The trading of foreign currencies, or simply ‘Forex’ or ‘FX’, is arguably one the largest investment markets in the world. To illustrate just how big the forex scene has become, it is estimated that the industry is responsible for more than $5 trillion in trading volumes – each and everyday.

With so many platforms to choose from, how do you go about finding the best forex brokers? What should you look for when choosing a FX brokerage service? Read our guide to find out the best forex brokers for 2024.

On this Page:

It is important to note that forex trading is not just reserved for institutional investors. On the contrary, the forex investment space is utilized by traders of all sizes. Whether you’re looking to trade forex full-time, or for a couple of hours a day, there are now heaps of established trading platforms available to choose from.

Keep in mind that the platforms we are referring to in this guide are not bitcoin robots such as Bitcoin Revolution and Bitcoin Trader, but actual brokers.

Best UK Forex Brokers for 2024

If you’re interested in trading forex and you’re based in the UK, you’ll be

If you’re looking for a forex platform that makes is super easy to trade, alongside a full range of educational tools and fundamental analysis guides, then we would suggest exploring Markets.com.

The platform has a number of regulatory licenses, including that of CySEC, the FSCA (South Africa) and ASIC in Australia. In terms of the number of currencies you can trade at the broker, Markets.com host more than 50 different pairs, across majors, minors and even exotics.

Pros:

- Information portal covers trading guides, fundamentals and technicals

- Regulated by multiple jurisdictions

- Free demo accounts

- More than 50 forex pairs

- Spreads include commission fees so all costs are transparent

- Withdrawals are free

Cons:

- Not authorized by the UK’s FCA

Plus500 is one of the best trading platforms in the UK, not least because they are publicly listed on the London Stock Exchange. In terms of the number of pairs available, Plus500 hosts more than 60 different forex pairs which can be traded as CFDs. Not only this, but their spreads are ultra-tight and trading fees are very competitive.

Plus500 are also an excellent choice if you like to use a trading platform that is easy to navigate. The only caveat that we should note is that the platform is not strong on educational tools. Moreover, a lack of daily fundamental analysis is also a slight negative, however in our view this is information that can be obtained independently with ease. Check out our Plus500 review to find out everything you need to know about this CFD broker.

Pros:

- Neat platform layout that makes it easy to trade

- More than 60 different forex pairs available to trade

- One of the most established forex players in the UK market

- Public listing on the London Stock Exchange offers complete transparency

- Fully regulated by the FCA

- Low spreads and competitive trading fees

Cons:

- Fees for leverage on the high side

- Lack of focus on educational tools and fundamental analysis

80.5% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the risk of losing money.

Best Forex brokers for U.S customers

Although U.S. citizens are somewhat restricted when it comes to trading

Just remember, if you are based in the U.S., you’ll be required to submit additional information during the application process with respect to your tax obligations. Furthermore, all of the following forex brokers are registered with the Commodity Futures Trading Commission (CFTC), meaning they are fully authorized to accept U.S. citizens.

Even though Forex is probably the most popular asset class for technical analysis and retail trading, it is also the most regulated markets in the US Market. The tight regulation has caused for many brokers to cease offering their products to US customers, cornering the market to only a few options to choose from.

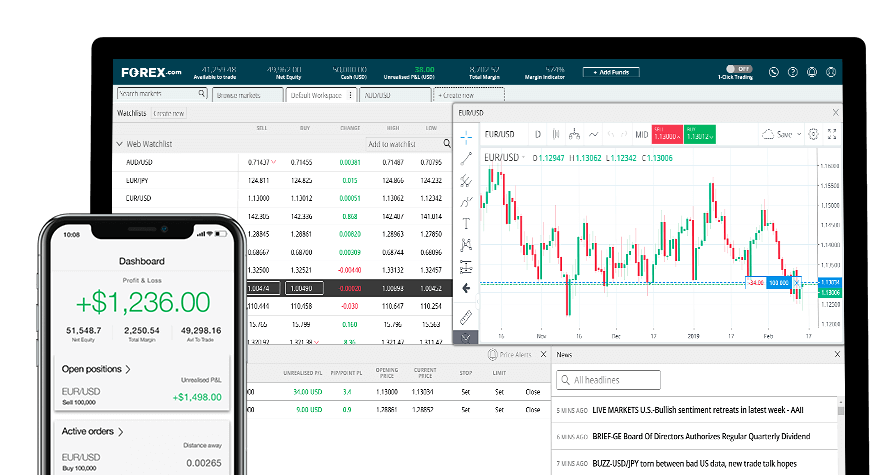

Forex.com is number one on this list intentionally, the firm is the Forex dedicated subsidiary of the prime broker Gain Capital (one of the largest in the country). The overall package delivered by this firm is the result of decades of experience as a major broker and also the result of being backed by one of the key players in terms of active and electronic trading since the early nineties.

One common concern that most Americans have when they inquire about Forex Trading is all the bad comments and reputation that the overall market has in Europe. The demand for currency trading has risen to fast that many regulators have failed to oversee the sector as they should, the result was the considerably large number of companies offering sketchy trading with little or no regulation at all.

Keep in mind that if are interested in trading Forex in the US, you will only find a handful of brokers to choose from. While this narrows options, it also assures you that if they are indeed regulated in the country it is very possible that you will never have to complain about their services.

Forex.com is simply a great option for anyone interested in this sector. If you are planning on beginning a forex trading career, why not do it from the hand of the very best in the game?

Pros:

- MetaTrader and NinjaTrader support

- Lots of education materials

- Direct market access accounts

- Over 80 forex pairs to trade

Cons:

- Maximum leverage on only three pairs

- No MetaTrader on spread or DMA accounts

- Relatively expensive compared to their European competitors

London based IG have been offering financial investment products since the early 1970s. Much like in the case of Plus500, IG are also publicly listed on the London Stock Exchange. This further supports their long-standing reputation as a highly credible broker.

However, although much of their user-base are located in the UK, IG are also registered by the CFTC. As such, their forex product range is fully accessible by those located in the U.S. In fact, the IG product range is one of the largest in the forex space, with more than 91 different pairs available to trade at the click of a button.

Pros:

- Established reputation that spans four decades

- Fully licensed by the CFTC

- Highly comprehensive forex listing of more than 91 pairs

- Very competitive spreads and fx trading fees

- Research, analysis and educational tools are freely available

Cons:

- Web browser size must be adjusted for optimal viewing

OANDA is an online forex and CFD broker that is authorized to accept a full range of nationalities, including that of the U.S. First, launched in the mid-1990s, this makes OANDA one of the most established online forex platforms in the industry. The broker hosts more than 70 different trading pairs, with currencies covering the major, minor and exotic risk-categories.

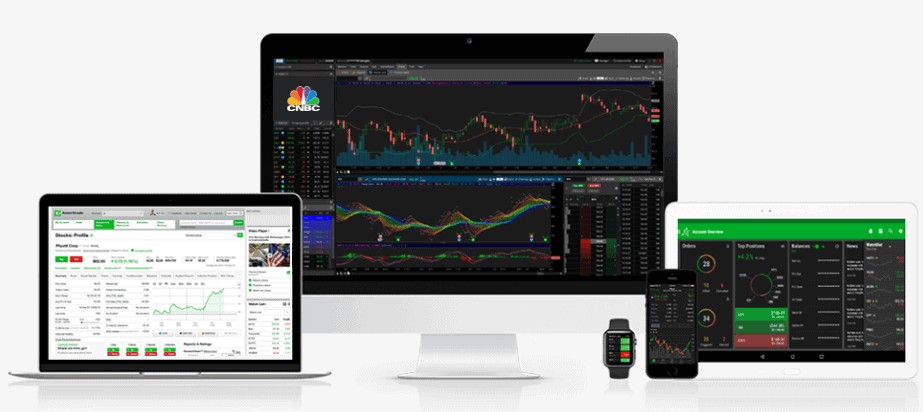

We also like the fact that the team at OANDA are very strong on their fundamental news developments, which is streamed directly from major sources such as CNBC and Reuters. Although their forex spreads are still competitive, arguably they are slightly higher than their key market rivals.

Pros:

- Good reputation that spans surplus of 20 years

- Registered with the CFTC, so authorized to accept U.S.citizens

- Number of Forex pairings exceeds 70+

- Ongoing stream of fundamental analysis from leading sources

- Clean layout on both desktop and mobile platforms

- Minimum deposit of just $20 is great for newbies

Cons:

- Not the most competitive spreads in the industry

When it comes to their forex trading department, TD Ameritrade only offers their services to U.S. citizens. Moreover, the broker’s parent company – TD Ameritrade Holding Corp, are publicly listed on the NASDAQ stock exchange. As such, the platform has a very strong following with those based in the U.S.

The broker offers more than 75 different forex pairs, which covers all major and minor pairings, alongside the more volatile exotic segment.

In terms of fees, this ultimately depends on the specific forex pair you are trading (built in to spread), and whether you opt for their commission-free or contract-based pricing structure.

Pros:

- Forex department reserved exclusively for U.S. citizens

- Highly intuitive trading tools

- More than 75 different forex pairings

- Premium fundamental research tools and technical analysis

- Advanced trading layout ideal for experienced investors

Cons:

- Somewhat complex trading fee structure

Best Forex CFD Brokers for Australia & New Zealand

For those looking for a CFD broker that allows you to trade forex and are located in either Australia or New Zealand, we would recommend taking a closer look at Plus500. Although the broker has a very strong presence in the UK space, they hold all of the required licenses to accept traders from both Australia and New Zealand.

As a company listed on the stock exchange, Plus500 discloses all its financials and is considered one of the most reputable forex trading platforms in the industry. The minimum deposit for forex trading on Plus500 is $100 and the leverage offered on their forex trading accounts is a maximum of 1:30.

✅Excellent reputation in the online forex space

✅ Publically listed in the UK

✅ Platform hosts over 60 forex pairs

✅ Competitive spreads

✅Low trading fees

80.5% of retail investor accounts lose money when trading CFDs with this provider.

Best Forex brokers for advanced traders

If you are looking for a highly advanced platform and you are a more experienced trader, then FP Markets is probably your best bet. Launched in 2005 and based in Australia, the broker offers huge leverage levels of up to 500:1. On top of this, and perhaps most importantly, FP Markets are an ECN broker, meaning that among other benefits, you’ll have access to ultra-low spreads.

✅ ECN broker – perfect for experienced traders

✅ Ultra-low spreads

✅ Leverage of up to 500:1 available

✅ Fully regulated by Australian-based ASIC

Cheap Forex brokers

Trading fees are an important factor to consider when searching for a new forex broker. This is especially true if you trade smaller amounts, as low-level traders are often penalized for small trade sizes. As such, Plus500 is potentially one of the most competitively priced CFD brokers operating in the market. Their commission-free pricing system is further amplified by tight forex spreads, especially in the major pairings.

✅ Trading commission fees are 0%

✅ Very low spreads, especially with respect to major currency pairs

✅ Minimum deposit of just $100

80.5% of retail investor accounts lose money when trading CFDs with this provider.

Forex Brokers Ranked By Category

The main types of forex brokers are Dealing Desks (DD ) and No Dealing Desk (NDD).

Forex brokers that operate through Dealing Desks (DD) make money through spreads and providing liquidity to their clients. They are also called “market makers”. On the other hand, NDD brokers simply link two parties together and do not execute their clients’ orderes through a Dealing Desk.

Now that we understand the division of forex brokers, it is also important to know that there are many different types of forex brokers out there. The different options available nowadays means that you are more likely to find a forex broker suited to your needs – whether it be high leverage, low spreads, or a large forex bonus. Below are the different types of forex brokers explained.

- Paypal Forex brokers

- High Leverage Forex Brokers

- STP Forex Brokers

- Low Spread Forex Brokers

- Islamic Forex Brokers

- Forex broker bonus

High leverage forex brokers provide the chance to use borrowed capital as a funding source. With leverage trading, traders can open FX positions with a small balance, and employ risky tactics such as opening a large number of trades at the same time.

Leverage in FX trading can go as far as 1:1000, meaning that for every $100 in your trading account, you could be trading up to $100,000 in value. Some of the most popular forex brokers with high leverage include XM Global currently offering leverage up to 1:888 and FXGlory with 1:3000 max leverage.

It is crucial to note that higher leverage in a forex trading account is perceived as riskier due to the possibility of losing all capital. Therefore, we recommend that you take precautions when opening trades with leverage, especially for beginners who tend to be unfamiliar with forex money management techniques.

STP forex brokers are platforms offering STP trading accounts (“Straight Through Processing”). STP brokers are similar to ECN brokers in that the broker’s trading commission is included into the spread, which makes it highly affordable.

STP trading accounts also begin at a low minimum deposit of $10 and offer very small transaction sizes. The trades are executed in the real market (the interbank market), where the big banks play the role of liquidity providers.

Trading with STP forex brokers is typically more cost-effective since STP brokers do not profit from the loss of traders (unlike Dealing Desk brokers) and they typically only charge on the spread. STP forex brokers also accommodate traders with different strategies (scalping, hedging, etc) , and offer the possibility of using high leverage. These USPs make STP brokers one of the best choices for forex trading. Some of the best STP forex brokers for 2019 are IC markets and Vantage FX.

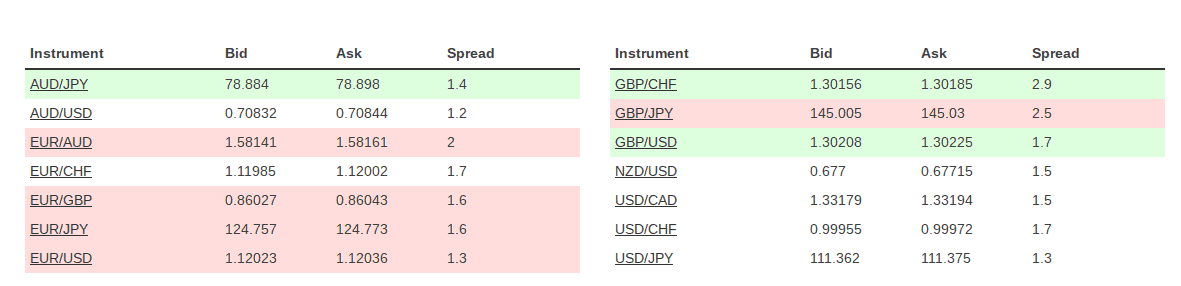

Low spread forex brokers charge small trading fees, which is particularly interesting for traders using scalping strategies who open various trades within one day and want to keep their commissions as low as possible. In order to cut their losses, those traders benefit from cheap forex brokers with tight spreads.

Since the main goal of trading is to secure personal funds and limit losses, using a low spread fx broker makes up a large part of any profitable forex trading stategy. Different brokers offer different spreads, but some of the cheapest options in the market today include Pepperstone with spreads starting at zero, and IC Markets, with an average spread of 0.1 pips.

According to Islamic law, Muslims are prohibited from trading for profit and their finance must be driven by ethics and justice. Islamic clients are also prohibited from executing risky trading strategies, and must not use brokers with high interest fees which according to Islamic law is exploitative and unlawful. Islamic forex brokers, also known as ‘no swap brokers” have therefore emerged in order to allow Muslim clients to trade forex in compliance with the Shariah law. These accounts do not charge rollover interest on positions held overnight but do charge a trading fee on open positions. The best Islamic trading account is IC Markets.

A good Forex broker bonus is a key characteristic for choosing a forex trading account. A forex bonus is a promotion offered to new or existing customers by a forex broker which can be accessed by signing up on a website or by depositing funds into your forex trading account.

There are 2 different types of forex bonuses. The first type is a forex deposit bonus which is trigger when a client makes a deposit. These are usually measured in %. An example of this is a 50% forex deposit bonus, which means that if you deposit $1000 you will receive $500 on top and have $1500 to trade with.

A forex no deposit bonus is a promotion which does not require the client to deposit funds. The only thing the client must do is sign up to the website, and their free forex bonus will be immediately available to trade with. This is a great option for beginners or those with limited funds as it allows you to trade the forex markets without risking your own funds, and to potentially make profits. Some of the best forex broker bonuses available are offered by Xtream Forex (100% initial deposit bonus), and RoboFX with a classic bonus of up to 115% on deposit.

What is Forex trading?

Forex, or simply FX, refers to the trading of foreign currencies. As domestic currency valuations fluctuate on a second-by-second basis, this makes it a highly active investment segment. The forex trading industry is now so fundamental that more than $5 trillion is traded on a daily basis.

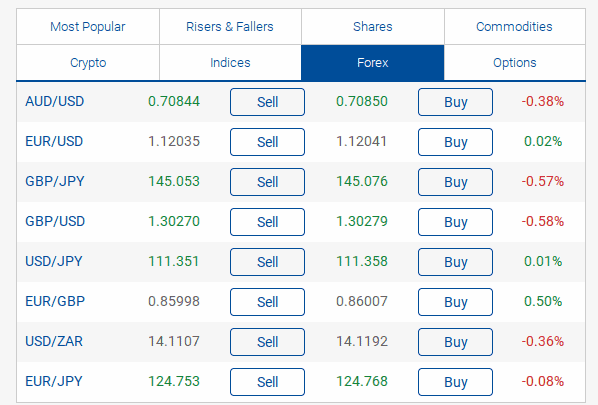

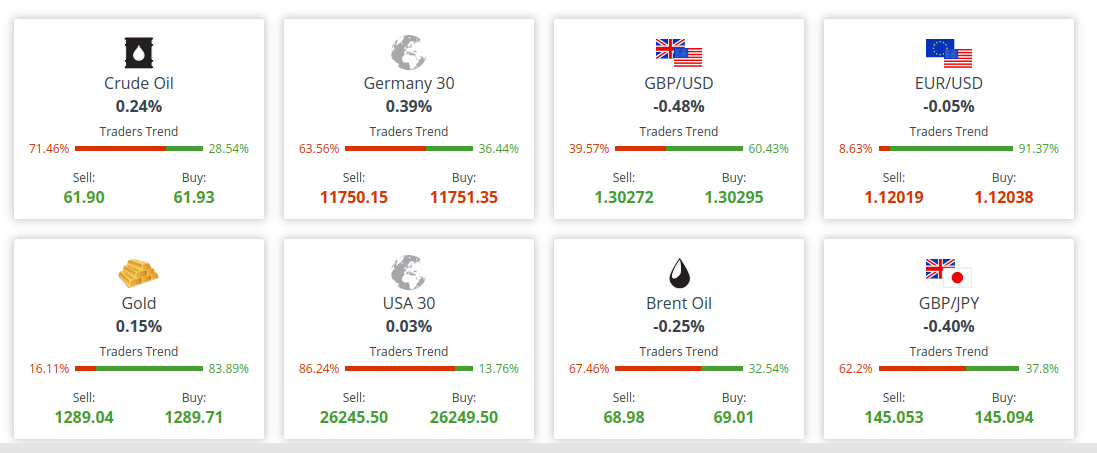

When trading two currencies against one another, this is known as a ‘pairing’. For example, GBP/USD would be one pairing, while USD/JPY would be another.

Generally speaking, forex pairings can be broken down into three key categories.

Major pairings

Firstly, and as the name suggests, major pairings must include the world’s most dominant currency – the USD. As such, each pairing must contain the USD on one side. These pairings must also include an additional major currency, such as GBP, EUR or JPY.

Here’s a full list of the major pairings.

- EUR/USD: Euro/US dollar

- USD/CAD: US dollar/Canadian dollar

- USD/JPY: US dollar/Japanese yen

- USD/CHF: US dollar/Swiss franc

- GBP/USD: British pound/US dollar

- AUD/USD: Australian dollar/US dollar

- NZD/USD: New Zealand dollar/US dollar

Minor pairings

Minor pairings refers to currencies that are still ultra-strong, however they do not need to include the USD. Example pairings includes the likes of EUR/GBP, GBP/JPY and AUD/JPY.

Here’s a list of some of the most widely traded minor pairings.

- CHF/JPY: Swiss franc/Japanese yen

- EUR/GBP: Euro/British pound

- GBP/CAD: British pound/Canadian dollar

- NZD/JPY: New Zealand dollar/Japanese yen

- EUR/AUD: Euro/Australian dollar

- GBP/JPY: British pound/Japanese yen

Exotic pairings

Finally, exotic pairings will include one major currency alongside a currency from a less dominant economy. These trading pairs often struggle to attract as much liquidity as major and minor pairings and thus, operate in a more volatile nature.

Here are some examples of some widely traded exotic pairs.

EUR/TRY: Euro/Turkish lira

NZD/SGD: New Zealand dollar/Singapore dollar

USD/HKD: US dollar/Hong Kong dollar

How does a Forex broker work?

Essentially, the role of an online forex broker like ATFX is to facilitate currency trading for investors. The platform will be responsible for matching buyers and sellers, subsequently allowing investors to trade in the open marketplace.

On top of providing the required tools for online investors, forex brokers will facilitate deposits and withdrawals, and in most cases, will provide an array of educational tools, as well as fundamental and technical analysis.

Due to the sheer size of the forex broker marketplace, each platform will have its own advantages and disadvantages. However, one of the most important factors that you need to consider is whether or not the broker holds the required regulatory licenses, and that they have acquired an established reputation.

What kind of Forex trading platforms are there?

1. MetaTrader 4 (MT4)

The underlying trading platform used by the vast majority of online forex brokers is that of MetaTrading 4, or simply MT4. First launched in 2005, MT4 is an electronic trading platform that facilitates ultra-fast forex trades in a safe and secure eco-system.

Prior to MT4, forex brokers were forced to design and host their own trading technologies. However, due to the sheer popularity of MT4, alongside the ease at which online brokers can install it in to their platforms, the protocol is now commonly used by most forex brokers.

2. MetaTrader 5 (MT5)

Alternatively, some brokers now use the more recent MetaTrader platform, which is that of MT5. MT5 has the capacity to facilitate trades across stocks, futures and of course CFDs that represent forex pairs.

3. cTrader

Competing with both MT4 and MT5 is that of cTrader. The platform also offers highly advanced capabilities in the trading of forex, subsequently providing up to 70 charting indicators across 54 time-frames.

What type of Forex trading accounts are there?

Although forex trading is accessible by investors of all shapes and sizes, most brokers will allocate a specific trading account based on your individual circumstances. In most cases, this will either be in the form of a retail/individual account, or for more experienced traders, an institutional account.

➡️Retail/Individual client account

Regarding the former, this will be an account best suited for casual traders, or for those with very little experience. By having a retail/individual client account, you’ll ability to obtain leverage is likely to be limited. If leverage is offered, this will be for ratios significantly lower in comparison to institutional accounts.

Depending on where you are based, retail/individual traders are sometimes accustomed to regulatory compensation schemes and financial protections, should the broker in question not have your best interests at heart.

➡️Institutional client account

When it comes to an institutional account, you’ll need to go through a much more stringent client onboarding process, and be able to prove that you have the required knowledge and experience to trade significant volumes. Once you are set up, you’ll likely be offered substantial levels of liquidity, with brokers facilitating ratios of up to 500:1.

How do I choose a Forex broker?

Due to the sheer size of the forex brokerage industry, it can be a difficult task trying to find the best platform for your individual needs. Here are 10 tips to consider to help you along your way.

Perhaps the most important factor that you need to consider when looking for a forex broker is their regulatory status. Not only do you need to ensure that they hold the required regulatory licenses, but also that they are authorized to offer their forex services to your country of residence.

On the other hand, depositing funds with a broker that does not hold any regulatory licenses should be avoided at all costs. You have to ask yourself why they are operating in a financial arena without the correct legal status. In most cases, regardless of how your trades perform, such a relationship won’t end well.

If you want to utilize leverage within your trading strategies, then take some time to understand what the broker offers. Although they might state that leverage is freely available, this might be on the proviso that you are an institutional investor. Leverage levels can also be capped based on where you are located.

If leverage is something that you want to use, you’ll also need to check what the overnight financing costs amount to. As you are essentially borrowing the money from the broker to trade more than you have in your account, this of course comes at a cost.

Understanding the fee structure of a forex broker is of utmost importance. While some brokers are very upfront as to what they charge, others are more opaque. Take the time to explore what the broker charges in terms of trading fees, commission and overnight costings.

Furthermore, some brokers claim to offer zero-commission fees. However, what they often do instead is to include their commissions within the spread. As such, although commission fees are zero per-say, you might be paying for this indirectly in the form of an unfavorable spread.

If you are an absolute beginner in the forex trading space, then it might be worth considering a broker that offers copy and/or social trading features. Not only will this expand your knowledge of forex trading, but it will also allow you to copy the trades of top-performing traders.

One thing that you need to look out for is how the results of traders are evaluated. For example, let’s say that the broker displays a trader that made 50% gains in the previous month. This might look good, however if they lost 40% in each of the three months prior, then it is misleading. All copy and social forex brokers should be transparent with how they gauge their trading statistics.

Before you register an account, check what payment methods the broker supports. You don’t want to go through the client onboarding process, only to find that you desired payment method isn’t accepted.

In the vast majority of cases, brokers will accept either a debit/credit card (such as Visa or MasterCard) and a traditional bank wire. Others will also delve into more modern payment methods such as PayPal. Don’t forget, each payment method might have different transaction fees attached to it, so also check this too.

Although the broker might hold the required regulatory licenses, you should still perform some due diligence on their overall reputation. If the general consensus from the online community is that the broker is reliable and credible, then this should act as notable sign of approval.

To further support your due diligence checks, find out when the forex broker was established, and whether they are owned by a separate parent company.

If you are a novice forex trader, then it is worth choosing a broker that offers a full range of educational tools. This might include webinars, videos and guides that contain all of the required information to begin your forex trading journey.

On top of this, you should also check whether or not the broker publishes frequent fundamental and technical analysis developments. Experienced traders rely on these information sources when they attempt to determine which way a particular currency will go in the open marketplace.

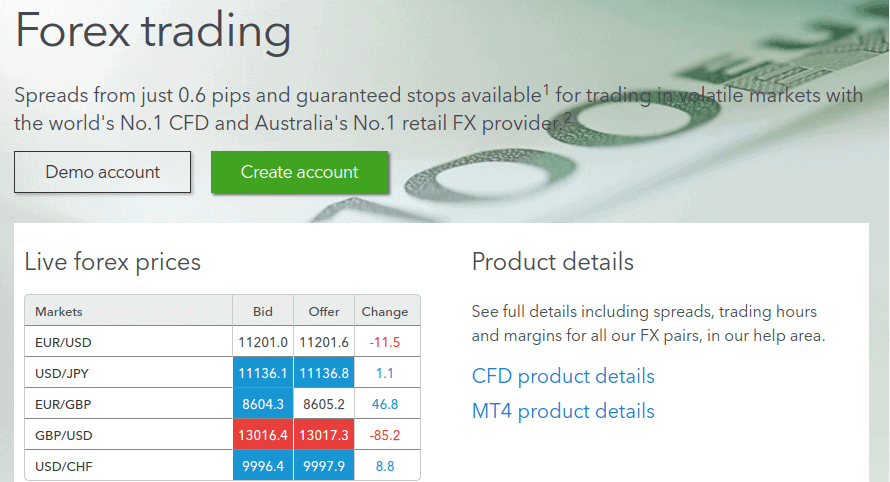

The spread between the buy and sell price can have a significant impact on your ability to make profit, especially if you are looking to scalp micro-gains. Spreads will usually differ depending on the underlying pairing, so check what’s on offer prior to opening an account.

In an ideal world, you want to choose a broker that offer super low pips, especially in the major pairings. You should expect higher spreads with minor and exotic pairings, however make sure these are not too unreasonable. Furthermore, just because a broker offers low spreads, this doesn’t mean that their overall fees are good value. They might instead charge high commission fees to profit off of your trades.

Always explore what security safeguards the broker has installed to keep your funds secure. From the perspective of the trader, this should cover two-factor authentication (2FA) and key-account notifications at an absolute minimum.

On top of this, it is also a minimum requirement that your chosen forex broker has installed SSL (Secure Sockets Layer) safeguards into their platform. In layman terms, this ensures that all of the personal information that you enter in to the broker’s website remains private, by encrypting the data.

Finally, you should also ascertain how many forex pairings the broker lists. Although the vast majority of the forex industry is dominated by major pairings such as the GBP/USD or USD/JPY, some traders like to explore other markets.

As such, not only should major pairings be readily available to trade, but also minor and exotic currencies too.

Conclusion

In conclusion, the online forex space is facilitated by a huge number of brokers. While listing them all would be beyond the remit of this guide, we have discussed the most notable. As you have probably now ascertained, you need to consider a full range of factors before joining a new broker. Take some time to understand what is most important for your needs.

In an ideal world, you want to choose a CFD broker such as Plus500 that is heavily regulated, has a full range of currency pairings and offers low fees and spreads.

How We Rated These Forex Brokers

In order to provide you with the most up-to-date, accurate and unbiased reviews, we have tried and tested each and every one of the brokers that makes our list. To give you an idea to what we look for when judging whether an online forex broker is worth choosing, we’ve listed the most important factors below.

- Trading fees, commissions, and other fees

- Spreads and leverage

- Basic risk management tools (stop losses, guaranteed stop losses)

- Risk management instruments (futures, options, swaps)

- Technical indicators

- Research and news

- Education and training resources

- Trading interface usability and customizability

- Trading platform (MetaTrader, cTrade, proprietary)

- Range of securities traded (CFDs vs direct trading)

Read more:

A-Z of Forex Brokers

FAQs

In its most basic form, the vast bulk of ‘real-life’ forex trading is performed by financial institutions of phenomenal size. Known as inter-bank trading, these institutions trade currencies on a direct basis. For lower level trading, such as that found via online forex brokers, the broker will purchase currencies on behalf of its clients. As such, this is why you must pay brokerage fees.

All of the forex brokers we have recommended in our comprehensive guide also allow you to trade forex. This will either be in the traditional sense (where you actually own the equity), or via a CFD (Contract-for-Difference).

You can. Trading forex online is super easy, and much more efficient in comparison to the days where you would need to make a purchase via the telephone.

Each broker will have their own fee structure and thus, you should also check this before making a purchase. In most cases, this will be in the form of commission, and is usually charged when you both buy and sell the asset.

In order to trade forex without a broker, you would need to be recognized as an institutional investor. This would require a significant amount of financial clout, not least because you would be dealing directly with the exchange that lists the assets. This is why the services of a broker are crucial for every day investors.

Forex brokers usually offer a full range of tradable pairings, which is usually determined by majors, minors and exotics. Majors are strong currency pairings that always contain the USD on one side. Minors are also strong currency pairings, but they don’t need to contain the USD. Exotic currencies contain emerging currencies from weaker economies.

If you believe the currency listed on the left-hand side of pairing will rise in value, then you’ll want to ‘buy’ the pairing. Alternatively, if you think the currency of the right-hand side of the pairing will rise in value, then you’ll need to ‘sell’ it.

The position size is the amount of money you want to risk per ‘point’. For example, if you risk $10 per point, and the pairing rises in your favor by 20 points, then you would make a profit of $200.

Forex stands for ‘Foreign Exchange’. It is also commonly referred to as ‘FX’.

This is entirely dependant on how you set up your trade. Keeping position sizes low and free from liquidity will reduce your exposure, as will installing sensible stop-losses. On the other hand, utilizing high levels of liquidity and failing to install stop-losses is an ultra-high risk strategy.

The amount of leverage available is dependant on the broker that you use, and the type of investor status you hold. Institutional investors will be afforded much higher liquidity levels than retail/individual investors.

Each broker will have their own minimum deposit amounts, as well as the minimum position size you can implement per trade. Some brokers allow you trade really small amounts, which is perfect for newbies. Always check this before you register an account. What is the difference between online forex brokers and real-life forex brokers?

Which online trading company is best for trading forex?

Can I trade forex online?

What fees do forex brokers charge?

Can I trade forex without a broker?

What currencies can I trade with a forex broker?

How do I know whether to buy or sell a forex pairing?

What is a position size in forex trading?

What does forex stand for?

Is forex trading high-risk?

What leverage levels can I trade forex at?

What is the minimum amount I can invest in to a forex pairing?

would you suggest giving demo trading a try before I deposit real funds even if I’ve signed up on one of the forex brokers you recommended??

Hello Tommy75. Thanks for getting in touch with us. Yes, we definitely recommend doing that. We are pretty sure that you will not be disappointed by the services offered by the brokers we recommend, but whether a broker is suitable or not for you also depends on your preferences. Trying the platform in demo mode will allow you to make sure that you get familiar with its proceedings but also to find out whether its functions suit you before real money gets involved. Being comfortable with the broker you are using is a big part of having a smooth trading experience.

are the education resources on forex broker websites useful??

Hello Bet84. Thanks for your question. Yes, they definitely are, especially if you are a beginner, but not only. Of course some brokers offer very limited education resources but others have very comprehensive ones. Most of our recommended brokers have great education sections with resources that you can access depending on your level of expertise. You will be able to find material for beginners, intermediate users and advanced users with information suited to your level. For beginners, it definitely is a good starting point to kick off your trading experience and for more experienced users, it is a great way to refine your trading strategies and improve your knowledge about online trading.

if you consider eToro to be the best forex broker on the market, does it mean that it’s the one that guarantees the best profits?

Hello alexis83. Thank you for getting in touch. That’s a hard question to answer. Generally, I would say no, I the sense that we do not rank brokers based on how profitable they are but on how the actual software works, its regulatory status, quality, price, services, education resources, customer support and so on. How much profits you make mostly depend on you, but eToro definitely makes efforts to help you make money, which not many other brokers do. I hope that answers your question.

i’ve seen this thing called pip on the websites of forex brokers… been trying to figure out what it is but I don’t really get it. Help??

Hello deren84. Thank you for getting in touch with us. Pip means ‘percentage in point’. It is basically a small measure of change in a currency pair constituting the forex market. It is probably easier to explain with an example. Say that the direct quote of a currency pair like GBP/CAD is 1.7042. That means that for £1 you can buy 1.7042 Canadian dollars. If there was an increase of 1 pip in the quote, the value of the GBP would increase (1.7043) compared to the Canadian dollar, meaning that with £1 you would be able to buy a bit more Canadian dollars. I hope that makes sense.

Why is eToro such a well-reputed forex broker?

Hello Matthieu. Thank you for your question. There are quite a few factors that convinced us that eToro is actually one of the best platforms out there. The first one is that it is a CySEC-regulated platform. CySEC is among the most trusted regulatory agencies out there so that is definitely a good sign. eToro is also very quick when it comes to processing requests such as withdrawals, deposits and verification processes. Other than that, it has a user-friendly interface, a good asset variety and it offers quite a few payment methods to choose from. One of the most important features offered by eToro though, is the copy trading option. With the copy trading feature, you can basically place the same trades as the ones placed by the top investors using eToro. It is a great function that all inexperienced users can benefit from. Feel free to check out our eToro review to find out more about the platform.

Hello. I’ve been thinking about signing up on OANDA but I am worried about hacking attacks. What should I do if that happens?

Hello Laurence. Thank you for your question. Hacking attacks are always a risk when it comes to online trading so it certainly is legitimate to be worried about it. The best thing you can do is to go on the OANDA website and have a look through the legal section or the terms and conditions to see if they have a refund policy. If your account gets hacked, it’s very likely that you will lose your funds, so it is important to make sure that if that happens, you would get your money back. Alternatively, you can simply contact customer support and ask if they do have a refund policy. If they do, you should go ahead and sign up without worrying about it too much.

What is the difference between major, minor and exotic pairings? What forex brokers offer the choice?

Hello Christina. Thank you for getting in touch. The difference between these pairings is that the major ones are basically the most popular currency pairs around, such as USD/EUR, USD/GBP and so on. The minor ones are less popular than the major pairings and they normally include pairings like NZD/JPY, CAD/NZD and so on. The exotic ones usually vary depending on the forex broker you are trading on. The less popular a pairing is, the more it struggles to attract liquidity, making it more volatile and risky to invest in. I hope that helps.

Hello there. I am new to the world of online trading but I am very interested in forex trading. The thing is that I don’t know the first thing about forex and I would like to find out how to develop trading strategies before I decide which forex broker to sign up on. Any suggestions?

Hello Brandon. Thank you for your question. There are a couple of things you can do to help you speed up the learning process. First of all, I suggest looking for video tutorials online on the best strategies to trade forex, YouTube is full of some really good material on the subject. Other than this, forex brokers often offer an education section on their website, where there is learning material and resources for all kinds of users, including beginners, intermediate users and professional traders. We recommend having a look through those, it definitely won’t hurt. Last but not least, you can sign up on brokers like eToro, that allow you to view the trades placed by the top investors on the platform so that you can place the same trades. That will help you gain some first-hand experience on what are the most profitable strategies to pursue. I hope that helps.

What kinds of leverage do forex brokers normally offer?

Hello Mary. Thank you for your question. It usually depends on the forex broker you want to go for. The regulated ones usually offer a very limited leverage so that inexperienced users are not exposed to unnecessary risks. Usually when it comes to the regulated ones, the leverage non-professional users have access to is around 1:30. In some cases, forex brokers offer access to higher leverage, but only if you are a professional user. This can go from 1:200 up to 1:500. I hope that answers your question.

Hello there. I have been searching for the right forex broker to start trading on but making this decision turned out to be much harder than I thought. What would you say is the primary criteria I have to base my decision on? Should it be reputation, fees, asset variety? Someone help please!

Hello Martin. Thank you for getting in touch. I would say a combination of all three of those factors and a few more as well. The first thing you should think about are your preferences. If you want to make your investments as varied as possible, which is something that we always recommend, then you definitely should go for a broker with a sufficient variety of assets. You should also do some research on the fees if you want to limit your investment costs to the minimum. As well as this, reputation and regulatory status are two other aspects that should be considered as well. A regulated and well-reputed broker is always an addition to its reliability. We also suggest looking at safety and the variety of payment methods available.

Would you say it is a good idea to decide whether to sign up on a forex broker based on how many assets it offers?

Hello Sarah. Thank you for getting in touch. I think that deciding based solely on the number of trading assets offered may not be a good idea. Of course, taking that into consideration is of course a good thing. After all, the more varied your investments are, the more you limit the risks of losing large capital. However, we do recommend taking other factors into consideration, such as regulatory status, reputation, ease of use, verification process and so on. There are scams out there that offer a great deal of trading assets to choose from, but that does not make them reliable brokers. I hope that helps.

Hi there. Really helpful review, thank you! I was wondering, what currency pairs do forex brokers offer?

Hi hp52, I am glad we could help. It really depends on the forex broker. Each of them offers a different variety. They normally divide the pairs into “major”, “minors” and “exotics”. Most brokers offer pretty much all of the majors and most of the minors. The major are the most common ones and usually include USD, EUR or GBP in the pair. The exotics are the ones that vary the most. What you can do is go on a forex broker website and have a look at whether they have an asset index. They normally mention what currency pairs are on offer.

I’ve tried these forex brokers, and the one I’ve had personal experience with before was eToro. I think it’s very easy and intuitive to use, but their withdraw fee is $25 USD. I guess that’s the average fee on other platforms as well.

Thanks for the article, I will try other ones you’ve recommended!

How do I know if a forex broker is reliable?

Hello klu6741. Thanks for your question. There are a few ways to figure out whether a forex broker is reliable. The first thing to look at is its regulatory status. Check if they regulated but most importantly make sure they are authorised to offer services in your country.

Other things to look out for are leverage, fees, spreads and payment methods. When the maximum leverage is high, you can get exposed to greater risks of fund loss. That is why several regulatory agencies impose a maximum leverage of around 1:30 for inexperienced users.

As for the fees, we suggest looking out for the hidden ones. A lot of platforms charge for inactivity, maintenance, commissions and so on. We recommend doing some accurate research of the fees charged on the platform you are interested in trading on. Spreads are also very important. We recommend paying close attention to the spreads offered by the platform you want to invest on because even though they might seem like small fees, they can have significant impacts on your profits. We advise looking for the lowest spreads possible.

As for the payment methods, the variety on offer is usually a good indicator of how much the broker is trying to meet the needs of customers. Usually, when only one payment method is offered, it is not a good sign. Also bear in mind that each payment method is most likely going to have a different transaction fee so we recommend looking into that too before you invest in a broker.

How do I choose the best forex broker to trade with?

How much do forex brokers charge exactly? There are so many different fees charged by different brokers that it can be quite overwhelming to know what I am getting myself into. Please could you shed some clarity on this? Thanks!

Hello Saz-24, forex exchanges charge their customers different amounts for different types of transaction. Some exchanges charge larger fees for larger transactions and for withdrawals of larger amounts. The best trading platform for you would be eToro as it charges a fixed amount of $25 on each withdrawal regardless of the amount you are withdrawing. eToro makes a lot of things easy for its customers and has an easy-to-learn interface which will help you at every step of your trading journey.

Is Oanda a good forex broker? I’ve heard mixed reviews and was wondering if you’d recommend it. Thanks!