In a rapidly evolving investment landscape filled with plenty of opportunities, investing in the stock market can be a powerful way for traders to accumulate life-changing wealth. In fact, stocks have the potential to deliver higher returns than interest rates paid on government or corporate bonds and have lower risk than real estate, hedge funds, and other alternative asset classes.

When people talk about investing in a stock, they are actually talking about buying and owning a piece of the company that issues it. However, considering the complex nature of the market, buying and trading stocks can be daunting for beginners.

To help with this, we have provided a complete guide, containing everything you need to kickstart your stock market journey with full confidence. How do you buy stocks? And which broker matches your investment style? Read on to find answers to these questions.

Whether you are a full-time trader or just a casual investor, learning how to buy stocks can be a significant step to achieving your financial objectives. In this section, we provide a quick guide on how to buy a stock of your choice.How To Buy Stocks – A Quick Guide

What Are Stocks?

A stock, otherwise referred to as equity, is a tangible investment asset that reflects fractional ownership in publicly listed companies. When investors purchase the stock of a company, they automatically become a shareholder, enjoying voting rights and a portion of the company’s earnings.

Meanwhile, a company’s stock – representing the financial instrument issued – is always sold out in units, known as shares. While both terms (stocks and shares) are mostly used interchangeably, the latter only represents a single instance of the former. As a matter of fact, an issued stock is usually divided into shares, which are eventually sold to interested investors.

That being said, an investor is considered a shareholder of a company based on the number of shares purchased from the overall issued shares. For instance, if a company is issuing 3,000 shares of stock and an investor buys 1,500 from it, such a person will automatically own 50% of the company’s assets and profits.

In such a situation, the person will also have a bigger voting power than those with small stakes during shareholder meetings. Hence, the number of shares purchased by an investor determines the size and value of their ownership in the company.

When it comes to regulatory oversight, the issuance and distribution of shares in the global market is usually supervised by the Securities and Exchange Commission. They are first listed as initial public offerings (IPO) on stock exchanges like Nasdaq and the New York Stock Exchange (NYSE). Thanks to the unmatched technology, insights, and market expertise provided by these exchanges, stock investors are able to facilitate strategic trades and strengthen their portfolios.

How to Buy Stocks – Full Guide

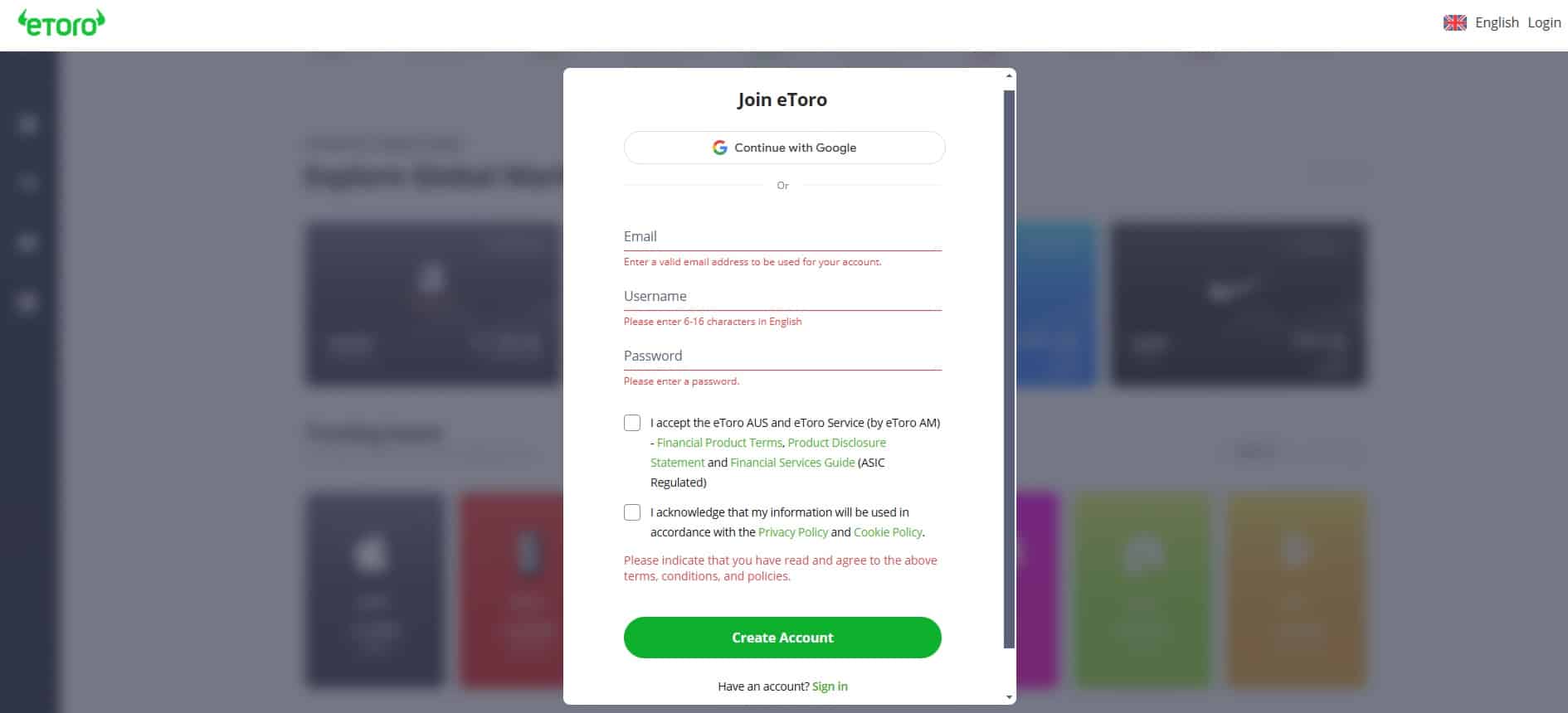

For those who are new to the investing world, buying stocks may sound like a daunting task. However, the process is simple and straightforward especially if you choose the right broker. With this in mind, we have come up with a complete guide on how to start investing in stocks using our recommended platform – eToro as an example.

Step 1: Create an eToro Account

The first task is to visit the eToro website to create a trading account. Click on “Sign Up” or “Register” button to get started. You’ll need to create a username and password, and provide your valid email address. It is also expected that you enter personal information, especially your name, date of birth, and contact information.

Step 2: Verify your Identity

In compliance with global regulatory standards, eToro requires users to verify their identity. To do this, you can upload a government-issued ID, like a driver’s license or passport. You must also provide proof of address, which could be a utility bill or your bank statement. However, such document must have been issued within the last three months. All these documents are to ensure compliance with anti-money laundering regulations.

Step 3: Fund your Account

Once your account has been verified, you need to fund your account to start investing. Click on the ‘Deposit’ button. You can choose your preferred mode of payment. eToro supports debit card, bank transfer, or PayPal.

Step 4: Search for your preferred Stock

Use the search bar at the top of the dashboard to find a stock. For instance, if you want to invest in Tesla (TSLA), type the name into the search bar, and it will bring out the information on the stock. You can also use the “Discover” section to browse trending stocks and find potential opportunities in the market.

Step 5: Purchase Stock

After you’ve chosen the Tesla stock, click the ‘Invest’ button to access the order form. Enter the amount you want to invest. Note that the platform support buying of fractional shares. Finally, click ‘Open Trade’ to confirm and execute your order, and immediately the stock will appear in your portfolio. You can also explore the platform’s tools and features to aid your trading decisions and build you more profitable investment portfolio.

Best Places to Buy Stocks – Broker Reviews

Finding the best broker to buy stocks can be complicated, especially for first-time traders. To help you with this, we have compiled a full review of some of the top brokers to consider.

eToro

Established in 2007, eToro has established itself as a globally recognized spot for trading multiple asset classes, including stocks, ETFs, cryptocurrencies, and commodities. It offers an easy-to-use platform enriched with advanced features like customizable dashboards and thousands of financial instruments, catering to investors and traders of all levels.

At the heart of eToro’s viral appeal is its commission-free policy on stock trading, empowering investors to maximize their profits. Also, the broker has also been praised for its one-click copy trader tool, which helps beginners to replicate the trading strategies of successful traders and make the best use of potential market opportunities.

Trusted by over 40 million users across 140 countries worldwide, eToro stands out as the reliable pick for those aiming to take their trading endeavors to the next level. Newbies looking to get acquainted with the market without risking real money can take advantage of its virtual portfolio tool. This industry-standard feature comes with $100,000 in practice funds that can be used to explore various trading markets.

For experienced traders, eToro provides top-of-the-line charting tools, enabling them to carry out in-depth market, sentimental, and technical analyses before making trading decisions. Likewise, it offers relevant educational resources, including tutorials, webinars, trading signals, articles, and many more.

Pepperstone

Pepperstone is a perfect pick for traders who prioritize speed and efficiency, thanks to its 30 milliseconds average trade execution times. Established in 2010, Pepperstone offers a combination of rapid trade execution and low pricing, ensuring that investors do not miss out on any potential opportunities in the market.

The platform’s extensive offerings cut across a range of tradable assets like stocks, forex, indices, commodities, cryptocurrencies, and exchange-traded funds (ETFs). It has the backing of top-tier regulators across the globe, including the FCA, ASIC, DFSA, and SCB, reinforcing its market position as a legitimate spot to trade stocks.

Being an all-in-one broker, Pepperstone provides seamless access to multiple platform options like MetaTrader 4, MetaTrader 5, and cTrader. These robust platforms are equipped with necessary charting tools, live market data, and customizable layouts to aid the trading experience of users.

Pepperstone’s vast offerings also extend to global stock CFDs, catering to stock investors who want to keep a strong and diversified portfolio. It uses a commission-oriented system for stock CFDs, charging at least $0.02 per share.

There is also a demo account for newbies who are still finding their feet in the trading market, allowing them to test strategies before committing real capital.

AvaTrade

AvaTrade has been serving investors since 2006, providing seamless access to a variety of investment instruments like stock forex, indices, commodities, and cryptocurrencies. Being a global broker, AvaTrade has offices and sales centers in top countries like Australia, Poland, Chile, Italy, China, Mexico, Mongolia, Japan, UAE, and South Africa.

AvaTrade has the regulatory backing of the Financial Conduct Authority (FCA), demonstrating its unflinching commitment to security and compliance. Also, setting itself apart from competitors, AvaTrade supports popular tools such as MetaTrader 4 and 5, appealing to traders looking to explore automated trading capabilities.

The broker has also been praised for its spread betting feature, which offers a tax-efficient way for traders to speculate on price movements without necessarily owning the underlying assets. On AvaTrade, investors can set up various accounts like demo, retail, standard, professional, Islamic, and VIP, with each varying slightly from each other in terms of fixed spreads and similarities.

AvaTrade also provides rich educational content like webinars, market insight, tutorials, and market analyses, equipping investors with the knowledge they need to navigate the complex nature of the market. The platform is also built with users’ convenience in mind, making it a great spot for beginners and experienced traders alike.

XTB

XTB is a household name in the stock trading market, with a history dating back to 2002. Known for its wide range of financial instruments including forex, commodities, stocks, and cryptocurrencies, XTB has distinguished itself as an ideal platform for investors who want to build and manage a vast portfolio.

XTB, unlike most of its contemporaries, doesn’t depend on MT4 or 5 for its charting tools. Instead, the platform has a proprietary xStation 5 and xStation mobile, adequately equipped with real-time market data and advanced charting tools to enhance the overall experience of all categories of users.

Recently, XTB unveiled a new feature; XTB socials that allows users to get trade alerts from selected traders on trades on their watchlist. It also offers buy and sell signals generated from leading banks like JP Morgan, Merrill Lynch, and Morgan Stanley amongst others, empowering traders to make informed investment decisions.

Like others on this list, XTB is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, adding an extra layer of reassurance for users. Meanwhile, when it comes to fees, XTB has adopted a commission-free model for standard accounts, with trading costs embedded within the spreads.

What type of Stocks can I buy?

The wide choice of different types of stocks allows the investor to build a custom portfolio that match investment goals. When choosing stocks to buy, start by determining your risk profile. Most online brokers and specialized stock picking service providers provide free risk assessment insights that could help investors make informed trading decisions.

Income stocks

On the low end of the risk spectrum is the individual close to retirement. The retiree’s portfolio has a higher allocation of cash, bonds and low risk stocks. The lowest risk stocks are known as the blue chip stocks. These large companies have a long history of delivering consistent revenue and earnings growth while paying a steady and increasing dividend. Because they pay steady quarterly income in the form of dividends, they are called income stocks. You will not get rich overnight, but over the long-term income stocks have created more value for investors than high growth stocks.

Value stocks

Value stocks are stocks with financial strength – a solid track record of earnings and revenues growth – that are trading at a low price-to-earnings multiple. The low stock valuation is due to a temporary situation typically unrelated to the core financial strength of the business. For example, a decline in the broader stock market, unexpected shortage of semiconductor chips, or failure of a new product line may cause a stock to temporarily decline below its long-term expected value. This situation provides an opportunity for the investor to buy the stock at bargain prices in anticipation of profiting as the stock’s value increases.

Growth stocks

On the higher end of the risk spectrum is the millennial. He makes $100k a year, has little or no debt and several decades to save for retirement. He may decide to allocate part of his portfolio to high growth publicly listed companies. The high growth company is growing revenues at a higher rate than average and has a high price-to-earnings ratio. The company reinvests earnings back into the company’s growth instead of paying dividends. Marijuana stocks are examples of high growth stocks. As states deregulate marijuana use, sales of marijuana are growing at more than 30 percent annually.

Penny stocks are considered very high risk high growth stocks. Penny stocks are public companies that trade at a low price (under $5) and do not meet the strict standards to list on a large exchange. Investing in penny stocks is considered speculative investing because they have a high rate of bankruptcy and scams.

Before you invest in any stock, take time to learn about the business. Remember the rule of the most successful value investor Warren Buffett – invest in companies you know and whose products you may use. Not all marijuana stocks are alike. Medical marijuana companies, for example, are licensed to sell products in many US states whereas the recreational marijuana market faces higher regulatory and market risk. No matter which type of stock you choose, you can lower your risk by doing your stock research.

Where Can I Get Reliable Stock Signals?

Below are the top two platforms to get in-depth market insights, real-time trading signals, and accurate stock alerts in 2024.

Benzinga Pro

Described as the most actionable financial research tool, Benzinga Pro is a high-ranking stocks signal provider that specializes in customizable real-time news, market analyses, and other valuable resources that can help traders identify trading opportunities and make better investment decisions.

What sets Benzinga Pro apart from other stock signal providers is its audio squawk tool which delivers live, clear, and audible stock alerts to subscribers, ensuring that they stay informed without necessarily monitoring their screens. It offers crucial signals like Option Activity, Price Spikes, Opening Bell, Block Trade, Halt/Resume, and Highs/Lows, allowing for prompt responses to emerging market opportunities.

Additionally, Benzinga Pro provides comprehensive charting capabilities alongside analysis tools like screeners which help investors scan and filter stocks based on their trading volume, market cap, dividend yield, and more. The platform also appeals to day traders with its daily trade picks from real-time experts.

In terms of pricing, Benzinga Pro has three subscription plans, namely Basic, Essential, and Streamlined. Regardless of the options chosen, traders can rest assured that they will get actionable trading signals that can help them improve their trades.

AltIndex

AltIndex is a renowned stock signal provider that converts various alternative data and projections into quality signals. The platform offers deep market analysis on stocks using indicators like website traffic, application download, social media sentiments, and customer satisfaction metrics.

At its core, the platform leverages artificial intelligence to analyze thousands of stocks and deliver accurate signals that position investors to make gains. It has a “Trending Stocks” segment that provides first-hand information about some of the stocks that have been making waves and generating many comments on social media platforms and search engines.

The platform will provide accurate data on the number of times in which each stock appeared in discussions within a specific period of time, ensuring that investors have insights into why a particular stock is trending. There is also an AI-driven stock picks segment which analyzes various data points and offers investment recommendations to subscribers, empowering them with information about which stock to buy and why.

Stock alerts and signals from AltIndex are usually delivered to users’ email. In each, the platform summarizes a list of highly promising stocks and advises investors on the next line of action to take. Meanwhile, beyond stocks, AltIndex also offers in-depth market insights on other asset classes like ETFs and cryptocurrencies.

What To Consider Before Diving Into Stocks

Here are some of the key factors to consider before diving into stocks:

- Do your due diligence, investigating every aspect of the company.

- Keep your stakes to a minimum, and have an exit plan just in case.

- Manage your expectations.

- Endeavor to diversify your investments.

- Subscribe to top stock trading signals providers.

- Keep learning.

Pricing of a stock

Stockholders are concerned with the stock price. The stock price is determined by the demand by buyers and supply by sellers (where the bid and ask prices meet. A stock price can be influenced by wider market trends. Sometimes a stock price will be undervalued and other times overvalued by the market. So besides the market value, it is also crucial to know the true intrinsic value (book value = assets — liabilities) of the company. If the company were to go bankrupt, after paying all the debts and selling the assets, how much would be left over to pay investors?

Why Should I Invest in the Stock Market?

Here are some of the many good reasons to invest in the stock market:

Compound annual returns

Investors place money in the stock market to grow their wealth. The secret to grow your wealth is the power of compound annual returns. Compound returns are the annualized returns of your investment gains and losses. If you place $1,000 in a savings account, at a 2 percent interest rate, you will have $1,020 in a year. Compounded that $1,020 will equal $1,040.40 in two years.

The risk-return trade-off

Picking the winning investment sector each year is not an easy task, and it is seldom the same sector two years in a row. But whatever your investment level, one sure bet is stocks. That’s because among all the investment asset classes stocks provide the best risk-return trade-off. The risk-return trade off states that the higher the return, the higher the risk. One measure of risk is beta. Beta measures the volatility of a stock relative to the market volatility of 1. Stocks provide a similar return as REITS (real estate investment trust) while assuming a much lower price risk.

Diversification

A number of stock funds invested in technology, internet, and oil drilling equipment had high returns. These are cyclical stocks that grow when the economy is growing. One way to diversify a portfolio is to invest in stocks that are both cyclical and non-cyclical. Cyclical stocks like smartphones and restaurants do well when the economy is growing. Non-cyclical stocks like food and utilities outperform when economic growth is slow because investors divert their money to industries that sell necessities people always need.

Passive investments

Passive investors place their money in ETFs, indices and mutual funds for the long term. As the markets continue on their roller coaster ride from year to year, the passive investor can sit back and relax. Eventually, the volatility will smooth out and deliver higher average annual returns than active investment funds.

How to Make Money Buying Stocks

New investors may be asking, why invest in stocks? Savings accounts provide a guaranteed annual return. Since stock market prices fluctuate, you assume the risk of selling your stocks for less than you paid for them. Unlike savings accounts or treasury bonds, stocks provide the potential to profit from the underlying stock price appreciation and dividend income.

Share price growth

Past performance is not an indication of future investment performance. Generally, though, the return of investment assets over time can provide an indication of future returns. Over the last 10 years, investors have earned a substantial 15% return on stocks. Average savings accounts in the United States currently pay a dismal 0.45% APY. A 30-year treasury bond, another safe bet, yield about 4.25 percent. And keep in mind stocks have the same market risk as treasury bonds. Stocks provide an investor with the most attractive returns for the risk taken.

Buy stock at a discount

Here’s how to buy stock at a discount. A stock that is undervalued relative to its industry group has a greater potential to appreciate in value. The most popular metric for valuing whether a stock is undervalued or overvalued is the price-to-earnings (P/E ratio). The P/E is calculated by dividing a stock’s price by its earnings per share (EPS). EPS is a measure of the amount of the profits earned per share.

Buying Stocks vs Trading Stocks with CFDs

CFD trading is like stock trading but instead of owning the stock outright, the trader buys a contract for differences (CFD) from a broker. The seller and buyer enter into a contract and settle on the difference between the buy and sell price.

Like a stock trade, the trader sets buy and stop limits and places a trade. CFDs are traded on margin and allow the trader to take higher leverage than a margin trade on a stock. An investor can easily take a long or short position in a CFD trade since the CFD allows you to trade assets you do not own.

Short selling involves borrowing shares, selling them at the market price, and then repurchasing them at a lower price and returning the borrowed shares. Like any loan, you will be required to pay back the loan plus interest. If the stock price falls, you will profit. If the stock price rises and you have to buy them back at a higher price, you will lose the difference between what you sold and bought the shares for, plus the interest on the margin loan.

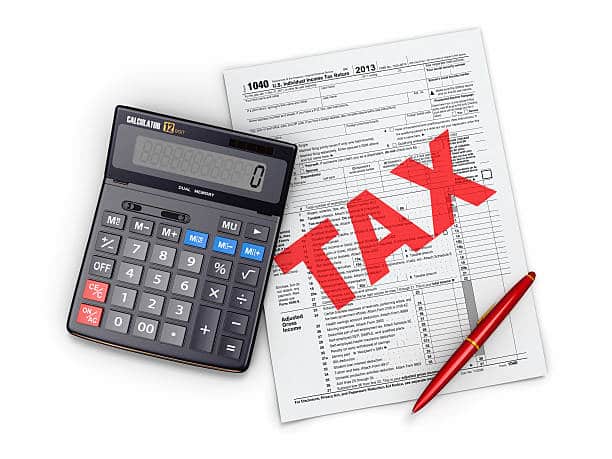

Do I Get Taxed on Profits?

Investors are required to pay capital gains tax on the profits (gains) from selling shares, or any other investment asset that has increased in value (e.g., real estate, art). If you buy Apple stock x10 at $180 and sell them at $200, you would pay tax on the $200 profit.

The capital gains tax varies between 0% and 20% depending on your tax bracket. A high income earner would pay a higher capital gains tax than a low income earner. If you buy Amazon stocks for your sister, you are required to pay capital gains tax when gifting assets. Capital gains tax is not paid on:

- Gains below your taxable allowance (£12,000 in the UK)

- Gifts to a charity or spouse

- Shares in retirement plans (ISA or PEP in the UK, 401ks or IRAs in the US)

- Dividends, which are tax free

But what about losses? Capital losses (minus the gains) can be deducted from your tax return up to a limit. Beyond the limit, losses can be carried over to the next tax year.

How Many Stocks Should I Invest In?

More important than how many stocks you own is the diversification of your stock portfolio. Start by deciding which type of stocks to buy based on:

Your investment goals

Do you want steady-income payers to save for retirement or a bit of oomph to boost your returns? Take another gander at the Income, Value and Growth investing objectives above.

Diversification

Never put all your eggs in one basket is a cardinal rule of investing. A portfolio of five stocks diversified across sectors, geography and company size (small, mid and large cap stocks) is more likely to provide a long-term stable return than 10 stocks in high growth technology companies.

Risk profile

Those 10 high growth stocks may be in a hot sector that could be obsolete in 10 years. If you are saving for long-term retirement, you would be better off investing in blue chip companies.

Investment advisors recommend between 10–30 stocks. Do not go on a shopping spree and buy 30 stocks tomorrow. Do your stock research and gradually build up a diversified portfolio.

Benefits of Buying Shares Through an Online Broker

Most investors buy stocks through a broker. A broker acts as a matchmaker between the buyer and seller. Trading with modern stock brokers provide a number of advantages including:

- Trade anywhere – More and more investors, especially day traders prefer engaging in mobile trading. You can trade while waiting for a bus, during the opening act of the Verdi opera, or in the elevator on the way to work.

- Low or no fees – Though online brokers do charge fees, they are significantly cheaper than those charged by traditional brokers. Many individual investors can access all the trading tools they need from a discount broker. Top brokers like eToro offer different levels of account services to meet the needs of different investment styles.

- Instant trade execution – Online brokers offer a robust architecture, accompanied by industry-leading tools and technologies to ensure swift trade execution.

- Many investment securities – Online brokers make it easy to diversify a stock portfolio across asset classes. The inverse correlation of bonds and CDs or higher risk currencies and commodities, hedging with futures and options and diversified ETFs and mutual funds all provide ways to hedge stock price movements.

- Stock trading research, price charts and technical indicators – Beyond offering a reliable interface for investors to trade a wide range of stocks, some leading online brokers like eToro also provide access to basic fundamental research, technical analysis tools, stock alerts, and accurate trading signals.

Which Stocks Should I Buy?

Beginners and sometimes existing traders might find it difficult to decide which stock to chose among a large number of options available. Fortunately, based on past performance, the stock metrics that are an indicator of future performance are well known. They include steady revenues and earnings growth, and dividend payouts. Investors should choose stocks based on these and other strong fundamentals. These stocks are more likely to perform well even in a market downturn.

That being said, some of the top stocks to buy now are Nvidia, Meta Platforms Inc (META), First Solar Inc (FSLR), Tesla (TSLA), and Verizon Communications Inc (VZ).

Conclusion

The stock trading market is highly volatile, making it a risky investment instrument. However, you can lower your risks by taking advantage of the wide variety of stocks and other securities offered by online brokers to build a diversified investment portfolio.

You can even start with safe stocks with strong fundamentals. Also, make good use of stocks signals providers like Benzinga Pro to enhance their investment decisions. Remember to also consider the intrinsic ‘true’ value of a stock, not only its market value.

As you become more comfortable trading and develop a diversified portfolio, you may choose to dedicate a larger allocation to higher risk stocks with the potential for higher returns. You can improve your risk-return profile by choosing a broker that matches your investment style. That being said, our top pick for the best place to buy stocks this year is eToro.

FAQs

You can buy your preferred stocks via any of the brokers that we recommended in the guide. We have also included a step-by-step guide, especially for investors who are still new to the market.

Our recommended brokers to buy stocks this year are eToro, AvaTrade, Pepperstone, and XTB.

Traders seeking data-driven investment insights and timely stock alerts/signals can subscribe to Benzinga Pro and AltIndex. How can I buy stocks?

What are the best brokers to buy stocks from?

Where can I get accurate stock signals?

Comments are closed.