Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – May 16

The daily chart of Bitcoin (BTC) shows harsh pullback today and has affected the majority of altcoins within the market.

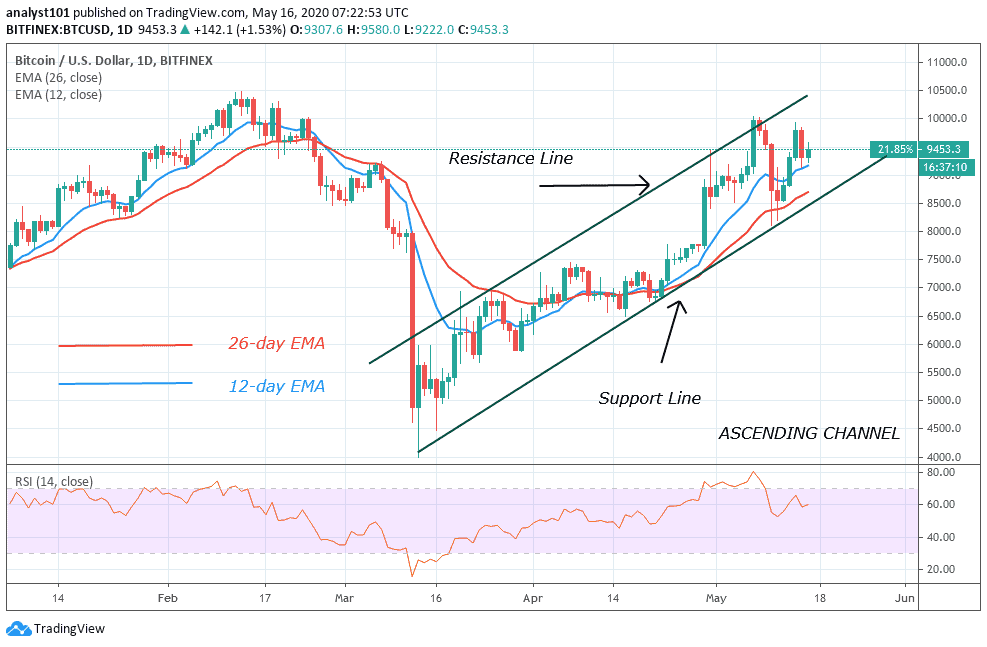

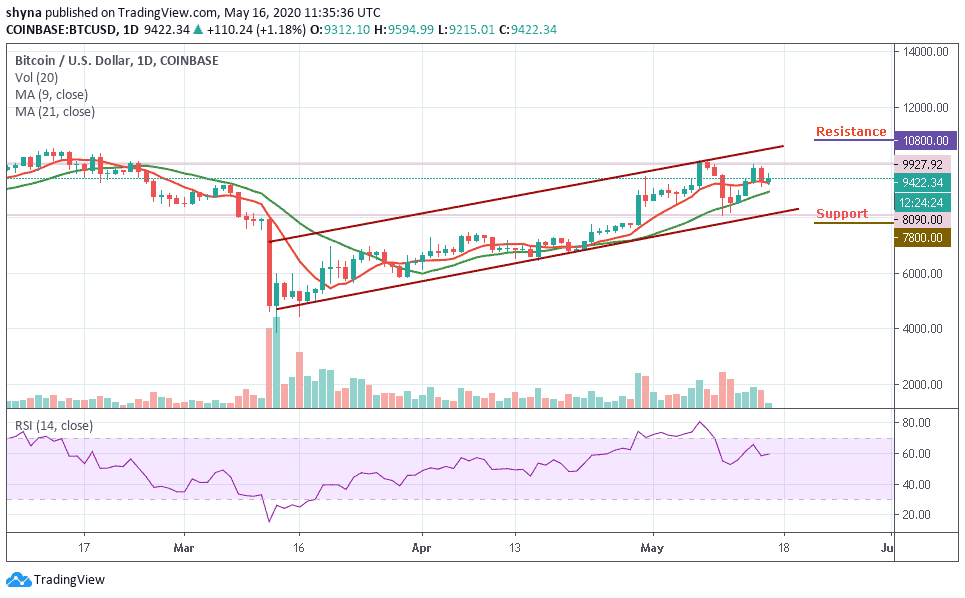

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $10,800, $11,000, $11,200

Support Levels: $7,800, $7,600, $7,400

BTC/USD is putting the traders under a nail-biting situation as the coin keeps heading downwards till just now. From its pulled-back price level of $9,608, BTC price is yet to bounce up to $9,800. The coin touched the daily high of $9,608 when the day opens, and the price correction is driving the coin below $9,500. Such notable price decline has triggered doubts amongst the crypto community as the decline has affected other coins within the market.

Moreover, the coin is trading at $9,422.34 and displays an intraday gain of 1.18%. The prevailing trend is still bullish with expanding volatility. The leader of cryptocurrencies currently consolidates in a bullish flag pattern. Meanwhile, a breakout out from this pattern is supposed to continue in the direction of the previous trend. In this case, we expect BTC/USD to rise above $10,000 resistance and could move towards the potential resistance levels at $10,800, $11,000, and $11,200.

