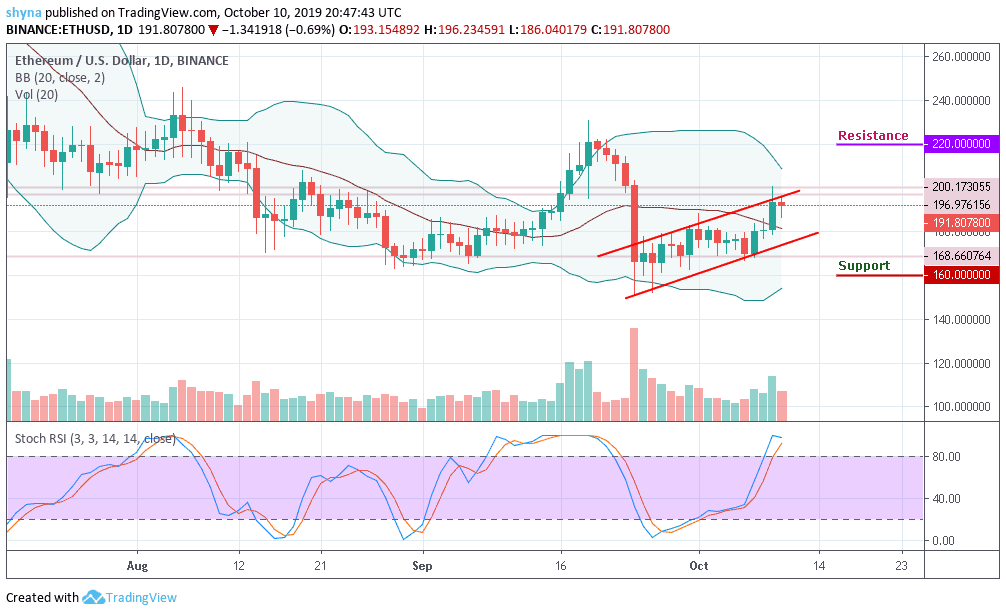

Against Bitcoin, the daily chart shows that Ethereum’s price is trading well in a strong uptrend around 0.0224 BTC. As soon as the price is above 0.0230 BTC, there is a possibility that additional benefits will be obtained in the long term. The next resistance key above 0.0235 BTC is close to the 0.0245 BTC level. If the price keeps rising, it could even break the 0.0250 BTC in future sessions.

Meanwhile, if the bears regroup now, the 0.019 BTC and 0.017 BTC supports may play out before rolling to 0.016 BTC and this may create a new monthly low for the pair. However, the daily outlook is still looking bullish as the price actions remain in a consolidation mode. The stochastic RSI is entering into the overbought zone to enhance the bullish movement for a while.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage