Join Our Telegram channel to stay up to date on breaking news coverage

NEW YORK (InsideBitcoins) — The numbers are simply too staggering to truly comprehend. Hackers have stripped the banking system of $1 billion in the past year alone, targeting dozens of global banking institutions, disrupting the financial industry to its core. And in spite of bitcoin’s shady reputation – its own fledgling exchanges hacked on a near daily basis of millions of dollars – the digital currency’s core technology may be the answer financial security so desperately needs: the blockchain.

Stealing with stealth

Kaspersky Lab, based in the UK but with 3,000 specialists around the globe, claims to be the largest privately-held security vendor in the world. Its recent report regarding the “greatest bank heist of the century,” details the shocking attacks against the fragile banking system, reading very much like a spy novel.

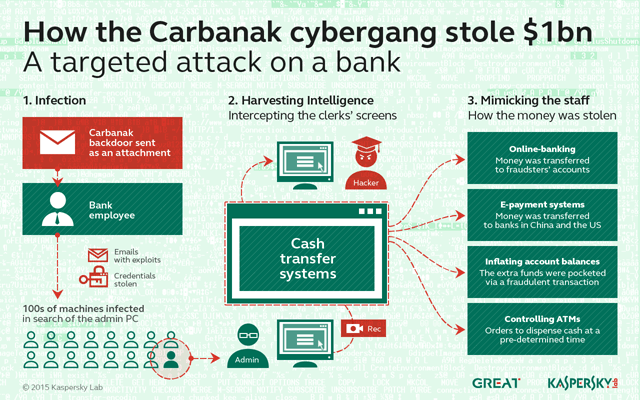

“In order to infiltrate the bank’s intranet, the attackers used spear phishing emails, luring users to open them, infecting machines with malware,” the report says. “After obtaining control over the compromised machine, cybecriminals used it as an entry point; they probed the bank’s intranet and infected other PCs to find out which of them could be used to access critical financial systems. That done, the criminals studied the financial tools used by the banks, using keyloggers and stealth screenshot capabilities.

“Then, to wrap up the scheme, the hackers withdrew funds, defining the most convenient methods on a case-by-case basis, whether using a SWIFT transfer or creating faux bank accounts with cash withdrawn by ‘mules’ or via a remote command to an ATM.”

And this was no smash and grab attack, but rather a prolonged high-tech theft that is ongoing. Kaspersky says the first thefts were discovered in February of last year – and are continuing to this day.

“Apparently, the attackers won’t stop until caught,” the report concludes.

Banks need the blockchain

Peter Kirby, the president of Factom, leads a group of developers that is working to build a layer of secure data on top of the bitcoin blockchain. He believes the technology can solve a host of challenges facing the financial industry, all built on the blockchain.

“It allows us to write a permanent system of record of basically anything, and it’s stored in a distributed way, with ten thousand different nodes protecting it. So, of course, everyone is really excited about all the opportunities to develop on top of it,” Kirby says in an introductory video on the Factom website. “One of the projects that we recently did is we partnered with Omni Wallet and secured, literally, every transaction they’ve ever done with a single hash and we put that hash in the blockchain. That’s proof-of-existence.”

A chain of records

Kirby believes blockchain technology can also help the banking industry in more mundane, day-to-day matters, as well.

“Bank of America recently paid $17 billion in fines because basically, they lost track of the chain of records of mortgages. What that led to was them taking peoples’ houses that they probably shouldn’t have and caused quite a bit of chaos,” he says. “How would that look different if you ran it through Factom? Well, every single mortgage contains a whole slew of documents — hundreds of pages — all secured in Factom, and then stamped with time and proof-of-existence, so you could see the chain of them.”

In the matter of the Billion Dollar Bank Hack, the perpetrators often modified individual account balances to inflate the available dollar value before withdrawing assets. Consumers were robbed of money they didn’t even have. Perhaps not a problem for the customer, but a nightmare for the banks that have to cover the multi-million dollar losses. The blockchain’s irrefutable record of transactions might have prevented such a theft.

Peter Kirby will be discussing more blockchain application solutions during his presentation “Solving Real Business Problems with the Blockchain” during the Inside Bitcoins Conference in Berlin March 5-6.

Inside Bitcoins conferences are produced by MecklerMedia, the publisher of InsideBitcoins.com.

Join Our Telegram channel to stay up to date on breaking news coverage

Comments are closed.