Chainlink is on a quest to assist blockchains in effectively integrating external data. The software is expressly built to connect smart contracts on top of blockchains to services that provide APIs, payments, and real-world event confirmation, allowing developers to build a more extensive range of products and services.

If Chainlink can solve significant challenges for smart contract users, it might become a vital tool for connecting blockchains and real-world applications. So far, LINK has already seen over 100x gains for investors lucky to buy LINK in 2019. However, the value of this DeFi crypto has since retraced, thanks to the 2022 bear market. While parabolic gains seem far off, hope remains in the market due to the early 2023 support.

Still, have questions about how Chainlink works? Read on for our ‘What is Chainlink?’ in-depth guide.

On this Page:

How to Buy Chainlink – Quick Guide

- Choose a Chainlink exchange – we recommend Binance.

- Create an account and verify it with your ID.

- Deposit funds into your account via bank transfer, Paypal, credit card, or other accepted payment methods.

- Search ‘Chainlink’ in the drop-down menu to see the LINK price chart

- Click ‘Trade’, select an amount of LINK to buy, and click ‘Buy’.

Where to Buy LINK- Best Platforms

After going through all the platforms for buying ChainLink we found that Binance was the best of all. That being said we’ve shortlisted the top exchanges here for you to be able to view them all.

1 – Binance

Binance is the world’s largest cryptocurrency exchange in daily transaction volume, with over $20 billion in everyday transactions. It provides access to hundreds of assets and a smooth trading service that makes it easy to generate money.

The advantages of Binance are pretty astounding. The trading commission is a flat 0.1 percent, low – or 0.075% if you hold BNB and use it to pay fees.

Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. Combining this with Binance’s high liquidity makes it easy to see why it’s so popular.

On September 28, 2017, the Binance exchange listed the LINK/BTC and LINK/ETH trading pairs.

Pros & Cons of the Binance platform:

- Excellent liquidity

- Outstanding security features

- Professional traders have access to a wide range of sophisticated items.

- High fees for credit card deposits.

Your Capital is at Risk

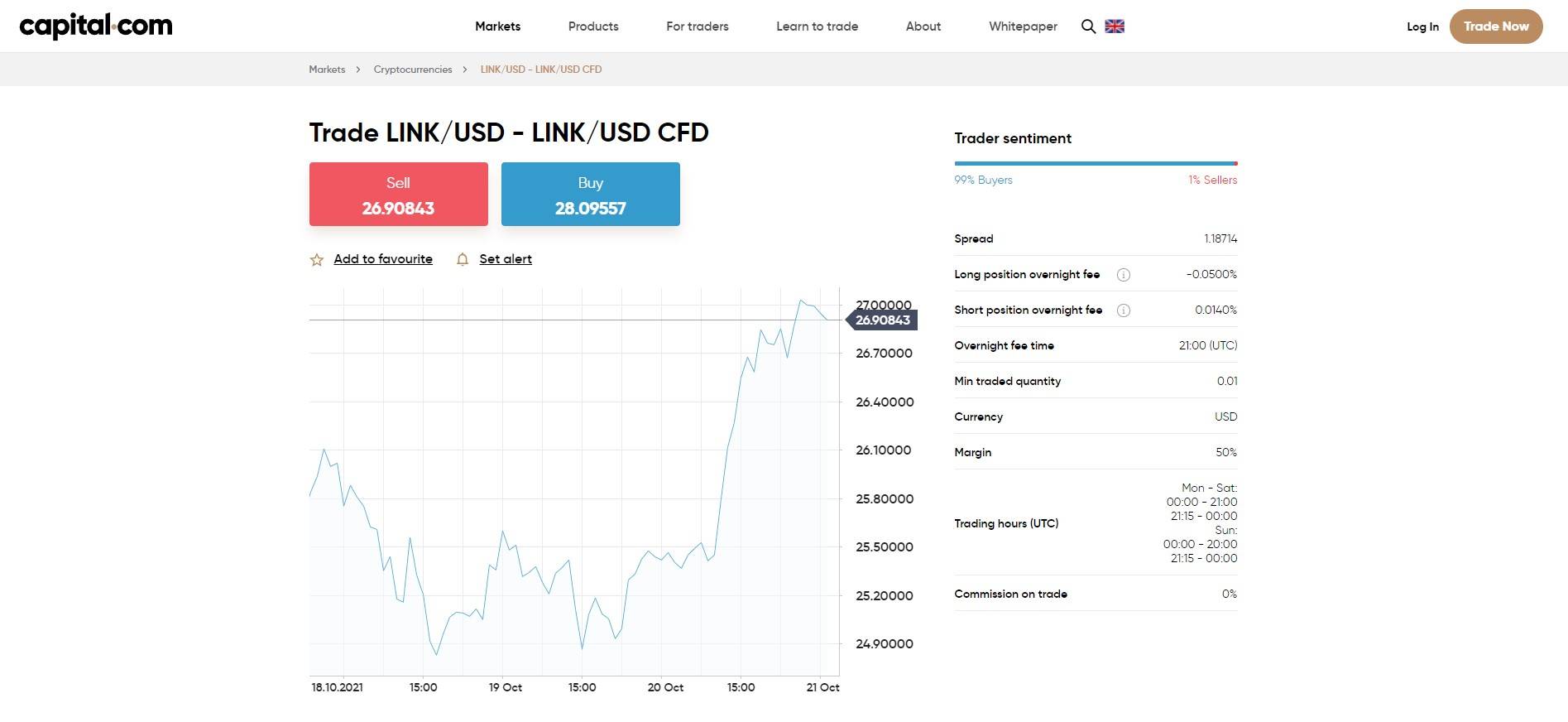

2 – Capital.com

Capital.com is a global CFD brokerage with subsidiaries in the United Kingdom, Cyprus, and Belarus. Over 2 million traders call it home, and it has processed over $18 billion in transaction activity. Investors who seek more flexibility in their investments can choose a UK-based trading platform at Capital.com.

Simply put, a trade of $100 can be made through an account with a balance of only $50. Capital.com not only offers to buy Chainlink (LINK), but investors can also try to short-sell if they think its price will decline or consider that Chainlink (LINK) is overvalued.

Over 3,000 liquid assets are spread across five sectors, making it an appealing option for all traders.

Initial Deposit

Captial.com requires a minimum deposit of $20 to get an account open. Client funds are fully separated at RBS and Raiffeisen; accounting behemoth Deloitte audits two of Europe’s largest financial institutions and accounts. This broker also caters to institutional clients through its Prime Capital division, implying a large liquidity pool. Captial.com offers only a proprietary trading platform.

Along with commissionless trading, Capital.com also charges meager spread fees. CFD crypto trading is recommended only for experienced investors, but Capital.com offers to help newbies with educational materials, including a trade learning mobile app. They accept payments through debit/credit cards, bank transfers, or e-wallets.

Buy Chainlink on Capital.com

Pros & Cons of the Capital.com platform:

- 100s of UK and US-listed shares are available for trading.

- Mobile app for trade education

- AI aid in identifying trading flaws

- Provides daily trading suggestions

- Trading in advance with charts and an analysis interface

- There is no commission at all.

- It does not support custom trading strategies

Your Capital is at Risk

3 – Bitfinex

Bitfinex is a renowned cryptocurrency exchange that provides advanced trading choices at reasonable prices. Giancarlo Devansini and Raphael Nicolle, the exchange’s founders, created the exchange in the British Virgin Islands in 2012. It is now headquartered in Hong Kong and is led by CEO JL Van Der Velde. In 2020, the company’s net worth was evaluated at more than $800 million, and in 2021 witnessed even more growth; the broker saw a 300 percent increase in new customers in the first three months.

The cryptocurrency exchange has grown to become one of the largest in the world, with offices in the United Kingdom (GBP), Europe (EUR), Japan (JPY), and other countries. Its services are most appropriate for experienced or professional traders. In addition to traditional cryptocurrency purchases, the site provides margin trading, staking, and lending.

Fee – Taker costs range between 0.2 and 0.055 percent, whereas Maker fees range between 0.1 and 0.0 percent. There is no trading cost for big orders placed through the OTC desk. Bank wire transfers incur a 0.1 percent deposit and withdrawal fee. For foreign withdrawals, this can be increased to 1%.

Bitfinex listed Chainlink (LINK) back on August 20, 2020. LINK can be traded with US Dollars (LINK/USD) and Tether (LINK/USDt).

Pros & Cons of the Bitfinex platform:

- Established since 2012.

- Suited for advanced traders.

- Over 100 supported coins.

- Accepts bank wire deposits and withdrawals.

- U.S. citizens not accepted.

- Not regulated.

- High trading fees.

- Hacked on more than one occasion.

Your Capital is at Risk

4 – KuCoin

KuCoin, which debuted in 2017, is a cryptocurrency exchange that provides third-party brokerage services. Despite having only three years of trading history, the platform has grown to become one of the largest cryptocurrency exchanges in the world. One of the key reasons is that the exchange hosts over 200 coins and over 450 cryptocurrency pairs. This includes big pairs like BTC/USDT and ETH/USDT and many crypto-cross pairs. If you want to trade a less liquid ERC-20 token, you’ll almost certainly find it at KuCoin.

KuCoin charges only 0.10 percent for bitcoin trading fees. This puts it on par with companies like Binance. Similarly, KuCoin has its digital token, KuCoin Shares (KCS). By owning and storing KCS tokens, you will receive lower trading costs and a percentage of the trading commissions collected by KuCoin.

Crypto-to-Crypto Exchanges – Every trading coin pair at KuCoin is crypto-to-crypto, not least because it does not provide any fiat-denominated securities. Instead, if you want to trade in the crypto-to-USD market, you must first trade your selected cryptocurrency against the USDT.

KuCoin listed Chainlink (LINK) on August 20, 2020, and supported trading pairs include LINK/USDT and LINK/BTC.

Pros & Cons of the KuCoin platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin.

- Users can trade using Arwen without transferring funds into a third-party wallet.

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers can access various trading pairs.

- Users can choose from a vast number of trade pairs.

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilize.

- Lacks the trading volumes found on some of the more established platforms.

- No fiat trading pairs

Your Capital is at Risk

5 – Bybit

Bybit is a newer trading platform that debuted in March 2018. It provides an industry-leading leverage trading exchange focusing on cryptocurrency derivatives, trading key coins such as Bitcoin, Ethereum, and EOS against

Takers are charged a fee of 0.075 percent for each order, which is a relatively average rate in the market. On the other hand, Makers pay a 0.025 percent fee — so if you are the maker in a $1000 trade, you would only pay $997.50, which we thought reasonable. The fees are the same regardless of the currency used in the transaction. There is also a tiny cost of 0.0005 Bitcoin for BTC transfers, which is lower than the global industry standard.

Pros & Cons of the Bybit platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets, including spot, perpetual, and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- A limited number of spot trading pairs against BTC

Your Capital is at Risk

What is Chainlink?

Chainlink is an Ethereum-based blockchain project to build bridges between payment services like VISA, PayPal, banks and blockchains like Bitcoin and Ethereum. It is the first platform of its kind with an Oracle service. The feature of transferring data from off-chain sources to on-chain applications is called an Oracle service.

In 2015, when smart contract functionality was first introduced after the launch of Ethereum, they were primarily limited to using blockchain-specific applications. However, with the creation of Chainlink, the developers have expanded the usage of smart contracts by making it possible to leverage Chainlink Oracle services to communicate with off-chain systems and APIs.

Not only this, but Chainlink also ensures the data’s validity by verifying it and making the process decentralized. Chainlink confirms that all off-chain data brought in to ensure on-chain is valid by creating a decentralized oracle network that uses smart contracts to verify oracle integrity, order match, and aggregate results. The concept behind Chainlink is entire to make smart contracts more connected to the outside world.

- Sergey Nazarov – Three main authors founded Chainlink, but there is a whole team behind the creation of this platform. The CEO and co-founder of Chainlink is Sergey Nazarov, who has also founded a ShapeShift-like cryptocurrency exchange, Secure Asset Exchange. He also founded CryptoMail, a decentralized email service.

- Steve Ellis – The next name in the founding team of Chainlink is Steve Ellis, who also worked previously on the Secure Asset Exchange. Before entering the blockchain industry, he used to work as a software engineer at Pivotal Labs. Now, along with being a co-founder, he is also the company’s CTO.

- Ari Juels – The third most important person on the team of Chainlink is Ari Juels, who also helped Nazarov and Ellis write the whitepaper of Chainlink. He is an advisor to Chainlink, and before this, he was a computer science professor at Cornell Tech and the director of IC3.

- Andrew Miller – Another advisor to Chainlink and a team member is Andrew Miller, who has worked as an associate professor of computer science at the University of Illinois. He is also an advisor to Tezos and Zcash. The last important team member of Chainlink involves Hudson Jameson, who is one of the prominent Ethereum developers.

Chainlink has secured many partnerships in a short period since its launch in 2017. The most prominent collaboration that has been seen for Chainlink is with the SWIFT banking system. Chainlink has provided SWIFT Smart Oracle to them, which uses Chainlink solutions to automate bond coupon payments. Chainlink was also a winner of the Innotribe Industry Challenge 2016, which is a segment of SWIFT focused on innovation.

Other partnerships include Zeppelin OS, which helped create a smarter, faster, and easier smart contract development process; IC3’s Town Crier, a patent-pending system that leveraged trusted hardware; and Factom, a decentralized data storage system using blockchain and smart contracts.

Furthermore, the Request Network, which creates an open-source, standardized, and decentralized PayPal-like currency-agnostic network, is also working with Chainlink to look into a possible fiat integration. Chainlink has been selected by the World Economic Forum’s report as the “Shift in Action” for smart contracts.

Performance of Chainlink (LINK)

The token of Chainlink is an ERC677 token, an extension of ERC20. The total supply of Chainlink’s token (LINK) is 1,000,000,000 LINK. The circulating supply of the token is 459,509,554 LINK coins. Almost 30% of the tokens have been kept to ensure continued development and payment to its staff. It has been launched on many famous exchanges, including Binance, Huobi Global, Mandala Exchange, OKEx, and FTX.

The whitepaper for Chainlink v1.0 was released on September 4, 2017. Chainlink launched the LINK token ICO in September 2017 with 35% of the total supply of one billion. The initial price of LINK was 0.11 USD, and the project successfully raised the hoped-for $32 million from the sale of the ICO.

The network uses the Chainlink token to compensate Chainlink Node Operator for retrieving data from external data sources, turning it into a blockchain readable format, off-chain computation, and uptime guarantees. It means a company that uses a Chainlink node to enhance smart contract usage will have to do it only with LINK tokens. Chainlink node operators determine the final price according to the demand for the off-chain resource and the supply of similar information.

The LINK token continued moving within the $1 and $4 range during the initial years of its launch. The coin experienced its first bullish momentum at the beginning of the 2nd quarter of 2020, which pushed its prices to as high as $19.67. After that, the coin kept moving from $8 to $14. The next bullish momentum was triggered at the beginning of 2021, which pushed the prices of LINK to $25 in just one month. The rally was not short-lived, as the token continued its upward momentum for 4 consecutive months and reached as high as $32 in April 2021.

The LINK token reached its all-time-high level at $51.94 in May 2021, when it experienced a massive correction and profit-taking, which triggered bearish pressure, and the coin started to fall.

Link went through a massive corrective phase throughout the later months of 2022, reaching $5 by the year’s end. But thanks to Bitcoin getting more support – LINK is now moving up to test its $10 resistance.

Is it Worth Buying Chainlink (LINK) in 2024?

Chainlink’s price has experienced a remarkable surge of 1500% over the course of three years. Moreover, there is an optimistic outlook for further increases in its value this year. What sets Chainlink apart are its unique features, specifically designed to tackle major challenges within the blockchain industry.

As a result, the strength of Chainlink’s token, LINK, has been propelled significantly. Since its inception, LINK has grown an impressive 15 times in value and managed to establish numerous partnerships within the span of three to four years. These expanding partnerships greatly contribute to enhancing the overall robust

Even proprietary blockchains can benefit from Chainlink’s connectivity. The growth of LINK in early 2021 was slow initially, but it quickly gained momentum due to partnerships and upgrades. Despite setbacks during the 2022 crypto winter, these factors continue to drive its success in 2023. With ongoing development and increasing awareness, Chainlink is poised to reach new heights.

Chainlink reached its highest price on May 10, 2021, surging to a remarkable $52.89. Conversely, the cryptocurrency experienced its lowest point on September 23, 2017, trading at a meager $0.126297. Following this peak and valley pattern, LINK’s price dropped to $4.88 during a cycle low and peaked at $8.42 during a cycle high. Presently, market indicators suggest a bearish sentiment regarding Chainlink’s future price prediction.

At the moment, Chainlink’s (LINK) price is $7.50, with a 24-hour trading volume of $426.33 million. The coin has a market capitalization of about $3.83 billion, representing a market dominance of 0.32%. In the past 24 hours, the LINK price decreased by -1.32%.

The Fear & Greed Index, which measures market sentiment, currently sits at 49 – indicating a state of neutrality. In terms of Chainlink’s token supply metrics, the circulating supply comprises 538.10 million LINK tokens out of a maximum supply of 1.00 billion LINK. It’s worth noting that the annual supply inflation rate stands at 14.59%, meaning that approximately 68.50 million LINK tokens were created within the past year.

In the realm of decentralized finance (DeFi) coins, Chainlink holds a prominent position as it is ranked #3. Within the Ethereum (ERC20) Tokens sector, it has achieved an impressive rank of #6. These rankings demonstrate Chainlink’s significant influence and standing in the cryptocurrency landscape.

Will the Price of Chainlink (LINK) Go Up in 2024?

Chainlink (LINK) has experienced a significant resurgence in 2023, following a bearish 2022. Its value has surged by 27% since the start of the year, aided by strong support from Bitcoin, the dominant cryptocurrency. Furthermore, Chainlink has maintained a steadfast position above the $7 mark.

The ongoing increase in LINK’s price reflects the project’s strategic growth initiatives. These include Network Monetization, the Chainlink Cross-Chain Interoperability Protocol (CCIP), and ambitious scaling efforts. Together, these endeavors have the potential to drive up its market value.

A recent milestone for Chainlink involves successfully launching the Chainlink Cross-Chain Interoperability Protocol (CCIP) on several prominent main nets: Avalanche, Ethereum, Optimism, and Polygon. This pivotal development has solidified Chainlink’s position as a versatile and cross-chain solution within the blockchain ecosystem.

1/ The Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially launched on Avalanche, Ethereum, Optimism, and Polygon mainnets.#LinkTheWorld pic.twitter.com/SdLVyaapg3

— Chainlink (@chainlink) July 17, 2023

Coinciding with a surge in LINK’s trading activity, the recent announcement triggered noteworthy consequences. Notably, the price briefly soared to $8 during midday trading while the trading volume more than doubled, surpassing $580 million. These impressive results contributed to LINK’s remarkable weekly gains of over 25%.

Furthermore, the incorporation of Chainlink Automation across multiple platforms has significantly enhanced LINK’s growth potential. Okutrade, a trading platform designed specifically for Uniswap, has seamlessly integrated Chainlink Automation into Ethereum’s Arbitrum, Optimism, and Polygon networks. This integration aims to streamline the execution of limit orders on Uniswap while improving overall functionality and enhancing the user experience.

In a significant strategic move, Chainlink has partnered with the Society for Worldwide Interbank Financial Telecommunication (SWIFT) and a consortium of major financial institutions. This collaboration highlights Chainlink’s influence and relevance in the industry. The joint efforts aim to explore and experiment with solutions that enhance connectivity and interoperability between public and private blockchains.

Chainlink’s involvement in these endeavors showcases the growing recognition of blockchain technology’s transformative potential in traditional finance. Sergey Nazarov, the co-founder of Chainlink, stresses the importance of a unified connectivity layer across diverse blockchains to facilitate global banks’ integration of blockchain-based financial services. His emphasis on this pivotal role highlights the significance of Chainlink’s contribution to the industry.

The culmination of these developments highlights the optimistic sentiment surrounding Chainlink’s future trajectory. As the project continues to expand its reach, establish key partnerships, and contribute to advancing blockchain interoperability, it is laying the foundation for a potential surge in the price of LINK. The combination of technical advancements, strategic collaborations, and increased adoption within the blockchain and financial sectors positions Chainlink as a strong contender for notable price appreciation in 2023.

How to Choose the Right Crypto Broker

Given the wide variety of brokers from which to purchase Chainlink (LINK), you must make the best option possible. Consider the following aspects while looking for the best broker for you:

1. Charges

What is the relevance of selecting a low-cost broker while trading cryptocurrencies like Chainlink (LINK)? Because costs can quickly add up. Before choosing a trading platform, get a breakdown of the broker’s fee structure. Withdrawal, deposit, transaction, and trading fees should be mentioned.

2 – Security

The right broker should have suitable safety and security measures to prevent unauthorized access to your money.

3. Assistance

A reputable broker also has a robust customer service staff to help you with your needs.

4. Deposit Alternatives

You want to be able to deposit as many funds as possible. There are always numerous options, from bank transfers to credit cards to payment processors. Just keep in mind that each one has its own set of costs.

When you’re considering an investment, follow these things:

Every cryptocurrency carries hazards, and this is especially true for Chainlink (LINK). So, when you invest, ensure you don’t get caught up in FOMO. Before investing in any digital asset, you should do your study in addition to following others.

1 – Research, research: Before investing your money, conduct thorough research on the product to avoid related hazards.

Here are the several ways we investigated:

- Investigating social media platforms

- Considering forthcoming events

- Investigate the fundamentals

- Discover popular subjects.

- Make use of the potential of specialist forums.

- Attend crypto meetups.

- Take note of the transaction volume.

- Keep track of the market:

The second stage in learning more about your chosen product or digital asset is to monitor the market. The market may move in a path that differs from your expectations, and remaining cool when the market moves in a different direction is equally important. The most straightforward approach to keeping up with the market is to read through review sites and recommendations.

Buying Chainlink (LINK) as a CFD Product

Contracts for difference (CFDs) are financial derivatives that enable you to speculate on numerous financial markets without owning the underlying asset. It is commonly utilized in established markets such as currency pairs, stocks, bonds, indexes, and commodities.

CFD trading requires more than just buying and selling; it also entails agreeing to exchange the difference in the price of an asset when the contract is opened and when it expires.

CFD trading has entered the cryptocurrency market, and Chainlink (LINK) is now available as a CFD product. If you have problems understanding bitcoin trading and where to keep your crypto funds, you can earn from Chainlink (LINK) using CFDs.

We advocate trading Chainlink (LINK) CFDs on the Binance or Capital or platforms because they are regulated and include various analytical tools.

Another popular leverage trading platform for altcoins is CryptoRocket. They don’t currently support LINK but so support ETH, DOGE, XRP, LUNA, and more, so we could expect them to list LINK soon.

Taxation on Chainlink (LINK) Earnings:

As the cryptocurrency market is new and finding its ground, regulatory agencies, including the SEC, want to regulate it. Furthermore, the Internal Revenue Service has been trying to set up a cryptocurrency tax regime. Cryptocurrencies and digital assets are treated as properties and fall under the capital gain tax bracket.

However, in certain situations, some earnings from cryptocurrencies are also considered income and fall under the income tax bracket. The following are the taxable events that qualify for capital gains and income taxes when trading digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21 and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals with bitcoin as a capital asset but not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxable events that are considered property gains tax in the US:

- Exchanging your cryptocurrency for fiat money

- Making purchases with crypto.

- Swapping one cryptocurrency for another – through an exchange or a peer-to-peer (P2P) channel – is common.

Taxable events that are considered income taxes:

- Block rewards from cryptocurrency mining

- Crypto assets are earned from liquidity pools (LPs) or staking.

- Receiving crypto for services rendered

- Getting crypto from an airdrop

- Gaining interest from lending to decentralized finance (DeFi) platforms

Be aware that you can write off your capital gains tax through losses incurred from trading. You can also save up to $3,000 of your income taxes, depending on how long you have held on to an asset.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things essentially decide the number of capital gains tax rates for cryptocurrencies: your income tax bracket and how long you have held on to your crypto asset. This will help you calculate your:

a) Capital Gains on Short-Term Investments

The short-term capital gains tax largely depends on how long you have been trading or holding cryptocurrencies. You will be taxed under your normal tax bracket if you have made gains or losses from trading or holding crypto for less than a year. Losses you incur for that trading year can be helpful. Leveraging a tax-loss harvesting strategy, you can write off up to $3,000 of your taxes. You also enjoy the privilege of post-dating your taxes to the following year.

b) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for over a year. You will pay taxes between 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values move, robots outperform humans during periods of substantial market volatility. This is because they rely on trading strategies to generate profits even when the market is down.

In addition, the most successful Bitcoin bots worldwide are known for their lightning-fast research and execution. As a result, they can complete many transactions daily and take advantage of any trading opportunities.

Trading Chainlink (LINK) can be difficult for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

Chainlink Mining: Can You Mine LINK?

Yes, you can mine Chainlink. Every ASIC mines the Chainlink block. However, this block is then shared among all miners. How long it takes to mine 1 block of Chainlink for yourself is determined by your hash rate, which is essentially the power of your mining rig. Using a GPU to mine, Chainlink will yield the best results.

How long does Chainlink mining take?

Every ASIC mines the Chainlink block. However, this block is then shared among all miners. How long it takes to mine 1 block of Chainlink for yourself is determined by your hash rate, which is essentially the power of your mining rig. Using a GPU to mine, Chainlink will yield the best results.

How much does one Chainlink cost to mine?

It is impossible to say how much it costs to mine 1 block of Chainlink because the price of your electricity varies. However, you must invest in specialist mining rigs known as ASIC to be profitable. They were designed to mine cryptocurrency, and as a result, they have ideal characteristics for the purpose and excellent efficiency.

How can I mine Chainlink on a computer?

Although it is feasible to mine Chainlink on your computer, if you are serious about cryptocurrency mining, you should consider investing in an ASIC mining rig. The best way to mine Chainlink is by using a GPU. If you want to go the computer route, join a miner pool.

How can I join Chainlink?

The best way to get started with Chainlink is to start from the ground up, which includes mining. In this manner, you may get your hands dirty and gain valuable expertise with this coin. We recommend GPU mining for Chainlink as the best technique to mine.

Decreasing Risk in Chainlink (LINK) Investment:

Every investor needs to find ways to protect themselves from any significant loss. If you want to cap your risks, then follow these rules:

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order restricts an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings daily if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it, and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders who follow a long-term strategy dislike such orders since they reduce profits.

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in various narratives (Oracles, Defi, or insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Fundamental & Technical Analysis: I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do a technical analysis. I consider things like where the currency is in its life cycle.

Are there any trading patterns? The coin has support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

Chainlink (LINK) vs. Other Cryptocurrencies

Chainlink (LINK) vs. Ethereum (ETH)

Chainlink and Ethereum have a fundamental and profound relationship. Chainlink, you see, is based on Ethereum. This means that Chainlinks “does its thing” on the Ethereum network. It is now, at least initially, extending out to numerous blockchains, broadening its base of operations.

But here’s the thing: Ethereum needs Chainlink as well!

The rationale for this is that Ethereum’s blockchain cannot use real-world data, separating it and limiting its potential use cases. Chainlink connects the real world to the Ethereum network, making it useable for enterprises and institutions outside the crypto space.

Chainlink (LINK) vs. Bitcoin (BTC)

Chainlink is anticipated to yield 1.54 times lower ROI than Bitcoin during a 90-day trading horizon. Furthermore, Chainlink is 1.45-fold more volatile than Bitcoin. It trades roughly 0.23 percent of its potential returns per unit of risk. Bitcoin’s volatility is currently around 0.52 per unit. If you invested $4,062,307 in Bitcoin on July 21, 2021, and sold it today, you would receive $2,025,470, or a 49.86 percent return on capital over 90 days.

Conversely, Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source, and nobody owns or controls it. Several of Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to.

Chainlink (LINK) vs. Polkadot (DOT)

Both projects are created to make a world where all networks and blockchains can interact with each other and work together, but there are some differences. Chainlink is an Oracle-based network built on Ethereum, whereas Polkadot is a next-generation blockchain that seeks to run without any of Ethereum’s problems. Polkadot also offers ways to improve blockchain interoperability.

Polkadot enables information to be effortlessly exchanged between chains, solving the blockchain’s scalability problem.

Chainlink (LINK) Price Predictions: Where Does LINK Go From Here?

Chainlink (LINK) experiences volatility in the crypto market, encountering both highs and lows similar to other assets. However, its consistent product launches and growth have bolstered its underlying strengths, leading to increased demand for its native token. Moreover, Chainlink’s oracle services play a vital role in facilitating cross-blockchain communication, offering valuable bitcoin market data that influences its price trends.

During the crypto winter of 2022, LINK faced challenges despite being recognized as a pioneer in Oracle solutions by the World Economic Forum. Its price plummeted from $18 to $7. However, there has been a recent upswing in its value due to renewed interest in crypto. Yet, uncertainties surrounding the sustainability of Chainlink’s price momentum persist.

Chainlink (LINK) Daily Chart – Tradingview

Chainlink Price Prediction for 2023

With the abovementioned factors working in Chainlink’s favor, the currency was poised as a highly well-performing cryptocurrency for the following year. However, the recent developments in the crypto space have upended much of this belief. People and experts have a realistic take on this asset – which would dictate our Chainlink price prediction for 2023.

First, the token’s performance since the start of 2023 has been great. As people started to shrug off FTX’s downfall and focus on the assets that are currently trading on the market, Bitcoin gathered support. That sentiment flowed into other assets, which continued to pump Chainlink and get it closer to $10.

If the growth opportunities that Sergey Nazarov, Co-Founder of Chainlink, mentioned in his article hold up, up would go the price of Chainlink by the end of 2023. We believe that this year, it will close at $11.

Chainlink Price Prediction for 2024

As the token gains momentum and the network expands, more people will be interested in its offerings. That interest, combined with the innovation LINK will bring to the blockchain space, would fuel LINK’s value all across 2024. Furthermore, the last embers of crypto winter would have died by then – giving Chainlink ample time and opportunities to grow. In that light, we predict that Chainlink will reach $20 by the end of 2024.

Chainlink Price Prediction for 2025

Mass crypto adoption will catch up in 2025, but that rise in interest won’t be linear but sudden. And with sudden interest comes parabolic gains. Major innovations will take hold of the project by 2025, and more networks will partner up with it. And as Chainlink grows even more ubiquitous in the cryptocurrency space, So by the end of 2025, we predict Chainlink stabilizing at around $25.

Chainlink Price Prediction for 2026 and Beyond

The crypto space will likely go through a major overhaul by the time 2026 arrives. Progressive regulations will arrive (hopefully) that won’t get in the way of innovation. But if the rules are regressive, cryptocurrency market volatility can persist.

Our optimistic outlook says that better regulations, coupled with better fundamentals, will push the price of this crypto beyond the $100 mark 0 2x of its all-time high in the coming years.

Summary

Chainlink is an Ethereum-based blockchain project to build bridges between payment services like VISA, PayPal, banks and blockchains like Bitcoin and Ethereum. It is the first platform with an Oracle service – the feature of transferring data from off-chain sources to on-chain applications.

In 2015, when smart contract functionality was first introduced after the launch of Ethereum, they were primarily limited in use to blockchain-specific applications. However, with the creation of Chainlink, the developers have expanded the usage of smart contracts by making it possible to leverage Chainlink Oracle services to communicate with off-chain systems and APIs.

If you’re ready to invest in LINK, we recommend using a regulated and user-friendly exchange where you can buy Chainlink.

You should also remember the following:

- It takes a lot of time and effort to invest in Chainlink and trade it.

- Chainlink is a risky investment because of its vast return potential.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should also consult review sites and online specialists for their thoughts on Chainlink.

Your Capital is at Risk

FAQs

Any risks in buying Chainlink (LINK) now?

There are always risks in buying digital assets. The major risk is in the possibility of Chainlink (LINK) price falling off the cliff or the asset becoming worthless.

Should I buy Chainlink?

When it comes to volatility, LINK, like every other crypto asset, is no exception. It all comes down to how well a cryptocurrency asset manages its highs and lows. Chainlink has diligently launched products and developments on schedule and has continually grown. Many analysts believe Chainlink's fundamentals are strong. This naturally increases demand for its native token, LINK. LINK price projection is certain to win all seasonal battles, racing ahead with $150 by the end of 2025, a never-before-seen surge.

Where can I spend my Chainlink?

Chainlink (LINK) is still not as widely used as Bitcoin. However, an increasing number of stores are now accepting it. In any case, you can always convert Chainlink (LINK) into other cryptocurrencies like Bitcoin, Ethereum, or Tether to make payments online.

Is it safe to buy Chainlink (LINK)?

Chainlink is an Ethereum-based blockchain project to build bridged between payment services like VISA, PayPal, banks, and blockchains like Bitcoin and Ethereum. It is the first platform of its kind with Oracle service. The feature of transferring data from off-chain sources to on-chain applications is called an Oracle service. Therefore, Chainlink (LINK) is a safe buy; however, we recommend not to put all your investment in one basket.

Will Chainlink (LINK) ever hit $150?

On a long-term price estimate for Chainlink, optimism appears to be catching up with the heat. Surpassing all predictions, the LINK price projection is certain to win all seasonal battles, racing ahead with $100 by the end of 2026, a never-before-seen surge.