Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – December 4

Bitcoin (BTC) has effortlessly zoomed above $7,400 but the upside is limited. Sustained movement below $7,000 will worsen short-term outlook.

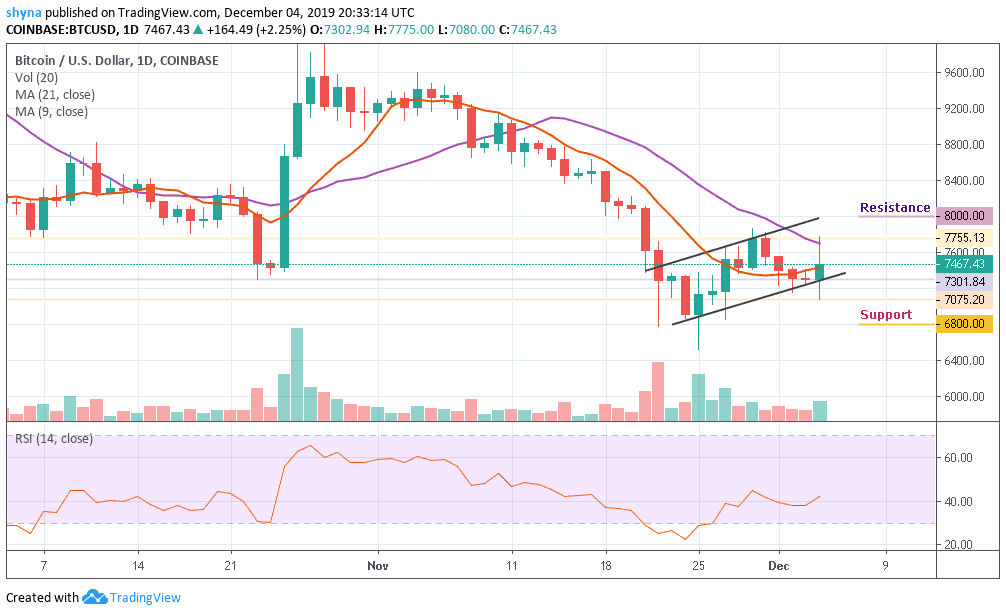

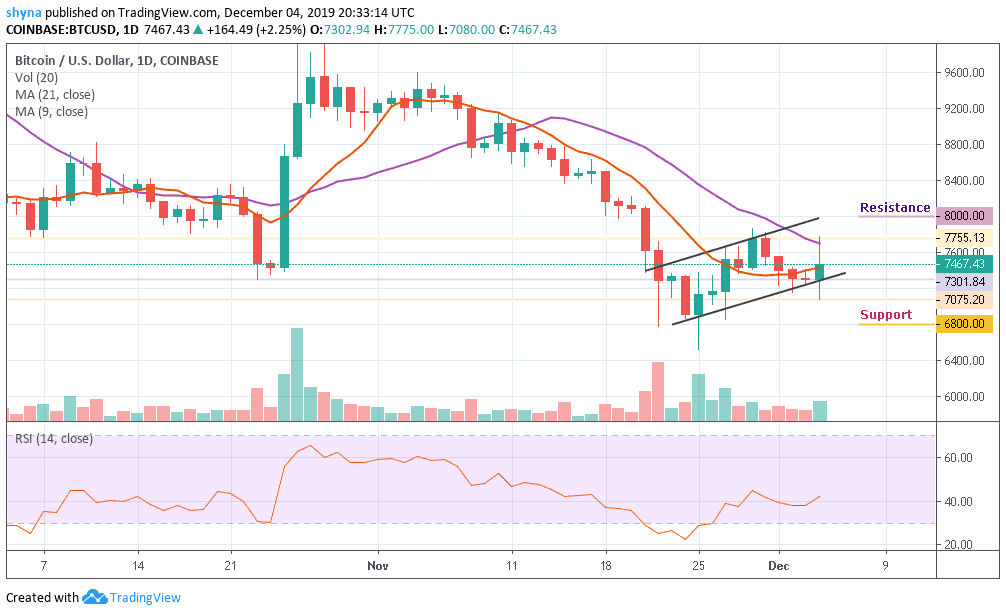

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $8,000, $8,500, $9,000

Support Levels: $6,800, $6, 300, $5,800

BTC/USD is currently following the bullish trend in the long-term outlook. A few days ago, the bears lost the momentum at the support levels of $6,800, $6,300 and $5,800 respectively and could not penetrate these levels. The coin bounced and propelled towards the north. The price has broken upside and crossed both the 9-day and 21-day moving averages when the coin surged upward but later came down to where it is trading currently at $7,467.

