Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – April 8

Bitcoin (BTC) has effortlessly zoomed above $7,300 but the upside is limited. Sustained movement below $7,000 will worsen short-term outlook.

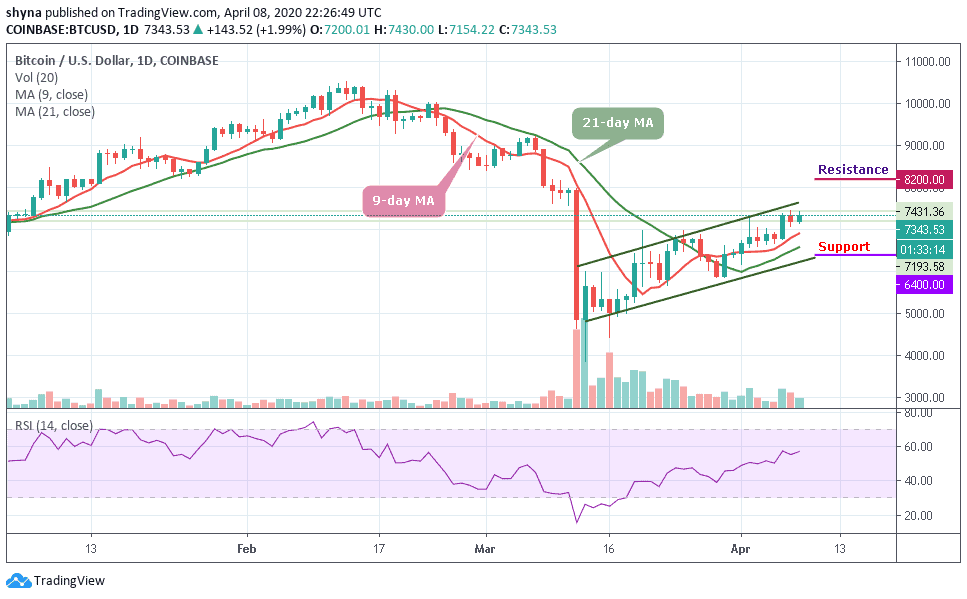

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $8,200, $8,400, $8,600

Support Levels: $6,400, $6,200, $6,000

BTC/USD has once again made an impressive move to the upside during the early trading session of today but the coin is currently trading below $7,400 after touching the key resistance at $7,431.36. The bulls are now expecting the price to rally higher but in order for things to change in the near-term, traders may need to see the price of Bitcoin to make a higher high and a higher low.

However, Bitcoin may face a setback for the moment; it’s not permanent. The coin will likely have a bullish trend in the near term, but a price rally could help it hit its monthly high again. Currently, Bitcoin is trading around $7,343 level after a free fall from $7,431. Moreover, the coin is now facing the resistance level of $7,400 waiting to break out of the channel. The strong bullish daily candle forming today on the daily chart indicates that the bulls may continue to be in control.

Meanwhile, looking at the chart, $6,800 serves as the major support level, making room for BTC to fall further which the support levels of $6,400, $6,200 and $6,000. The RSI (14) for the coin is heading above 55-level to indicate an upward movement. More so, BTC/USD may likely see the resistance levels at $8,200, $8,400 and $8,600. The technical levels remain positive, especially with the technical indicators.

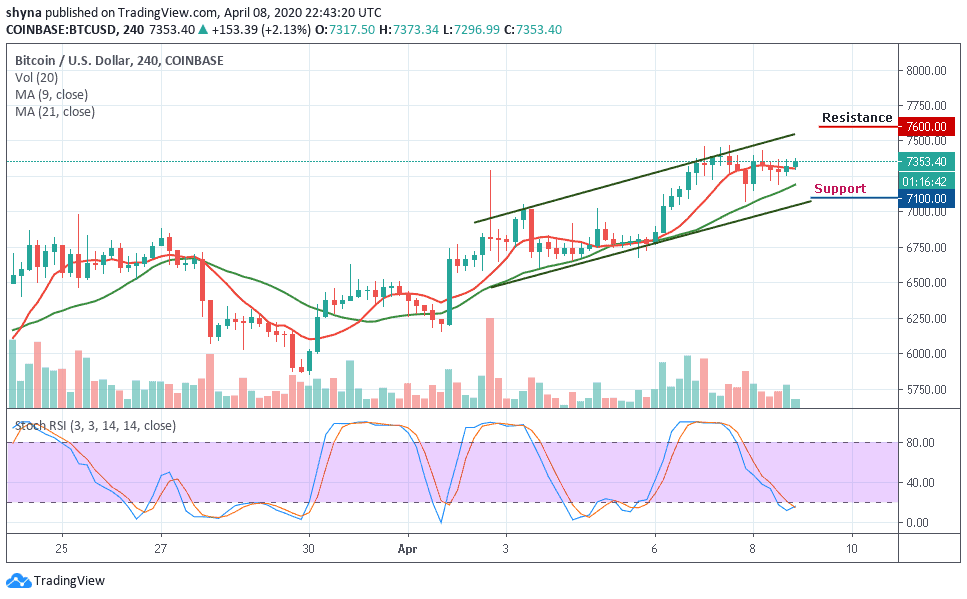

BTC/USD Medium – Term Trend: Bullish (4H Chart)

BTC/USD is seen performing well at present. With this, we expect the coin to gain the lost momentum and hit the trade above $7,400. However, the volatility hovers and the selling pressure still exists which leads the coin to lose the major support from the moving averages. Meanwhile, the $7,000 and below may come into play if BTC breaks below $7,100 support level.

However, in as much as the buyers can reinforce and power the market, traders can expect a retest at $7,500 resistance level and breaking this level may further allow the bulls to reach $7,600 and above. The stochastic RSI is nose-diving toward the oversold zone which shows that more bearish signals may surface.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage