Join Our Telegram channel to stay up to date on breaking news coverage

The witching hour for the buy Dogecoin crowd draws near, as NBC drops a teasing SNL trailer in which Elon Musk, aka the Dogefather, promises he’ll be “good-ish”.

Here we provide five reasons to stiffen the resolve of otherwise trepidatious market participants out there wondering whether it’s a good time to buy Dogecoin, given that even the swashbuckling Elon Musk urged caution earlier this week.

Fear of possible disappointment risks a ‘sell the news’ moment.

Also, in exclusive comments provided to insidebitcoins.com, veteran crypto watcher and investor Clem Chambers provided his Dogecoin thoughts – he reckons whatever happens post SNL, it’s all about the brand power.

In addition Rob Gaskell, founder and partner at Appold, the emerging tech advisory and investment firm, reveals that he is very much of a mind that Dogecoin is the sort of plague-spreader the crypto industry could do without.

Currently trading at $0.63, down 9% in the past 24 hours, here are the five reasons why you maybe shouldn’t give up on Dogecoin just yet or the joke could be on you.

But remember, binary events are not good for the blood pressure, so you may want to sit out the fun that starts at 11.30 EST and make your move after the excitement has died down. As all good hosts will tell you, it’s all about the timing.

1. The Musk effect is still potent

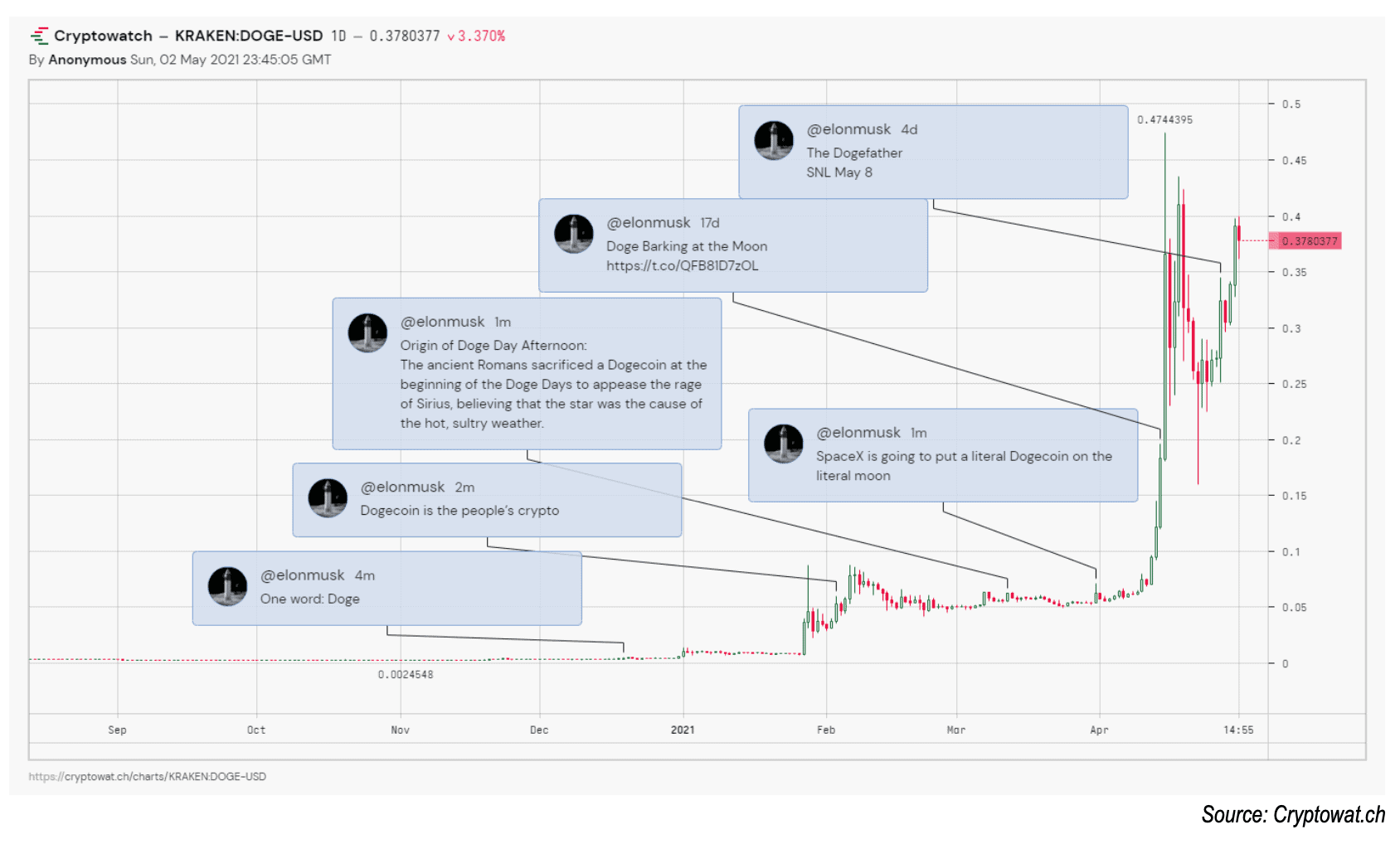

Elon Musk is on Saturday Night Live and whenever he gets the chance to promote his favourite crypto he takes it. That should be good news for Dogecoin because a tweet from Musk, no matter how inscrutable, invariably provokes riotous buying.

For example, on 4 February he tweeted: “Dogecoin is the people’s crypto”, followed up with the tweet of riff on the Lion King, with Musk holding up a baby Doge and the words “ur welcome”. The cryptoverse went into overdrive – or at least the Doge lovers. The coin’s price advanced 50%.

He pulled off an even bigger pump on 15 April when he tweeted “Doge Barking at the Moon”. The result? Dogecoin surged 520% that week.

2. Dogecoin is a Bitcoin offspring

The Shiba Inu doggie coin, which, for those not fully initiated, is actually pronounced as if it work the Doge of Venice (soft g), was a self-confessed joke developed in 2013 around an internet meme doing the rounds at the time.

Dogecoin’s inventors are Jackson Palmer, who’s day job was in the Adobe marketing department and an IBM software engineer by the name of Billy Markus, but they disowned the coin a few years later.

Palmer, no doubt with his tongue firmly wedged in cheek, tweeted back in 2013, “investing in dogecoin, pretty sure it’s the next big thing”. That was thought to be the first public mention of Dogecoin.

The mining of the genesis block followed soon thereafter, on 6 December.

But what exactly is Dogecoin? Actually its codebase is pretty solid, even if its route to mainnet was somewhat convoluted. The coin is a codebase fork of a fork of fork of a fork, but at root is based on bitcoin (Luckycoin, Junkcoin, Litecoin, Bitcoin).

3. The trend is your DOGE friend

Dogecoin keeps defying the naysayers. Naturally, it is shunned by those who are hostile to crypto but also by those who are serious about crypto, the latter dismissing the meme coin as a diversion or worse calling the entire sector into disrepute.

Rob Gaskell, a partner at digital asset advisory Appold which focuses on helping its institutional clients to understand and gain exposure to crypto is, as you would expect, in the ‘wish it would go away’ camp.

He is dismissive: “Doge is really being hyped and a simple use case that is so similar to other coins. As you can probably tell I am not a fan as this damages the space in my view.” So Gaskell won’t be buying, regardless of the price trend.

The price momentum anchoring effect is much written about in academia and by trading theorists, but in a nutshell it captures the fact that we don’t like buying when the price is at or near the top. Anchoring is a behavioural bias where traders place excessive weight on the nearest-in-time price point. But when a price is trending higher – albeit in gigantic bursts – it tends to continuing doing so.

And in the case of Dogecoin, the momentum is not fuelled just by the musings of rocket man Musk. We have already seen the power of the crowd take shape in the form of the Reddit-Robinhood nexus. That, combined with the third handout of helicopter money from the US government, and it does seem to suggest that there could plenty more strength in the Shiba Inu’s legs.

4. Dogecoin’s supply is limitless

Dogecoin supply is avalanche-like. An inflationary supply has an advantage for a coin that aspires to be a medium of exchange that is actually used as such. Unlike bitcoin which is deflationary, if it ever does become common currency in the commercial world, it would at some point become a fetter on economic activity because there would not be enough Satoshi to go around, although it could of course be tweaked to further subdivide satoshi into yet smaller units.

Dogecoin would have no such problem. The block reward is 10,000 and with blocks added to the chain every 1 minute (as opposed to bitcoins every 10 minutes), that means supply inflation runs at a whopping 14.4 million newly minted Dogecoin every day – although the inflation rate does reduce as supply becomes grows. There is also no cap on supply. So every year 5.2 billion new DOGE babies are born.

Sure, Dogecoin only has one use case – money for the people. But if it catches on in that department then its supply constraints won’t be one of its problems. (Dogecoin dropped the SHA-256 algo used by bitcoin in favour of scrypt which requires less hash power, but that’s another story.)

5. Dogecoin has brand power

Our fifth reason to buy Dogecoin is because of its brand power. At last count, according to Coinmarketcap, there are 8,751 cryptocurrencies vying for our attention. The fight for visibility among the thousands of competing projects, even if a large chunk of that number are close to dead or essentially inactive, is intense.

Getting into the top 100 and staying their matters for the health of a crypto, even if many a team will tell you its all about the on-chain activity of the blockchain network of whichever industry it is being targeted for disruption by the decentralising crypto new(ish) kids on the block.

And if being in the top 100 is vital, then of course top 10 status makes you crypto royalty – as well as these days signalling that your network is likely to be valued at tens of billions of dollars.

We asked Clem Chambers, the chief executive of global private investor network ADVFN and also the CEO of Online Blockchain, what he thought about the Dogecoin hype.

“Dogecoin has always had a great brand and will always have a great brand and as such will always be a major crypto.”

But before you jump in to buy Dogecoin after reading the five reasons laid out above, you might want to dwell on Chambers’s assessment of the SNL situation.

“Crypto is all about brand; Elon Musk, Dogecoin and SNL have huge brands, so the world is expecting fireworks but it should all be in the price by now so there may be a major disappointment.”

Looking to buy or trade Dogecoin (DOGE) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Join Our Telegram channel to stay up to date on breaking news coverage