Bitcoin could have faced a setback for the moment; it’s not permanent. The coin will likely have a bullish trend in the near term, but a price rally could help it hit its monthly high again. Currently, Bitcoin is trading around $7,467 level after a free fall from $7,755. Moreover, the coin is now facing the resistance level of $7,600 waiting to touch the 21-day moving average again. The strong bullish daily candle forming today on the daily chart indicates that the bulls may be fully in control.

Meanwhile, looking at the chart, $7,000 serves as the major support level, making room for BTC to fall further. The RSI (14) for the coin is heading above 40-level to indicate an upward movement. More so, BTC/USD may likely see the resistance levels at $8000, $8,500 and $9,000. The technical levels remain positive, especially with the technical indicators.

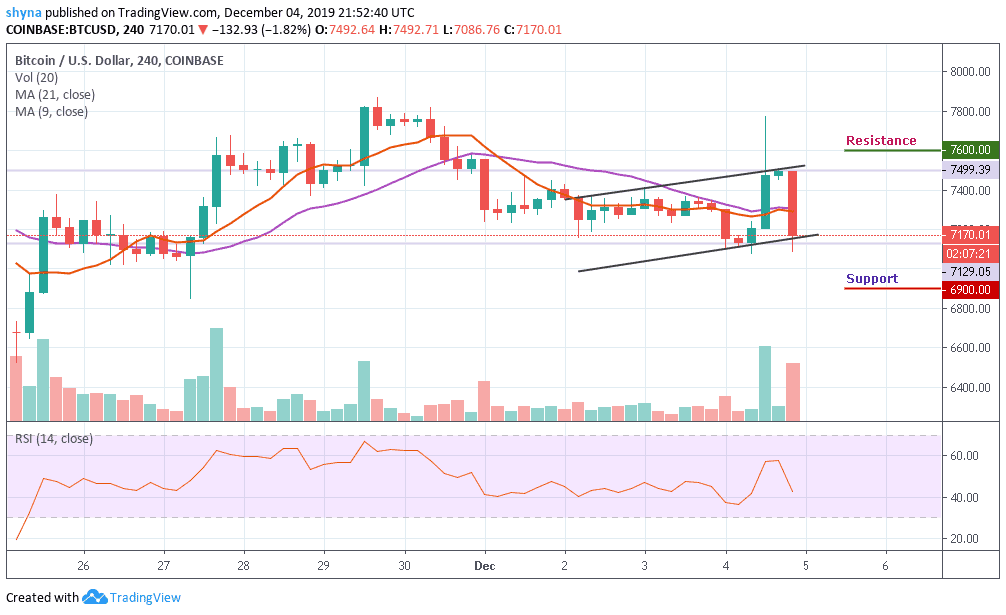

BTC/USD Medium – Term Trend: Ranging (4H Chart)

Before a serious drop that surfaced today, the Bitcoin price surged upwards of over $300 in today’s trading, catapulting its price from $7,129 to reach around $7,499. After the sudden rise, the coin started dropping in price to where it’s trading currently at $7,170. Should the price continue to drop further, it could reach the nearest supports at $6,900, $6,600 and $6,300 respectively.

Moreover, if the bulls could put a little effort to push the price above the moving averages, the price of Bitcoin may likely hit the critical resistance at $7,400 before heading to the potential resistance levels of $7,600, $7,800 and $8,000. Meanwhile, the RSI (14) just nosedived to the south which has recently revealed a sign of trend reversal, which shows more bullish momentum, is likely to play out.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage