Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – September 15, 2020

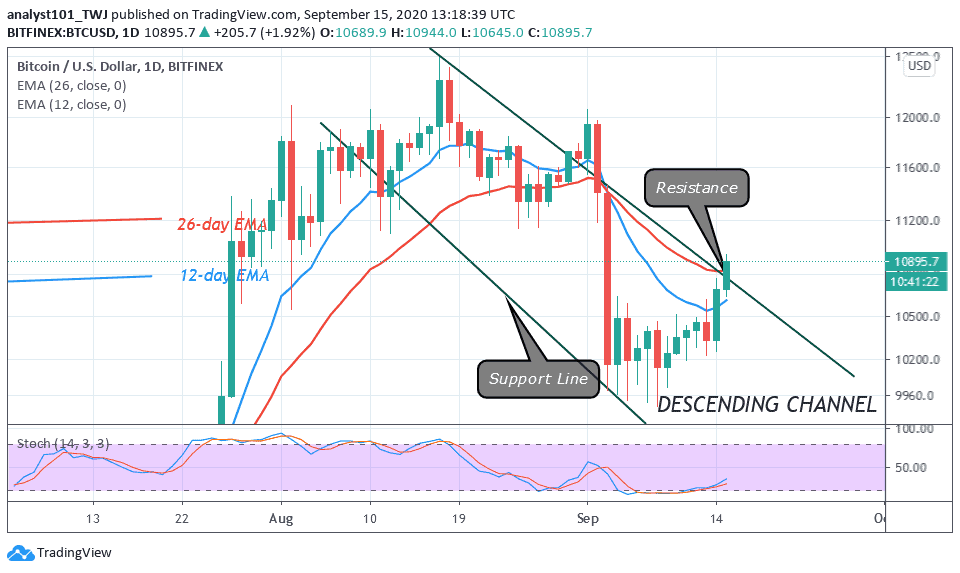

Yesterday, BTC/USD rebounded above the $10,200 support as price breaks the $10,600 resistance. A rally above $11,000 is possible if the bullish momentum is sustained. The crypto is trading above $10, 800 at the time of writing.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Since September 3, Bitcoin has been fluctuating in a tight range between $10,000 and $10,500. After the rebound above $10,200 support, the price momentum broke the $10,500 and $10,700. The bulls have sufficiently broken the $10,700 resistance as buyers push on the upside. The price has been able to break above the 12-day EMA and the 26-day EMA.

A break above the EMAs will accelerate price movement to the upside. Nonetheless, the coin may face further resistance at the $10,800 and $11,000. Bitcoin will be out of the downtrend zone if the current resistances are cleared. Possibly, the market will resume the upside range momentum above the $11,000 support. Meanwhile, Bitcoin is in a bullish momentum above 25% range of the day stochastic.

Bitcoin (BTC) Will Equal JP Morgan’s Market Cap If the $16,500 CME Gap Closes

In August the sentiment around Bitcoin was noticeable after the breakout above $12,000 resistance. The reports have it that if BTC is strengthened and it reaches the $16,500 high, it would equal JP Morgan’s market capitalization. This explains the growth of the crypto currency markets. The significance of Bitcoin reaching the high of $16,500 is because of a CME gap at this level. This CME gaps emerge when Bitcoin’s price moves below or above the price last seen on the CME market before it closes.

Also, the CME Bitcoin futures market closes during the weekends, this causes gaps between CME and the crypto currency markets to emerge. Currently, two gaps are opened at $9,650 and $16,500. According to MMCrypto, an on-chain analysis firm listed major financial conglomerates’ valuations, relative to BTC’s potential price. Bitcoin’s potential price level will equal the market capitalizations of the following companies if it rises :

BTC‘s potential price level

$16,500 JP Morgan

$23,000 Visa

$40,300 Facebook

$106,000 Apple

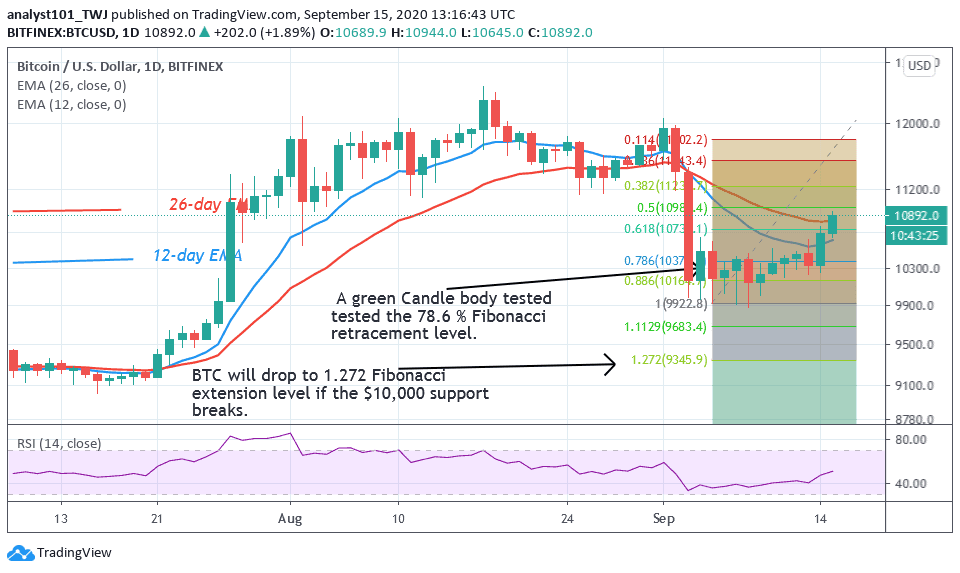

$487,000 Gold

Nonetheless, Bitcoin bulls have also broken the resistance line of the descending channel. BTC has survived the $10,000 support as the market resumes upside momentum. Since the psychological support is holding, the Fibonacci tool analysis is not likely to hold. The king coin is likely to return to the bull market if price breaks above $11,000 support.

Join Our Telegram channel to stay up to date on breaking news coverage