Join Our Telegram channel to stay up to date on breaking news coverage

Ever since Bitcoin halved its mining rewards on May 11, the number of BTC withdrawn from cryptocurrency exchanges has increased. Data from Glassnode suggests that that people have withdrawn Bitcoin worth $220 million from various exchanges since the halving.

Thousands of BTC withdrawn

According to the Bitcoin Exchange Net-Flow statistics from Glassnode, users have withdrawn around 24,000 BTC from their crypto exchange account since the halving in May. Data from Bituniverse is also suggesting a similar outflow of coins from trading platforms. However, it indicates that this activity is taking place only in certain exchanges.

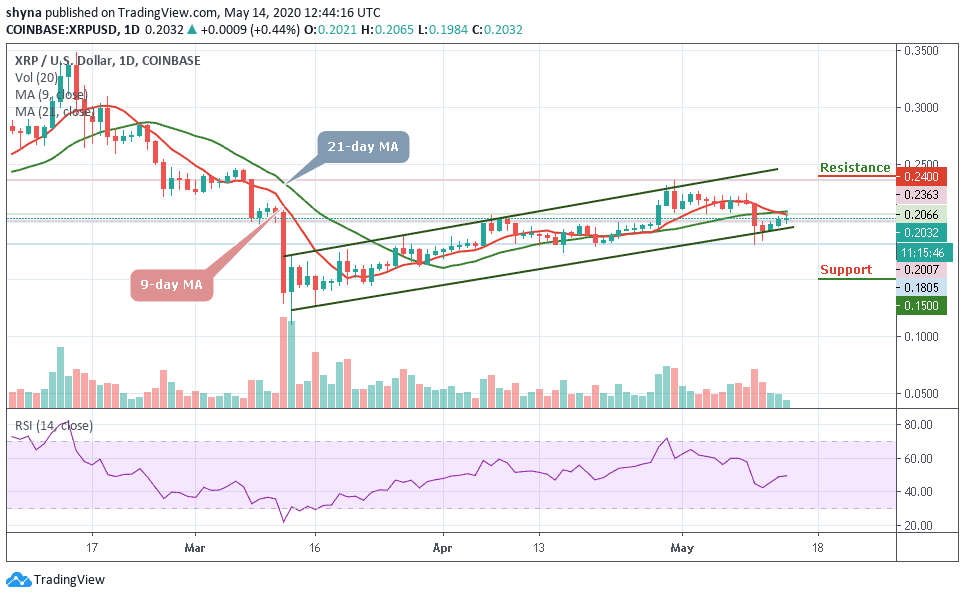

The price of Bitcoin has gone slightly higher since the halving. The overall hashrate has lost a little hashpower. However, there has been no drastic drop in the overall hashrate, as predicted by some skeptics. On May 12, the total market of Tether (USDT) ballooned higher than that of Ripple’s XRP. At the time, the overall supply of stablecoins crossed the $10 billion valuation mark. USDT markets showed that the total market valuation of Tether is currently $5.74 billion, which is more than 50% of the total stablecoin market valuation.

A move away from centralized platforms

Centralized trading platforms are experiencing an outflow of Bitcoin. In mid-April, data from Chain.info, Glassnode, and Bituniverse pointed in the same direction. Glassnode suggests that even though over $200 million left centralized exchanges after the halving, this pattern has been ongoing since mid-April. It wrote, “In the hours before and after Bitcoin’s halving, exchange net flow decreased significantly. So far, the event has had no impact on 2020’s trend of investors withdrawing BTC from exchanges.”

Data suggests that Coinbase has the largest reserves of BTC, which have remained roughly the same. However, about 20,000 BTC left Huobi since April 12. Bitfinex had 205k BTC in reserves around mid-April, which has fallen to 134k. Bitmex’s reserves have reduced from 228k to 214k. Bitstamp reserves have gone up from 66k BTC to 71k BTC.

Both Bitfinex and Bitmex have dropped down the listings by reserve counts since January this year. Today, the top 5 crypto exchanges are Coinbase, Huobi, Binance, Okex, and Bitfinex.

Join Our Telegram channel to stay up to date on breaking news coverage