However, should Bitcoin price failed to remain above the 9-day and 21-day moving averages; the price could drop to $8,800 vital support. A further low drive could send the price to $7,800, $7,600, and $7,400 support. The technical indicator RSI (14) has recently revealed a sign of trend reversal, which shows a possible bearish momentum.

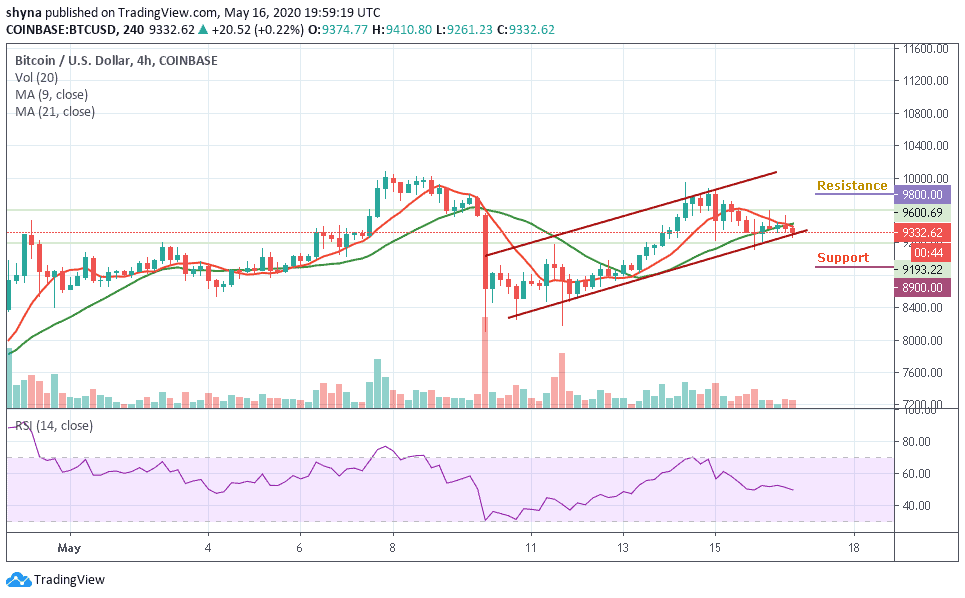

BTC/USD Medium – Term Trend: Bullish (4H Chart)

At the opening of the market today, the Bitcoin price first went up but has dropped slightly within 24 hours, bringing its price from $9,600 to touch the low of $9,267. Should the price continue to drop further and move below the channel, it could reach the nearest support levels at $8,900, $8,700, and $8,500.

Moreover, if the bulls push the coin above the 9-day and 21-day moving averages, the price of Bitcoin may likely reach the potential resistance levels of $9,800, $10,000, and $10,200. Presently, the market is indecisive as the RSI (14) indicator moves below the 50-level.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage